Steepening yield curve What s happening in the bond market and what it signals The Tell

Post on: 4 Июль, 2015 No Comment

As the U.S. bond market adjusts to an eventual shift in the Federal Reserves monetary policy, bond yields are forming what bankers describe as a steepening yield curve. This occurrence, which happens in every business cycle, is of great interest to lenders. For individuals, its good news if youre buying long-term bonds for the interest payments. But not great if youre getting ready to buy a house.

Heres whats happening. After the Fed on Wednesday released minutes from its October policy meeting which suggested that the central bank was deciding how to wind down its bond-buying stimulus program the longest maturity Treasury yields spiked higher while yields on some of the shorter maturities actually fell.

Reuters Janet Yellen, nominee for chairwoman of the Fed

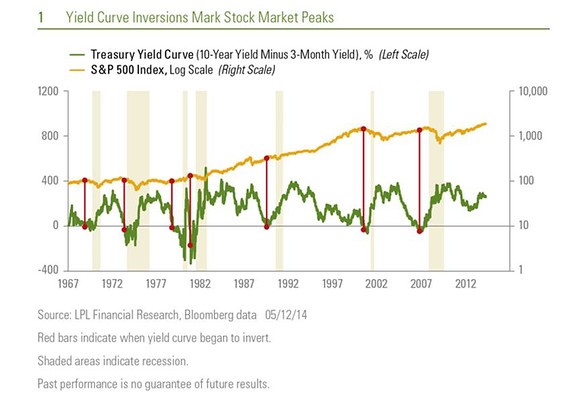

The Treasury Department issues securities with various maturities, which yield incrementally more as their maturities get further out into the future. When you plot them against each other, you get a yield curve.

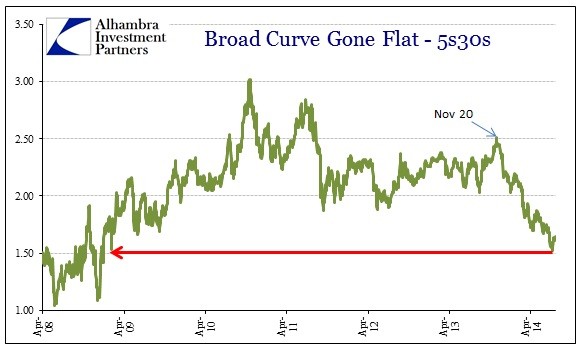

When the differential in the yield between shorter maturities and longer maturities widens, its known as a steepening yield curve. When the differential narrows, the yield curve is said to get flatter. There are various ways to measure this so-called spread between the shorter and longer end: you could take the differential between yields on the 5-year /quotes/zigman/4868109/delayed 5_YEAR and 30-year /quotes/zigman/4868063/delayed 30_YEAR. or the 2-year /quotes/zigman/4868354/delayed 2_YEAR and 10-year /quotes/zigman/4868283/delayed 10_YEAR yields, or use another variation.

A steepening yield curve is traditionally thought to signal an improving economy. And theres some truth to that in the recent steepening action, given economic improvement in the U.S. and Europe, says Michael Collins, senior investment officer at Prudential Fixed Income.

A steep yield curve is an indicator of stronger economic activity and rising inflation expectations, he says. The numbers have been pretty strong out of Europe. In the U.S. economy, there’s some fundamental underlying strength.

But theres more to it, he notes, as there always is when the Fed interferes with the market. To find out what, lets look at the spread between the 5-year and 10-year maturity Treasury yields, where much of the steepening has taken place recently. In fact, that spread is at its highest since mid-2011. (See chart of the spread below).

The Fed has said it is committed to keeping its short-term interest rates low into the foreseeable future. But as bond yields rose sharply over the summer, that message got obscured by the fact that the central bank was thinking about scaling back its bond-buying stimulus program.

However, now that theres firmer anchoring at the shorter part of the curve, it suggests the market expects rates to remain lower for longer. Thats backed up by indicators of future rate projections, such as eurodollar futures contracts, which show that the market expects rate hikes to be a long ways away .

I think investors have gotten the message that rates will remain lower for longer whether the Fed tapers or not, said Gemma Wright-Casparius, senior portfolio manager at Vanguard Inflation Protected-Securities Funds.

The longer end of the curve had been held down by the very bond buys that the market is now expecting to come to an end. So, once we get beyond the time-frame in which the Fed would likely hold down its short-term interest rates, the Fed has less control of the yield curve. Suggestions that the Fed could step out of the bond buying business in the near-term have pushed longer-term Treasurys higher.

The steepening is driven by signals from the Fed on shifting its rate policies back to the front-end and away from manipulating long rates, said Richard Gilhooly, U.S. director of interest-rate strategy at TD Securities, in a note.

This poses a challenge for the Fed down the road. Many, including Vincent Reinhart. chief U.S. economist at Morgan Stanley, say that pivoting away from bond-buying will make it harder for the central bank to control the yield curve.

But for now, the shape of the curve could be considered a victory for the Fed, since it reflects the markets growing belief that even as the central bank removes its bond buying, it will remain accommodative through its use of forward guidance well into the future. David Schawel, portfolio manager at Square 1 Asset Management, summed this up nicely in a tweet:

The way the yield curve is acting is actually a huge win for the Fed. Bond mkt is buying the FG promise while acknowledging a taper

David Schawel (@DavidSchawel) November 20, 2013

And bond guru Bill Gross, of asset-manager Pimco, made the logical connection to investors:

Gross: Bond investors should hold bonds that don’t go down in price. If #Fed stays put at .25 for years, front end fits the bill.