Spread trading Tricks of the trade

Post on: 21 Июль, 2015 No Comment

In todays volatile and sometimes uncertain markets, traders looking for a way to protect themselves should consider using spread trading. A spread is buying one futures contract and selling a related futures contract to profit from the change in the differential of the two contracts. Essentially, you assume the risk in the difference between two contract prices rather than the risk of an outright futures contract. There are different types of spreads and different methods for using each.

Pick your spread

Calendar spreads are done by simultaneously buying and selling two contracts for the same commodity or option with different delivery months. These spreads can be just the mechanical process of maintaining a long or short position through a roll period when the front month or spot contract goes off the board or putting on a position designed to benefit from a change in the differential. The further out you go in time, the more volatility you buy in the spread. CME Group offers calendar spread options in corn, wheat, soybeans, soybean oil and soybean meal (see Knowing your options). Calendar spreads are popular in the grain markets due to seasonality in planting and harvest. For example, for corn, in a July-Dec calendar spread, you are selling the old crop (July contract based mainly on carryover from the previous growing season) and buying the new crop (December contract based on the current growing season) (see Out with the old, in with the new).

Alternatively, you can execute a Dec-July spread, selling the new crop and buying the old crop. You also can trade a year- round spread, trading Dec-Dec. For wheat, you can do a spread trade for Dec-July, July-Dec, or July-July; and for soybeans July-Nov (old crop/new crop), Jan-May, Nov-July, and year-round Nov-Nov.

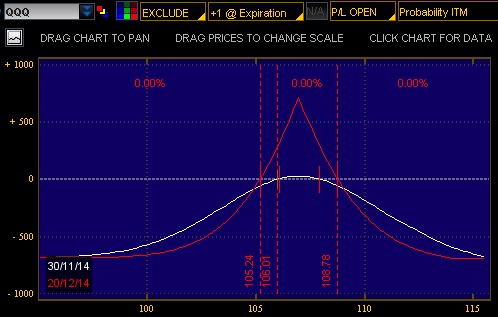

In an options calendar spread, youre essentially buying time and selling the front month, or a net debit, explains Joe Burgoyne, director of institutional and retail marketing at the Options Industry Council. The benefit of that is you have the time decay or the erosion working in your favor as the front month option that youre short gets closer to expiration, he says, adding that you should execute the strike where you anticipate the underlying being at expiration because the optimum value of the spread is when the future is at the short strike at expiration.

[A calendar spread] is a long volatility spread. You are long volatility, so it makes sense for an investor to have some sense of where volatility levels are in those two options, especially the one youre buying further out in time because thats going to be a little bit more sensitive to volatility than the front month, which is more sensitive to the erosion aspect, Burgoyne says.

In commodity markets, however, many of the fundamental assumptions of spread trading have been turned upside down by the emergence of long only commodity funds. These funds benchmarked to various commodity indexes maintain a long only bias and roll those positions at a predetermined time based on the index prospectus. The S&P GSCI (Goldman Sachs Commodity Index) rolls its positions on the fifth to ninth business day of the month preceding expiration.

Because funds benchmarked to these indexes have become so large — positions in some agricultural commodities exceed the previous years total carryover — the nature of certain spreads has changed. For instance, in bullish seasonal markets, front month contracts traditionally would outperform further out contracts but because of the size of the roll where huge volumes of the front month are being sold and long positions are being rolled to the next month, that has changed. There have been instances where what would be considered a bull spread (buying the front month and selling the further out contract) has lost money during a bull market because of the Goldman roll.

To combat this effect, many traders have entered bear spreads (selling the front month and buying the further out contract) prior to the indexes roll periods hoping to take advantage of money flows. This often has been effective, but presents a problem if a serious supply issue arises pushing the spot month contract higher. This happened in September 2006, costing bear spreading locals in the wheat pit at the Chicago Board of Trade in excess of $100 million by some estimates.

The bottom line is that some traditional relationships have changed and traders need to be aware of fund activity when entering spread positions.