Stop Loss and Stop Limit Orders

Post on: 16 Март, 2015 No Comment

Saturday, March 13, 2010

Stop Loss and Stop Limit Orders

In recent weeks, I have written about risk and included concepts like protective puts and stop loss orders as ways a trader might endeavor to cut losses in the event a position moves against her. The articles sparked a question from a subscriber who wanted to know about the difference between stop loss and stop limit orders and how the two might be used by a trader.

The stop loss order is an order to a broker that says if a stock hits a specific price the position is to be closed at the market. Suppose, for example, that we own shares of XYZ trading at $25 a share and we see a support around $24.25. If the stock goes below $24.25, it has broken support and is no longer showing the bullishness for which we initially bought the stock. In such a circumstance we might place a stop loss order at $24.20 thereby instructing our broker to sell our shares in the event XYZ hits $24.20 OR BELOW. Once the stock price hits $24.20 or below, our order goes to the market as a market order. I emphasize the or below part because there are times when a stock may gap down and never touch our stop. In the XYZ example, suppose, for example, that the stock closes at $25 a share today and that this evening it announces unexpectedly poor earnings. Tomorrow, the stock opens at $23 a share. Well, it didn’t hit our stop price at $24.20, but passed right over it. In that event, our stop is activated, the sell at the market order goes to the floor, and we are sold out of the position at the market which is now around $23. While we did not get the $24.20 we might have expected, but, quite importantly, we are out of the position and that might not be a bad thing since the stock is falling sharply and we want to cut losses.

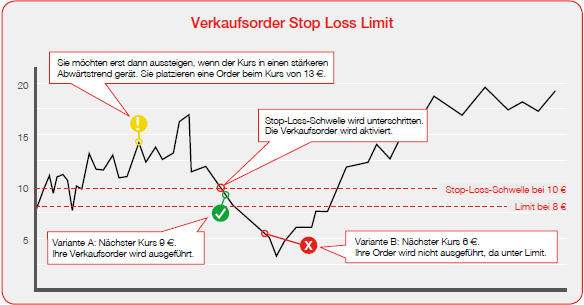

Instead of utilizing a stop loss order, we might have chosen a stop limit order. Actually a stop limit order is two separate orders combined into one. The first part, the stop is the same as I described in the preceding paragraph. The second part is the limit which places a limit on what we are willing to take. Using the XYZ example, above, we might place a stop limit with a stop at $24.20, limit, $24. Now, we have instructed our broker to sell our shares if the price hits $24.20 or below, but only if we can get $24 or better. In the situation where the stock gaps down the following morning, our stop would be hit because the price is now at $23, well below our stop, but we would not be sold out of the position because our order was to sell at a limit of $24.20 and since the stock is selling well below our limit, we would not be filled and would still own the falling stock. In general, then, if we are placing a stop so we can get out of a position that is moving adversely, we would probably want to use a stop loss rather than a stop limit order.

When might we want to use a stop limit order? Perhaps, if we saw a stock that was dealing with a resistance and we wanted to buy shares, but only if it broke above that resistance. Let’s say ABC has been trading in a range between $14 and $16 a share and we saw a triple top resistance at $16. If the stock breaks through that resistance, we might want to own shares, but we would like to get in fast on that break above $16. In such circumstances, we might choose to place a buy stop limit order. The order might be buy stop at $16.10, limit $16.50. By that order, we have instructed the broker to place a limit order to buy the stock at $16.75 or better, but only if the stock hit $16.10 or higher. In that event, if the stock broke resistance and hit our stop number, our limit order would go to the floor, and we would buy the stock provided it was at or below our limit of $16.75. Such an order would prevent the situation where the stock broke above resistance, but rocketed past a price at which we were willing to buy.

As you can see, these orders, used properly, can be very valuable additions to a trader’s arsenal. In Trade Your Way to Wealth, I discuss in detail a number of important orders available to the trader that can be used to help control losses and to protect gains. Knowledge of available orders can be extremely helpful to the trader and I often use them in my own trading.

by Bill Kraft. Editor

All Rights Reserved P.S. Save $50 PER MONTH on my subscription trading newsletters!