SATS5 metastock trading expert system introduction

Post on: 29 Май, 2015 No Comment

STS8 Trading Method Introduction

STS8 or Stocata Swing Trading Stocks is a trading method based on 8 rules that must be complied with to open or close a trade. It uses a number of proprietary indicators. The STS8 method can be used to trade stocks futures and forex on an end of day or real time basis.

There are eight clearly defined rules for making swing trading buy or sell decisions. These rules are applied to a customized chart template with a number of proprietary indicators. Some of the rules allow alternatives.

One of the indicators is an expert system that can be used for full auto-trading.

www.ninjatrader.com/ ) .

It can be used free of charge if you do not want to trade full automatic with your personal broker. End of day price data is also available free of charge.

We will have a detailed look at each of the rules and the rules for opening a short trade and closing a trade. Inclusive a worked-out example trading the stock GT in a period from July 2010 till August 2011. A buy and hold strategy during this period gives a profit of about 40% while applying STS8 produces a profit of 300%. I wish you a lot of fun and Happy Trading!

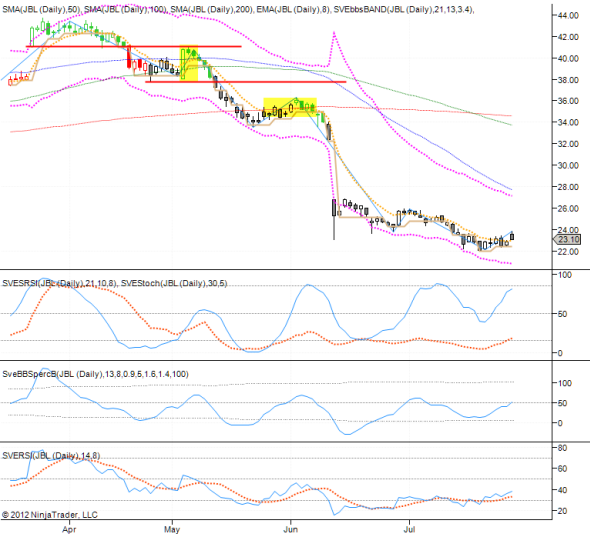

Open, high, low and closing prices are displayed as a standard candle chart. The candlesticks are color coded by an expert indicator for buy, sell and open short position signaling. However as with the basic candle coding an empty (white) body has a closing price above the opening price and a filled (colored) body has a closing price below the opening price.

Sub-window 1:

A proprietary stochastic RSI indicator (light blue) and a standard stochastic oscillator (dotted red).

Sub-window 2:

A proprietary %b oscillator based on the BBS (Band Break System) bands. More about the BBS system now available HERE .

Sub-window 3:

A standard RSI indicator (light blue) overlaid with an average (dotted red).

- An eight period exponential moving average (dotted orange).

- A proprietary trailing buy-sell noise indicator SVETrailNoise (brown staircase line). This indicator reverses direction when there is too much noise or price change.

- A proprietary indicator to assist you in counting waves SVE123Count (Light blue zigzag line). The basic rules behind and the application of this wave count system is explained HERE. This indicator shows a direction change after complying with a minimum reverse condition.

- The proprietary SVEbbsBand (purple dotted lines) upper and lower band is used to catch the up and down price moves within the bands.

- A standard 50 periods (days) simple moving average (blue small dotted line).

- A standard 100 periods (days) simple moving average (green small dotted line).

- A standard 200 periods (days) simple moving average (orange-red small dotted line). All of the standard averages will be used as active support and resistance levels.

- Pivot points SVEPivots, PP, resistance R1 to R3 and support S1 to S3, calculated on a previous bar of a higher time frame. On a daily chart we use a monthly reference.

- The proprietary Price Range expert system SVEPRExp color codes the candles. Green for a long position, red (or black) for closing a long position and black for a short position with green closing the short position. This expert can be used for full auto-trading.

In the first sub-window there are 2 indicators. The first is a fast stochastic RSI SVESRSI (light blue) and the second a slow standard stochastic (dotted red).

The second sub-window is a %b indicator SveBBSpercB a %b indicator based on my BBS band deviation system.

Finally in the third sub-window there is a standard RSI indicator (light blue) with a simple moving average (dotted red).

For all the basic techniques, please consult my book Capturing Profit with Technical Analysis, published by MarketPlace Books and available HERE