Stock Market Set To Open Higher On Monday

Post on: 22 Август, 2015 No Comment

This past week was a wicked one for the bulls. Heading into the week we were looking at the potential for two scenarios. The first involved a third slightly lower low in the Nasdaq Composite ($COMPX) on a 60-minute chart. Had the index been able to break the upper end of the trading channel connecting the highs from 8/22/2008 to 8/28/2008, then it would have triggered a momentum reversal buy setup. If the 50-day simple period moving average, on the other hand, gave way, then it would trigger another sharp wave of selling. This would also mean that the S&P 500 ($SPX) and Dow Jones Industrial Average ($DJI) would also trigger short setups of their own with a two-wave reversal pattern.

As you can tell by taking a quick look at the 60-minute and daily time frames, the second scenario was the one which triggered. The two-wave highs in the S&Ps and Dow were from 8/22/2008 and 9/2/2008. The lighter volume throughout the range of these two waves higher also support a breakdown. It looked like the pattern in the S&Ps and Dow was going to try to trigger coming off the highs on the 28th, but a gap higher into last Tuesday morning created a very slightly higher high. It wasn’t enough, however, to trigger the larger buy setup on the Nasdaq because the 15-minute highs held and the gap took the typical way out for its size and closed. I will return to this gap closure strategy once again at the end of this column since we are dealing with another scenario heading into this Monday as well.

Nasdaq Composite ($COMPX)

Once the selling began last week, it continued nearly unabated. From late Tuesday afternoon throughout the day on Wednesday, the S&P 500 formed the same price action the Nasdaq Composite had formed on the daily time frame from 8/21/2008 — 8/28/2008. It stepped lower with two lows and two highs following each low. The pace of the downtrend channel slowed. It could have also formed a momentum reversal pattern as a buy had the upper end of its channel broken, but like the Nasdaq, both triggered breaks lower and the momentum increased substantially on the breakdown. Notice the similarities in the bottom chart in the above Nasdaq with the chart below which displays the SPY (S&P 500 ETF). Even through the time frame on the Nasdaq begins to form the setup on 8/15/2008 into lows on 9/5/2008, notice that the pattern is the same as the SPY pattern that begins on 9/2/2008 with lows on 9/5/2008.

SPDR TR (SPY)

Dow Jones Industrial Average ($DJI)

Oil prices last week failed to rise as many had feared with the approach of Hurricane Gustov. The storm had a relatively minor impact on oil activities in the Gulf and prices again began to fall this past week, kicking off the a strong gap lower Tuesday morning following the weekend’s storm. The price continued to inch lower throughout the week and closed on Friday at $106.23 a carrel. It had hit a low of $105.13 during the session, down 8% on the week and 24% for the quarter. After a 54% gain on the year in mid-July, it is up only 10.7% on the year to date. This is the weakness we had been expecting to see continue as we move into fall. The $90-$100 a barrel zone is where I continue to see the largest support. Again, this is the trading range from late last year into early this year. Currently oil is hitting the first support I mentioned in last Tuesday’s column, which is the 50-week simple moving average. This is the zone it closed at on Friday. With Hurricane Ike once again causing concern, it is likely that this level will hold for a few days at least.

S&P 500 ($SPX)

The biggest news heading into this new week comes once again from Fannie Mae (FNM) and Freddie Mac (FRE). The index futures are up strongly off Friday’s close following the Sunday morning announcement by the Treasury Secretary Henry Paulson that the government would be taking over the two mortgage giants indefinitely. The companies will be placed in a government conservatorship with the Treasury purchasing up to $100 billion in each company to allow them to maintain a positive net worth and inject the companies as needed with additional funds by purchasing either convertible preferred shares or warrants in the two companies. Although shares in the two companies will continue to trade, stockholder rights will be suspended, taking a back seat to those of the government, and dividends will be eliminated. Fannie Mae and Freddie Mac own or guarantee almost half of the U.S.’s approximately $12 trillion in home loans.

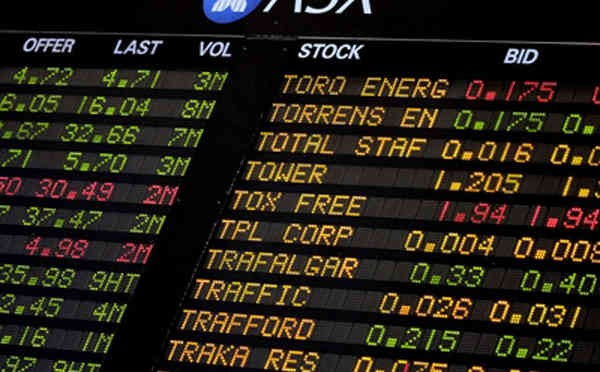

In addition to the index futures for the Dow, S&P and Nasdaq trading higher on Sunday, Asian markets were also up on the news, particularly the financials. As of 9:20 p.m. ET the Nikkei was up 3%, while the South Korean Kospi rose 3.6%. Australia also saw strengthening with the Aussie S&P/ASX 200 up 3.2%. The Dow Jones Ind. Ave. had closed lower by 2.8% last week at 11,220, while the S&P 500 had fallen 3.2% on the week and ended on Friday at 1,242, and the Nasdaq Composite had lost 4.7% and closed at 2,255.

With the markets set to open higher on Monday morning, the big question of the day will be: Can it sustain those gains? Typically when the indices post an extreme open either way there is a decent chance that the gap will begin to fill by about 15 minutes after the opening bell and proceed to close until at least one of the major indices has completed the gap closure during the morning’s trade. This is exactly what happened on Tuesday, September 2. Trend days in the direction of the gap closure are quite common. A major exception to this tends to be at larger market reversal points on a daily time frame. Given the extreme selloff of this past week and the news in the financial sector, this can easily be one of those exceptions. The key will be what happens after the first 15-20 minutes. Generally speaking, when the gap on an extreme gap day intends on filling, it will hold a 15-minute pivot or base into 9:45 ET. When that 15-minute low breaks, it triggers the start of the gap closure and hence a short setup. If the 15-minute low holds, however, then in the case of a gap higher the odds favor a continuation of the gap momentum and a trend morning with a decent chance of a trend day on the upside.

Should the market follow through and hold the gap, moving higher on strength in the financials, then the indices still risk this action on the weekly time frame serving as part of a two-wave correction. In other words, the market can then continue higher or hold the longer range to play out the 4-month correction off July lows into late October, which will put the corrective move on common ground as the previous correction off lows earlier this year. This can then be followed by another break lower. I do not expect, however, that such a move would be as strong on the downside in the S&Ps as the previous two declines on the monthly time frames since last year’s highs. Nevertheless, the next major support zone is the congestion from 2005. In the Dow Jones Industrial Average this is the 10,000-10,500 zone.

Toni Hansen is President and Co-founder of the Bastiat Group, Inc. and runs the popular Trading From Main Street. She can be reached at Toni@tradingfrommainstreet.com.