SafePlay Stocks Bonds and Gold Sink After US Hiring Surge

Post on: 18 Июнь, 2015 No Comment

NEW YORK — Safety wasn’t safe Friday.

A blockbuster U.S. jobs report sent investors fleeing their traditional places of comfort: dividend-paying stocks, as well as bonds and gold. The selling left major indexes slightly lower.

When nervous investors crowd into safe-haven assets, it’s known on Wall Street as a flight to safety. Instead, it was a flight from safety Friday as investors grew more confident that the economy would grow.

The January employment report was strong across the board, said Michelle Girard, an economy at RBS Securities, in a note to clients. The data were clearly very healthy.

Gold fell more than 2 percent. The yield on the 10-year Treasury jumped to 1.95 percent from 1.81 percent as investors sold off the ultra-safe investment.

Utility stocks, one of the best-performing parts of the market over the last year, took a beating. The Dow Jones utility index, a collection of 15 power companies, had its worst day since August 2011, plunging 4 percent.

January’s jobs report startled investors with evidence that the job market is closer to full health. U.S. employers added 257,000 jobs last month and wages jumped by the most in six years. The gains were far better than expected.

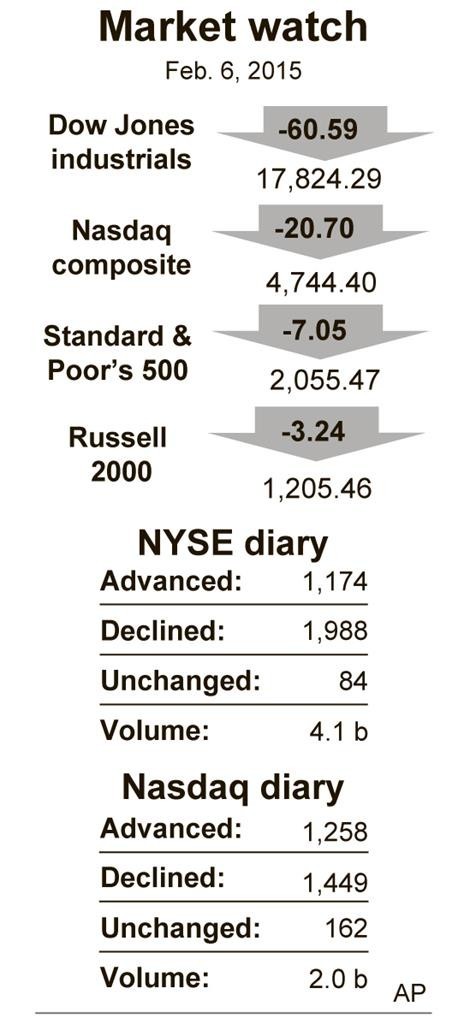

The Dow Jones industrial average fell 60.59 points, or 0.3 percent, to 17,824.29. The Standard & Poor’s 500 index lost 7.05 points, or 0.3 percent, to 2,055.47 and the Nasdaq composite fell 20.70 points, or 0.4 percent, to 4,744.40.

Understanding why a strong jobs report could push the stock market lower requires some counterintuitive thinking.

Unlike their counterparts in Europe and Asia, who are lowering interest rates, U.S. central bankers could lift rates as soon as June. Strategists say the surprisingly robust jobs report gives the Fed more ammunition to justify a rate increase sooner rather than later.

There’s an underlying nervousness in this market built on cheap money, said Russ Koesterich, global chief investment strategist at BlackRock.

The current near-zero interest rates have been a key factor driving the stock market’s dramatic rise since March 2009. By keeping rates low, the Fed has made bonds appear more expensive than stocks. If interest rates rise, a richly-priced stock market would tend to be less attractive to investors, strategists say.

That dynamic was reflected in utility stocks Friday. Utilities typically pay investors consistently high dividends and tend to fluctuate less than other stocks, giving them a bond-like quality. That makes them appealing to investors seeking income and less risk.

It’s much more difficult to justify these high prices for utility stocks with yields rising like this, Koesterich said.

Despite Friday’s downturn, it was a good week overall for investors. The Dow ended up 3.8 percent and the S&P 500 climbed 3 percent. Stocks have now reclaimed the ground they lost in January.

The price of oil also rebounded this week on signs that crude production is slowing. U.S. crude jumped 7 percent, its biggest gain since February 2011, during the Arab Spring and turmoil in Libya.

On Friday, U.S. crude rose $1.21 a barrel, or 2.4 percent, to close at $51.69 a barrel. The jobs report suggested to investors that demand for fuels could rise.

Brent, the international standard, gained $1.23, or 2.2 percent, to end at $57.80 a barrel in London.

The price of oil is still down by about half from last June because of a glut in global supplies.

In other metals trading, silver fell 50 cents, or 2.9 percent, to $16.69 an ounce and copper fell a penny to $2.59 a pound.

In other futures trading on the NYMEX:

— Wholesale gasoline rose 3.4 cents to close at $1.559 a gallon.

— Heating oil rose 3.3 cents to close at $1.839 a gallon.

— Natural gas fell 2.1 cents to close at $2.579 per 1,000 cubic feet. It was the eighth down day for natural gas out of the last 9, pushing natural gas to its lowest level since June of 2012.