Shorting USO Reducing Risk With Options The United States Oil ETF LP (NYSEARCA USO)

Post on: 21 Июнь, 2015 No Comment

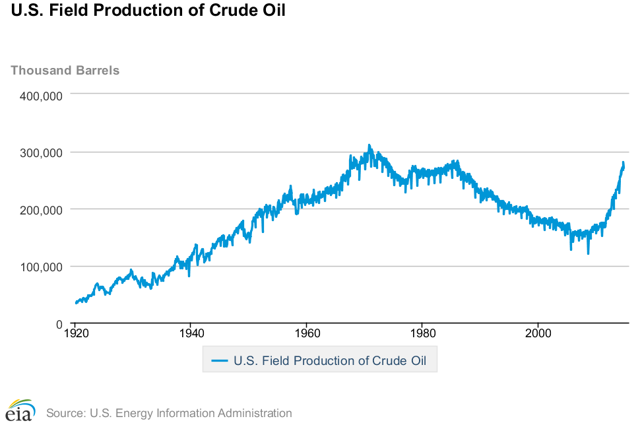

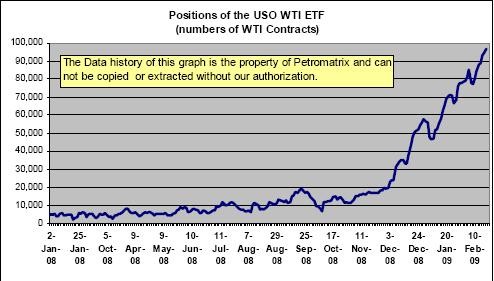

United States Oil (NYSEARCA:USO ) is an ETF that consists of a portfolio of nearby crude oil futures contacts. A number of Seeking Alpha articles have noticed that USO seems to substantially underperfrom its benchmark, the price of crude oil. The reason is that physical supplies of oil are quite high, and the cost of storing that oil is significant. Currently, the oil futures market has a positive carry of about 0.6% per month. This means that if the cash price of oil does not change, the holder of USO will lose 0.6% x 12 = 7.2% per year. This relationship has held for quite some time.

This would suggest that shorting USO is a good trade. But it’s very risky. The problem is that oil prices can go higher even with the current oversupply. Oil prices are influenced by many things including market perceptions and geopolitics. Take it from me, there are few trades worse then getting caught short in an oil price spike.

One way of reducing the risk of this trade (if you have access to the futures market) is by shorting USO and going long a deferred crude oil contract. However, even this is somewhat risky. In a true price spike (a revolution in Saudi Arabia for example ), the nearby contracts that USO owns will move up faster than the distant ones.

My idea is to use options to reduce the risk even further. In USO options, the deeper out of the money puts are relatively more expensive than the at the money ones, i.e. implied volatility is higher on the lower strikes. I propose buying a put ratio spread. As I wrote this, USO was at $37.89. One could buy the Oct 2011 38 put and sell two Oct 2011 35 puts for a .05 cost. In the three months between now and Oct, the carry will be 68 cents. If the oil price stays the same, that is what you will make. If oil goes up, both sides of the trade go to zero, and you break even. If oil goes down somewhat, you could win big. If it’s 35 at expiration, you make $3.

The risk in this trade is that oil prices quickly collapse. In that case, you would lose if USO goes below 32 at expiration. If it collapses immediately, you would have immediate mark-to-market losses. The top chart is from the iPhone/iPad app OptionPortfolioCS which allows one to quantify the risk of options positions. Note that the black line is the current gain/loss.

Right now, this is a slightly bullish trade. However, the red line is the payoff at expiration. This gives the maximum payout of

$900 at $35. The green line is the current gain/loss if the implied volatility spikes right now by 50%. Another OptionPortfolioCS chart, not shown, gives the current delta at 5 shares per unit.