State Bank raises interest rate to fight inflation

Post on: 16 Март, 2015 No Comment

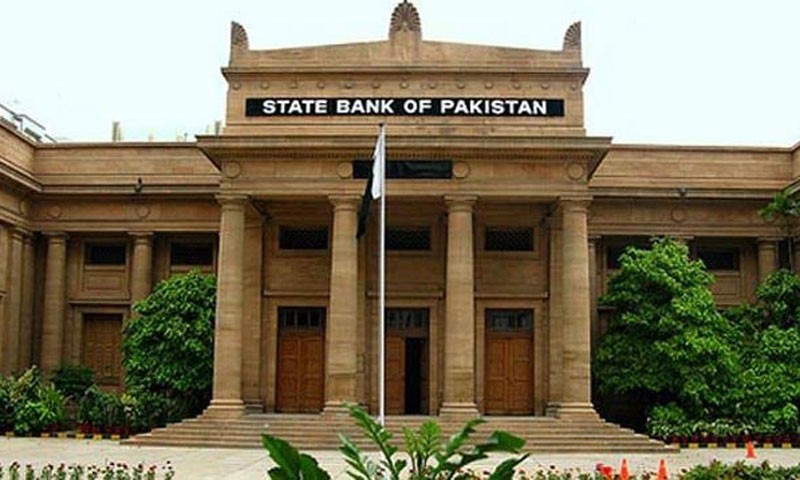

KARACHI — Pakistans central bank raised its benchmark interest rate for the second straight meeting, seeking to fight inflation and keep a struggling economy on track for help under an International Monetary Fund loan program.

The State Bank of Pakistan (SBP) boosted the discount rate to 10 percent from 9.5 percent, spokesman Umar Siddique said in Karachi today. The decision, to raise policy rate by 50 basis points, was taken at a Wednesday meeting of SBP Central Board of Directors which was chaired by Governor Yaseen Anwar. The bank hoped it would give impetus to banking sectors to invest in the government papers and private sector alike.

The move however can potentially increase demand pressure through consumption as well as dampen investment, and thus the productive capacity of the economy. In addition, with fragile external flows, negative real return can encourage outflow of foreign exchange increasing the pressure on exchange rate.

After witnessing a significant decline in FY13, inflationary pressures are resurging and could be observed in the sharp increase in inflation during the first four months of FY14. This trend is being contributed by both food and non-food group, however, the reversal in CPI food inflation is relatively sharper. With the continuing of these trends CPI inflation is likely to remain at an elevated level, between 10.5 and 11.5 percent.

The deterioration in the external accounts has continued in FY14, largely on account of weak financial inflows. The external current account had a deficit of $1.2 billion in Q1-FY14, similar to that witnessed in the previous quarter. With imports picking up at a relatively higher pace than exports, the widening of the trade deficit mainly explains this. Moreover, the financial account balance had a net outflow of $68 million. Further, taking into account substantial repayments to the IMF, SBP reserves declined by $1.3 billion during Q1-FY14. The SBP reserves stand at $4.2 billion as of Nov 1, 2013.

Successful completion of structural benchmarks under the IMF program will ensure additional financial inflows from other IFIs, it is hoped. In the absence of such reforms, the burden of adjustment falls disproportionately higher on interest and exchange rates that may perpetuate speculative sentiments in the market.

The decline in the estimated FY14 fiscal deficit, compared to 8 percent in FY13, owes much to the realisation of non-tax revenues such as the CSF. The first instalment of CSF ($322 million) was realised in October 2013 and the remaining is expected in the current and the forthcoming quarters. Similarly, the realisation of the other proceeds is also critical to maintain the deficit within this estimated level. What is more important to consider is the fact that these are either one-off receipts or may not be relied upon on a long term basis. A more permanent solution still lies in the tax reforms.

Similarly, rationalisation of expenditures is also important. The revision in power tariffs is expected to contribute in curtailing subsidies and thus creating fiscal space for other expenditures. Such fiscal consolidation measures, however, have their inflationary consequences also. Adjustments in administered prices are directly reflected in higher inflation and raise inflationary expectations, as is evident from the current trends in CPI inflation.

Agencies add: Prime Minister Nawaz Sharifs government has changed energy policies to tackle power shortages and plans to raise as much as $1 billion in a bond issue abroad to bolster depleted foreign-exchange reserves. The IMF approved a $6.6 billion loan for the South Asian nation in September to help stabilise the economy, which has also been set back by a Taliban insurgency.

Officials needed to raise rates to bring down price pressures and support the currency as they try to rebuild reserves, Yawar Uz Zaman, senior analyst at Alternate Research Pvt. Ltd. in Karachi, said before the decision.

Pakistans rupee has depreciated about 10 percent against the dollar this year, hurt by the nations economic woes, and traded at 107.445 per dollar as of 5:56pm local time. A weaker currency has stoked inflation, with consumer prices climbing more than 9 percent in October from a year earlier, the second-fastest pace in a basket of 17 Asia-Pacific economies tracked by Bloomberg.

The IMF released about $544 million of its loan on Sept. 6 and signaled last week that Pakistan is making progress in overhauling the economy under the program. The lender predicted 2.75 percent economic growth for the fiscal year ending June 30.

The IMF said after sending a mission to Pakistan that its crucial that firm action be taken to begin to rebuild foreign-exchange reserves, adding officials reaffirmed their commitment to align monetary and exchange rate policies to this objective, while maintaining price stability.

The text of the Monetary Policy Decision read: While the challenges for macroeconomic stability in the external sector remain, the fundamentals of the economy going forward in the backdrop of the recent policy and reform measures appear stable. Notwithstanding rising inflation, the prospects of an economic revival inspired by successful political transition and the resolution of energy related circular debt issue are encouraging, SBP statement said.

For ensuring that the economy remains on a stable path, further structural reforms are in progress. Although, it is too early to conclude about their impact, there are some indications of a pickup in economic activity. The growth in large scale manufacturing (LSM) has accelerated with a year on year increase of 8.4 percent during the first quarter of the current fiscal year. Similarly, the exports have also marginally picked up, growing at 1.3 percent in Q1-FY14.

It said the deterioration in the external accounts has continued in FY14, largely on account of weak financial inflows. The external current account had a deficit of dollars 1.2 billion in Q1-FY14, similar to that witnessed in the previous quarter. With imports picking up at a relatively higher pace than exports, the widening of the trade deficit mainly explains this.