Strength of a candlestick pattern

Post on: 16 Март, 2015 No Comment

How does HotCandlestick.com determine the strength of a candlestick pattern?

The strength of a candlestick pattern was created by HotCandlestick.com to give an indication of how closely the pattern resembles the text book definition of a particular pattern. A positive strength value indicates a pattern that is found in the correct recent price trend according to the text book definition of the pattern. A negative strength value indicates a pattern that is not found in the correct recent price trend. The magnitude of the strength value correlates to the strength of the recent price trend and number of individual candlesticks making up the pattern.

HotCandlestick.com considers the recent trend of the stock price, number of candlesticks in the pattern and 14-day average volume. To avoid displaying less meaningful signals that are generated by thinly traded securities, only securities averaging at least 120,000 shares / day and have an average close of at least $1 / share for the previous 14 days are considered by HotCandlestick.com in scans for candlestick patterns.

If you are looking for a number to tell you how successful a particular candlestick pattern has been, then you must subscribe. The measure of past success of the candlestick patterns tracked at HotCandlestick.com is called the SCORE. not the STRENGTH. Think of the strength as a measure of correlation between the definition of the candlestick pattern and the actual pattern formed.

The strength value can be any value. However, it will tend to gravitate toward zero. A positive value means there is a positive correlation between the candlestick formation’s definition of a proper setup for the formation and what is actually happening on the stock chart in recent days. For a candlestick pattern with a negative strength, this signifies that the price action prior to the candlestick pattern does not correlate with the defined expected forward price action of the stock. The larger negative strength value correlates less with the setup of the candlestick pattern.

www.hotcandlestick.com/candles.htm to view the defined expected forward price action for a particular candlestick pattern. HotCandlestick.com looks for the defined expected forward price action to manifest itself in the stock price over a period of 1-10 days after the daily candlestick pattern appears.

The interpretation of strength values depends on what type of pattern referenced. And, not all patterns hold all of the time due to the many factors that play into the price action of a stock. Supply / Demand, fundamental news, world events, etc. So use caution and do not rely solely on candlestick patterns to make your trading decisions. Past performance is no guarantee of future results. 14 day fast stochastics and HotCandlestick Intraday Momentum Index (IMI) are incorporated into the database to serve as additional technical indicators. Subscribers can query and sort by these indicators.

Example of positive candlestick pattern strength on a weekly chart.

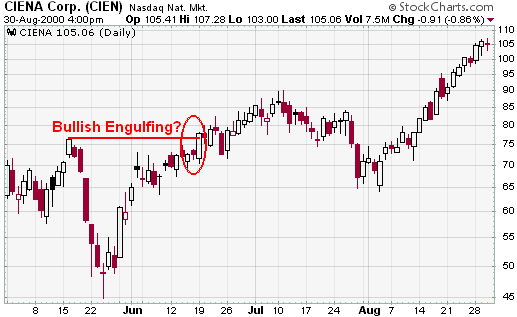

Example of negative candlestick pattern strength on a daily chart.