Sortino Ratio Correcting Sharpe Ratio flaws

Post on: 16 Май, 2015 No Comment

Ever since I began following investment manager performance, I have been advised to look at Sharpe ratio as a measure of risk adjusted performance. It is a truism of investing that you cant simply look at returns but on the amount of risk taken to achieve those returns. This is particularly important when examining trading strategies that involve leverage like managed futures and various arbitrage based hedge funds.

Futures has the advantage of imbedded leverage you are posting a small percentage of the value of a contract for margin instead of actually borrowing to get more of something.

Most managed futures strategies offer managed accounts so an investor is posting the necessary margin with his broker. The riskier the strategy the more money you need to post and the less you can earn on the rest of your money. Hence, to fairly measure the performance of a strategy you must look at the risk taken to achieve it or more specifically the money at risk to maintain your positions.

The Sharpe ratio has for years been a benchmark investment measure of risk adjusted returns. It also has had its critics, and I count myself as one. There are two basic flaws. The first is that it uses standard deviation in its calculation of risk, which means an investment strategy can produce a weaker Sharpe ratio when it has strong upside performance. This is particularly damaging to trend followers who tend to produce mediocre returns until hitting upon one or two strong trends that can make a managers year. The whole theory behind trend following is to cut your losses short and let you winners run. That does not suggest a smooth return stream.

The other problem with the Sharpe ratio is that it tends to be biased towards negatively skewed strategies such as option writing. Tom Rollinger and Scot Hoffman, principals of Commodity Trading Advisor Red Rock Capital, made this point in a white paper titled: Sortino: A Sharper Ratio .

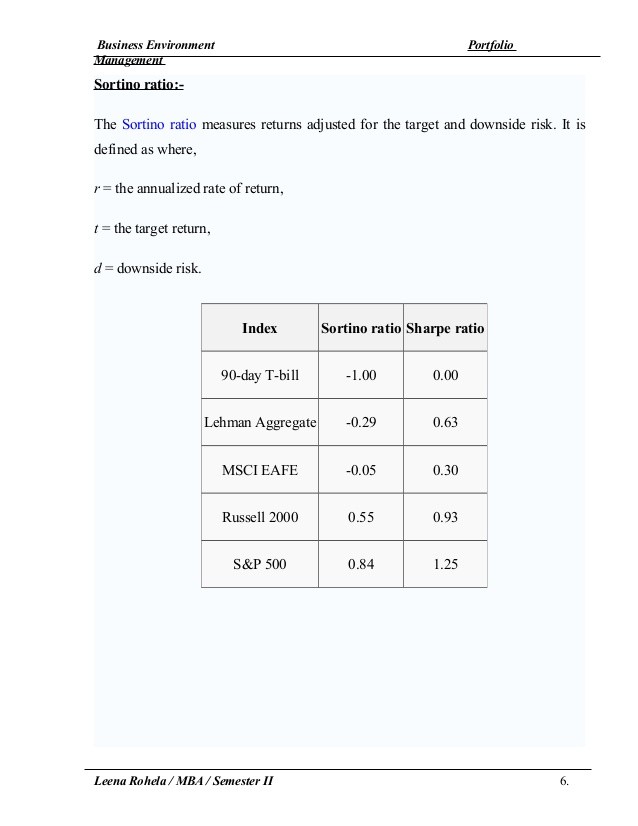

The Sortino is one of several risk adjusted performance measures created to improve on Sharpe, basically by just looking at negative returns instead of standard deviation, which penalizes upside volatility.

The paper points out that the Sharpe ratios bias towards negatively skewed strategies may lead investor towards greater risk. For example, the typical option writer often will have several strong years of performance with no hint of volatility and then get whacked by a spike in volatility. This often is not captured by Sharpe. While sophisticated investors understand this, there are those that swear by the Sharpe ratio and will see a strong Sharpe ratio as a sign of a low risk investment.