Silver Futures Silver Futures Prices Contract Specification Charts

Post on: 22 Июль, 2015 No Comment

Silver Futures

Current Silver Futures | Futures Prices

Silver futures. at a first glance, can seem like a conundrum, but it’s mainly about packing for a hiking trail and reaching the top of the mountain. Firstly, to be properly equipped, you need have to understand what you are carrying. Silver, in general, is a shiny-gray metal that possesses a brilliant white luster.

Silver Futures Trading

The atomic number of silver is 47 and on the periodic table its symbol is Ag. This luminescent metal can be traded on the New York Mercantile Exchange (NYMEX), and Tokyo Commodity Exchange (TOCOM). When silver is traded on NYMEX quotes are given, in dollars, cents per ounce, with lot (quantity) sizes of 5000 troy ounces. On the converse, on the TOCOM, silver is traded in grams, 964.53 troy ounces, and is quoted in yen per gram. Silver trading is a commodity that is volatile and depends on the demand from the public. In addition, as you setup these trades, futures contracts are essential. When employing a futures broker. they need to understand how to set up a futures contract and the insight into the commodities market.

As a broker looks at a silver futures contract. they look to begin witha certain futures exchange. In general, the futures exchange is a layout, where the futures contracts are traded. Moreover, with the study of trends, a general conclusion is projected for what a commodity may be worth in either the near or distant future. However, the future cannot be measured, because it is unpredictable. In short, the futures contract begins with a simple commodity, for the sake of our topic, silver, that will be sold at a future date and price, either at the above price of purchase, for a profit, or bought higher for a loss. When trading with silver contracts, there is no certainty. There is only underlying obligation of a futures contract and that is to pay. If the contract is at a loss, the funds on hand, are transferred from the party who lost funds, into the one who made a profit. As the financial market has evolved, most trades are done on a cash basis. Silver futures are a windy road, and you need an apt guide, to navigate the dips and unexpected twist of the financial journey. Trading silver futures. takes time, and skilled brokers, still are befuddled by its elusive makeup.

Silver futures. can be traded on an online platform, or through a broker, who specifically handles futures contracts, and trades. In selecting an online trading platform. some allow beginners, to paper trade. Paper trades, generally, allow novice investors to the commodities market, to trade, in real market conditions without losing money. In the futures market, the interactions are between the hedgers, and the risk takers (the speculators), meet to make a profit. In highlighting the role of speculators in futures contracts, there sole motivation is chase massive potential profits. Brokers have a full comprehension for the need for speculators. Their role keeps the market from unhinging, and being volatile. The speculators simply are the first aid-kit to the financial market. Usually, when speculators see a rise in silver prices, they take a long position, and on the flip-side, will take a short position when silver prices fall.

As one of the leading commodity brokers in the industry, Cannon Trading has helped clients all over the world achieve their trading goals. We have been in business since 1988, and have received several customer service awards, and consistently maintained good standing with the NFA and CFTC.

Our professional commodities brokers will work with you to understand your specific trading style and requirements, and provide you the essential advice and information you need to thrive in this highly lucrative market.

Cannon Trading’s Broker-assisted Trading solution provides traders who are new to the field with the essential advice and tools they need to accelerate their understanding of the silver futures market.

Contact us today to learn more about commodities trading, as well as information on options prices and contracts.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Latest Silver Futures News

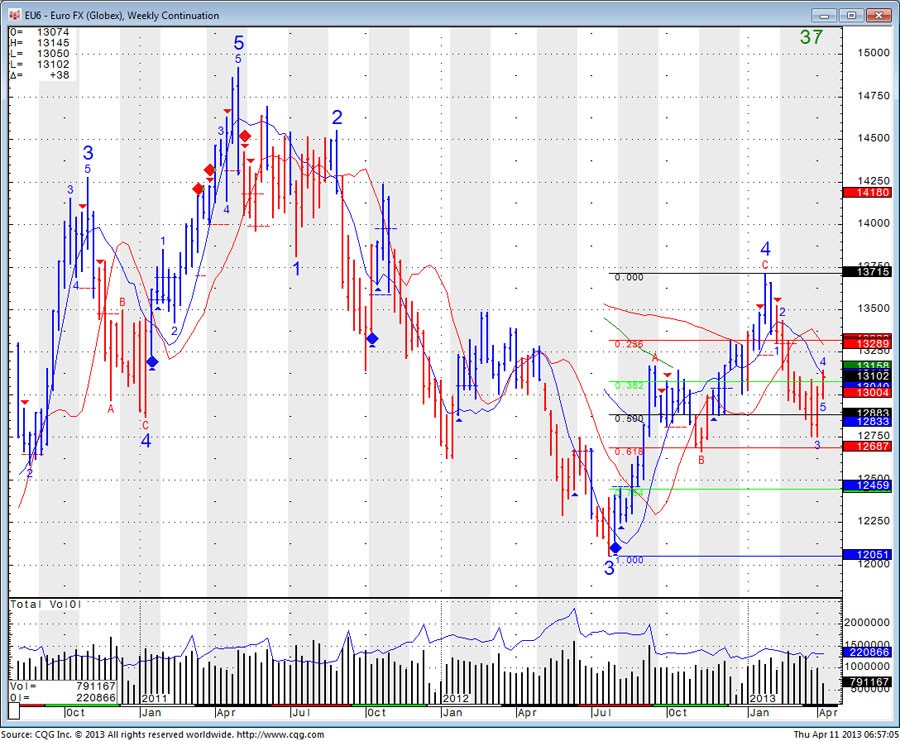

Silver Futures Prices — Historical Chart

Chart of Silver Futures futures updated Nov 4th, 2014. Click the chart to enlarge. Press ESC to close.