Short and Leveraged ETFs 3 Pitfalls You Shouldn t Ignore

Post on: 5 Июнь, 2015 No Comment

SAN DIEGO (ETFguide.com)  When it comes to cars, few manufacturers deliver the kind of thrills Munich-based BMW does. The BMW M6 in particular has become the benchmark for high performance vehicles. This ultimate driving machine (BMW’s slogan) comes with a dual power setting. A mysterious power button, located in the center console, instantly boosts the engine’s power from 400 hp to 507 hp.

You may wonder what the BMW M6 has to do with ETFs. Simply put, leveraged ETFs (long and short) are the BMW M6 of investing. With or without a power button, those ETFs offer high octane performance.

Even though the BMWs 507 horse power can zoom you from point A to point B in a hurry, you may also find yourself wrapped around a tree if you’re not careful. Leveraged ETFs (short and long) just like the M6, can rack up profits at high speed, but can also crash your portfolio in no time.

Driving a fast car is exhilarating, as long as you don’t push your luck and are able to arrive safely at your destination. Investing with leveraged ETFs can speed up your portfolios return (or hedge effectively), as long as you follow a few simply rules and guidelines; consider them your road signs. Don’t worry, there are no investment cops. The market’s vicious speed bumps, however, may do more damage than a speeding ticket ever will.

A look under the hood — the basics

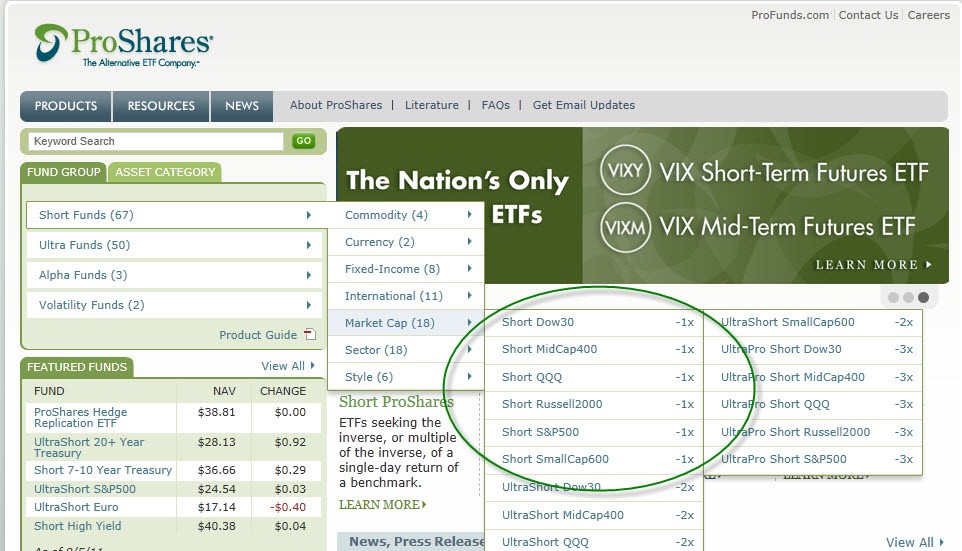

Leveraged (long) ETFs aim to magnify the performance of the underlying index by 2x or 3x. Short ETFs intend to replicate 1x, 2x, or 3x the daily inverse, or opposite performance of the underlying index.

First gear: leveraged (long) ETFs

To illustrate, let’s take a look at a suite of leveraged ETFs. The objective of the Ultra S&P ProShares (NYSEArca: SSO) aims to deliver 2x the performance of the S&P 500 (SNP: ^GSPC), while the Direxion Large Cap Bull 3x Shares (NYSEArca: BGU), and PowerShares UltraPro S&P 500 (Nasdaq: UPRO) aim to deliver 3x the performance of large cap stocks. ETFs representing non-leveraged exposure to large cap stocks include the iShares Russell 1000 Index (NYSEArca: IWB), S&P 500 SPDRs (NYSEArca: SPY), and Dow Diamonds (NYSEArca: DIA).

In a perfect world, SSO will gain 2% if large cap stocks are up 1%. BGU and UPRO would gain 3%.

Second gear: leveraged (short) ETFs

Unlike long ETFs, short ETFs delivery the inverse (opposite) performance of the underlying index. The Short S&P 500 ProShares (NYSEArca: SH) aim to deliver the opposite daily performance of the S&P 500. The UltraShort S&P 500 ProShares (NYSEArca: SDS) aim to deliver twice the opposite daily performance of the S&P 500, while the objective of the Direxion Large Cap Bear 3x Shares (NYSEArca: BGZ) and ProShares UltraPro Short (Nasdaq: SPXU) is to multiply the daily inverse performance by 3x. A 1% loss in the S&P 500 would (ideally) translate into a 1% gain for SH, a 2% gain for SDS, and a 3% gain for BGZ and SPXU.

While Direxion, ProShares, and Rydex are known for their leveraged equity ETFs, PowerShares and Van Eck offer ETNs linked to various commodities and currencies.

Respect the speed of leverage

If you are looking for a way to make or lose 60% in a few days, double or triple leveraged ETFs are the solution. Leveraged ETFs linked to volatile sectors can fluctuate 25% or more (daily) during periods of volatility. Such ETFs include the Ultra Financial ProShares (NYSEArca: UYG) or UltraShort Real Estate ProShares (NYSEArca: SRS).

Such leverage needs to be respected and used responsibly. Buying a leveraged (long or short) ETF at an inopportune time can set your portfolio back real quick. Timing is a key component for investing in general, and investing in leveraged ETFs in particular. (More about how to get the timing right in a moment)

Tracking error — the odometer may not be correct

The objective of leveraged ETFs is to deliver a multiple of the underlying index’s DAILY performance. Notwithstanding a small margin of error, most ETFs are able to live up to their objective.

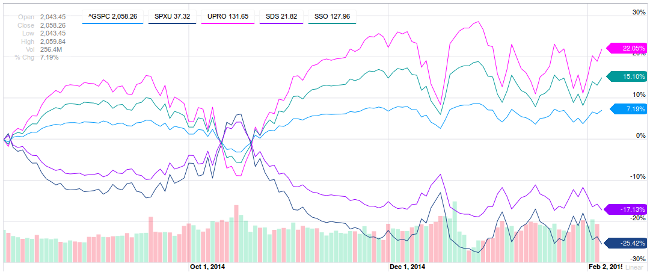

There is the misconception, however, that the magnified DAILY performance multiplied by a longer period of time, will also result in accurate long term performance mirroring. This is not so.

Due to the compounding effect of leveraged performance, the long-term performance of leveraged ETFs can deviate substantially from the underlying index. According to an in-depth study by ETFguide.com, the performance tracking error becomes particularly pronounced during periods of volatility (available in the April issue of the ETF Profit Strategy Newsletter).

The fourth quarter of 2008 marked such a period of volatility. Even though the Dow Jones (DJI: ^DJI) was essentially range bound, some leveraged short ETFs deviated from their perceived long-term objective by 20% and more.

As much as volatility hurts the performance of leveraged ETFs, especially in combination with a non-directional market, a directional market actually helps the performance of leveraged ETFs. This, once again, is due to the effect leverage has on compounding interest. Once more, timing is key.

Don’t forget about taxes

In order to manufacture magnified returns, leveraged ETFs have to resort to investment strategies that include swaps and futures, which are the most effective way for short ETFs to create the inverse performance.

This, however, also disqualifies them from the traditional in-kind redemption process which has given ETFs a reputation of tax efficiency. Up to 85% of leveraged long ETF assets could be allocated to securities of the underlying index, with the remaining portion invested in swaps and futures.

Tax distributions for many ETFs reached double digits in 2008. Shareholders of the Rydex Inverse S&P Energy ETF (NYSEArca: REC) got hit with distributions in excess of 80%. The UltraShort Industrial ProShares (NYSEArca: SIJ) paid a taxable distribution of over 44%. This tax hit can be avoided by simply not owning susceptible ETFs on the ex-dividend date. The ETF Profit Strategy Newsletter continually informs investors in advance when an ex-dividend date is coming up.

The key ingredient — TIMING

When driving a fast car, knowing when to apply the brakes is a must. Imagine going full throttle during rush hour approaching an intersection, Chaos is destined to occur. Opening wide on the German autobahn on the other hand, will move you fast and save you time. No doubt about it, timing is the key ingredient to using leveraged ETFs successfully.

Drivers rely on road signs to ascertain the speed limit. Investors have been looking to the ETF Profit Strategy Newsletter as a reliable source for finding the right entry and exit points.

The December 15th newsletter recommended adding (leveraged) short ETFs above Dow 9,000. From January 2nd to January 6th, the Dow sat above 9,000. The subsequent 2,700 point loss in the Dow resulted in triple digit gains for a number of recommended short ETFs.

The January newsletter identified Dow 6,000 to Dow 6,700 as a target range for a bottom. On March 2nd, just a few days before the Dow bottomed at 6,440, subscribers on record received a Trend Change Alert with the recommendation to buy leveraged long ETFs. A number of leveraged ETFs have racked up triple digit gains since the March 2nd alert.

Even though leveraged ETFs have their flaws, those flaws are far outweighed by their benefits. The key is knowing how and when to use them. If you ever get a chance to drive the M6, do it. If you haven’t tried leveraged ETFs — long and short — simply follow the above steps, get your timing in order, and enjoy the ride.