Stock Market Prediction Software

Post on: 19 Июнь, 2015 No Comment

Stock Market Prediction Software / Dynamic Traders Elliott Wave Software

Sometimes it’s not easy to know which Elliott waves we are in, but when using stock market prediction software/Elliott waves software by Robert Miner of Dynamic Traders, you can be pretty much sure that you can do the Elliott wave analysis and trade accordingly.

As mentioned before, fibonacci retracement also work in time and price and also as numbers. Remember, waves retrace or extend a certain percentage of the previous waves.

Let me show you an example of an actual trade I did using Dynamic traders time and price projection method as taught in the trading books and folders that came with the software.This Elliott wave software pin point end of wave 2 to the exact day! The power of this Elliott waves software speaks for itself. I think this is the best trading software for predicting future turning points!

In fact I call it the best stock market prediction software!

I did an end of Elliott wave report from Dynamic traders screener / filter page to find this stock (end of wave 2 scan after market closed on Friday 12th October, where the blue and red lines crossed )and also perform the following to be 100% sure.

End Of Wave 2 Analysis

There are Fibonacci time retracements buttons at the left, and I placed it at the end of what I think was end of wave 1,number 5 in August and the stock market prediction software automatically draw Fibonacci retracemnets time percentage lines. (purple vertical lines)

I also place a fibonacci price retracement from number 8, where the green line is to the bottom of Elliott wave 1. This dynamic trader stock market prediction software automatically draw all lines projected upward. There is also a EOW button, which if highlighted on wave 2, it will display the lines where the end of Elliott wave 2 appear. For clarity, I deleted all apart from that red horizontal 61.8% line.

There is a button known as Time Count. This counts the number of traded bars in calendar days or traded days as Fibonacci numbers, remember the fibonaaci number sequence, 1,2,3,5,8,13. etc Well, price and time hit exactly 0.618 as the reciprocal of golden ratio, remember from Fibonacci retracement page.

It was fibonacci number 13 traded days the day after from point 9. The Dynamic traders oscillator was in oversold position and heading down. With all these time and price meeting as well as indicators pointing downward, the market should definite turn. And it did!

Wave 3 Analysis

I placed a down bet/short and rode it to the next Fibonacci retracement levels of around 50-61.8% down where I expect the price to bounce up to form wave 1 of wave 3 down, remember

wave 3 can subdivide into 5 little waves. 6 traded days later, or 10 calendars days later ( down trend normally end in even Fibonacci numbers- not sure why but it does happen every now and then), it bounced off 50 ( measured from 5 to 10)and 88.86 % ( measured from 7 to 10 ), Dynamic Traders oscillator crossed up. It was also a Market matrix turning point, so I had to close the trade with a little profit and went long.

I did a Fibonacci price retracement projection from 10 to 11. and Fibonacci time retracement and also time count. I expect this little pull back to be little wave 2 to be 50 to 88.86% and when it broke through 50 & 61.8% and closed below open at 78.6% Fibonacci time and price retracement and also 5 traded days up from point 11, I closed my trade and place a down bet for what I think was wave 3 down.

Recounting Elliott Waves

When I saw price bounced off the Fibonacci retracement line across number 11, and did not go below it to the minimum level ( 2nd horizontal retracement level lines), I had to recount these waves and closed my trade at a profit.

As mentioned before, I also use market matrix, a slightly bigger turn was near the red point 4. Time retracement ( purple lines) was 100% of big wave 1 ( from 8 to 5 where the green line is). This big wave 1 could now be wave A, AS IT LOOKED TO HAVE 3 LITTLE WAVES DOWN.

I placed an up bet/ went long aiming to exit the trade at end of wave B.

I placed a fibobnacci price retracemment from

- 8 to bottom of wave A

- wave a of B, 10 to 4

- bottom of wave A, to 10 to 4

It produced a cluster of Fibonacci level near each other.

For time retracement, I did fibonacci time retracement from

- 8 to bottom of wave A

- bottom of Wave A, to 10 and 4 ( green lines)

- bottom of wave A to 10 (blue lines)

- 10 to 4 ( red lines)

- time count in CDs and traded bars.

This stock market prediction software produced a few time lines all hitting roughly the same area,with 3 lines on the same date. I closed some of my position when price broke through the golden ratio 1.618% of 10 to 11 and started to go down.

I hold on to the rest and moved my stop loss to be just below what appeared to be wave 4 of wave c of wave B, then moved this stop loss to be just below the low of the bar before where all time bars meet.

The day after where red, green, blue time retracement lines met triggered my trade to close at a profit. This analysis predicted a turning point to the exact date yet again!

See how powerful and useful this Dynamic trader stock market prediction software is for doing your Elliot wave forecast.I truly recommend this software to anyone who wants to do their own Elliott waves analysis as well as time and price projections analysis.

More Than Just Elliott Waves Software

There are other filters in this Elliott waves software /stock market prediction software that you can trade like gaps up & down, inside days, continuation, reversal trends etc.

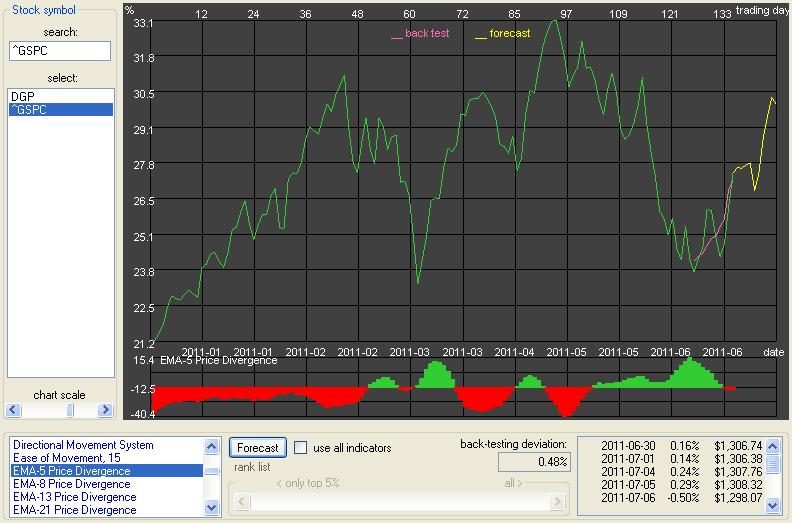

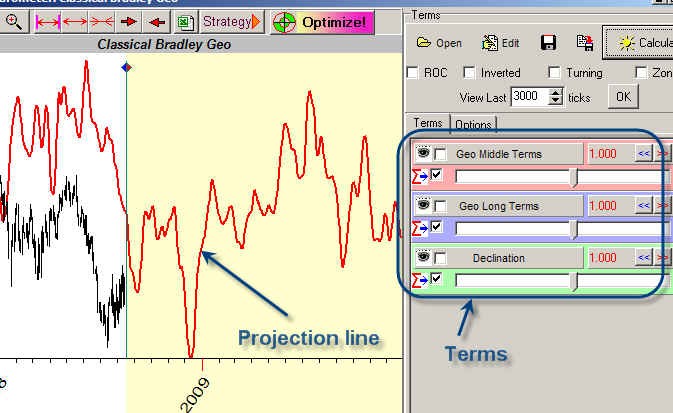

If you are interested in purchasing this dynamic traders stock market prediction software, I recommend you to pay a little extra ( one off fee) to get Market Matrix Cycle lines as well. It has a default S&P500 solutions solved by the inventor Steve Copan, so you can trade turning points without working them out.

Also, you can use the cycle lines to do your own analysis. You may have noticed that I used these matrix cycle lines ( vertical color dividing lines) to help me in determining turning point as mentioned above. See Market Matrix page for explanations.

As you can see from this example, I am sure you can recover the cost of software and data feeds in one or two trades once you mastered how to use them. As mentioned before, I did hesitate for a little while before getting involved in this, may be you agree with me that this is the best stock market prediction software around!

Short Term Advisory Services on Emini S&P 500, Euro Futures and 10 Years Note

As you can see the power of this stock market prediction software and what it can do for you. If you want to trade the above but do not want to purchase the software, then I suggest you try Harmonicedge.com. They use this prediction software and apply Eliiott Wave and fibonacci retracement analysis on their short term services.

You will get email alerts during trading hours and also access to their updated 15, 60 minutes, daily and weekly chart each evening and follow their recommendations and trade accordingly. They have a good winning trading record so far ( more than 70% profit).

When registering use promotional code STSAP268 to receive a 10% discount.