Should You Invest In Managed Futures Or Trade Commodities On Your Own

Post on: 24 Июнь, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

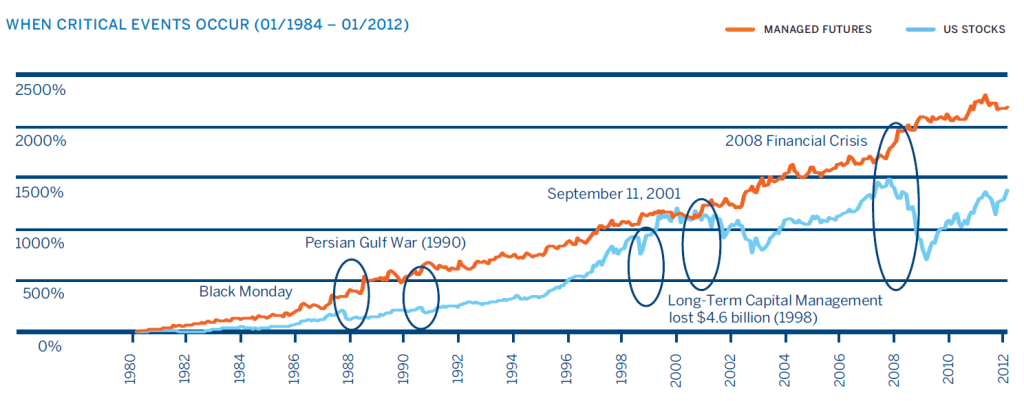

Managed futures are professionally managed investment accounts that invest in the commodities and futures markets. Managed futures are a good way to diversify your overall investment portfolio. but many investors wonder whether they should manage their own commodities trading account.

Time and experience are the two major factors to consider when you are deciding to manage you own account or invest in a managed futures fund.

Time Devoted to Managing a Commodity Trading Account

Most investors work full time jobs and cannot commit the time it takes to properly manage a commodities trading account. It can be very time consuming managing commodity trades, especially if you prefer to do short term trading. The futures markets are much more leveraged than stocks, so they do require a more hands on approach.

You must honestly ask yourself if you can commit the time and whether monitoring the markets and trades will be a distraction to your normal life. It can take anywhere from a couple hours a week to 8 hours each day to manage an account, depending on your trading style. It normally doesn’t make sense to jeopardize your full-time occupation to manage a commodities account that is only a portion of your overall investment portfolio.

The opportunity costs that are involved in managing a commodities account are also a concern. Could you make more money in the long run by devoting more time to your job? Or, would you rather spend the extra time with your family or on your hobbies? These are considerations that you should evaluate on whether it makes sense to invest in a managed futures account or you want to manage it yourself.

Experience in Trading Commodities

Your trading experience in the futures markets could be the deciding factor in your decision process. If you have never traded commodities before, you have to realize that it takes a great deal of time to learn how to trade properly. Many traders never get it right and it is a very frustrating and costly endeavor for them.

I can tell you with great certainty that the odds of success in the futures markets are much higher if you leave the trading decisions to a professional. By a professional, I mean a Commodity Trading Advisor (CTA) with a proven track record over a period of several years.

There are a few good sources for finding a managed futures fund online that can help you with the process. In the end, you have to decide whether you believe you can do as well as a professional with a solid track record and you have the time available to manage a commodity futures account. You also have to consider the learning curve and there will undoubtedly be some stress along the way if you try to trade on your own.