Royalty Trusts Income And Investing

Post on: 6 Апрель, 2015 No Comment

This is part I of the series, Unconventional Income From Uncommon Stocks. The series is meant to be an absolute beginners introduction to uncommon stocks. The focus of this post is on Royalty Trusts.

Investing For Income

The national average for interest on your savings account is about 0.17%. How would you like to get an yield of say 6.5% paid as quarterly dividends from royalties from oil wells in Alaska? Almost all of the profits are passed on to you in proportion of your share AND you can even factor oil well depletion as a tax write off! Sounds intriguing? Read on!

Investing In Royalty Trusts

There is a class of shares called Royalty Trusts that are neither stocks nor bonds but trade like shares. The above example was from a Royalty Trust called BPT. BP Prudhoe Bay Royalty Trust. First, take a look at some of the stats for BPT.

1 Employee

Thats no typo, thats a characteristic of Royalty Trusts. Royalty Trusts dont have any employees! There is just the trust manager which is usually a bank and any profits are passed on to the unit holders.

In the case of BPT, the trust is managed by Bank of New York.

What Exactly Are Royalty Trusts?

Royalty Trusts hold assets in natural resources like Coal, Oil, Minerals and Natural Gas.

Royalty Trusts dont have any operation on their own. The resources are mined/drilled by a different company and pay royalties to the trust in return. By law, Royalty Trusts are required to pass on almost all the returns to unit holders and yields of 10% are not uncommon.

Royalty Trusts dont pay any corporate tax. This is passed on to the unit holder as well.

So, Whats The Catch!

Sounds great right? But Royalty Trusts do have some drawbacks.

Natural resources are finite in nature and Royalty Trusts invest in them, which implies when these resources get depleted, the royalty trust has to shut down. And thats exactly what happens to Royalty Trusts. Once the resources are depleted, the trust is closed. Keep this in mind when investing in Royalty Trusts. They are not forever. You should know when to get out!

Since a Royalty Trust doesnt pay any corporate taxes, you bear the tax burden.

You also have to pay a state tax in the state where the assets are located.

Be prepared for decreasing distributions as the resources get depleted.

Is It Worth It?

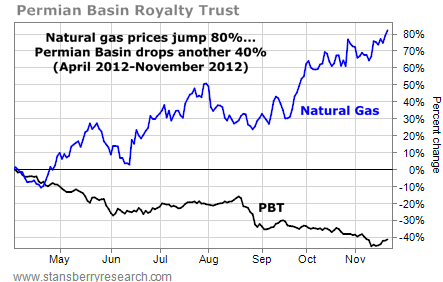

Definitely! For some additional tax prep time, you get above average yields which are directly tied to commodity prices. If you invest in an Oil RT, your distribution is directly tied to the price of Oil. If the prices go up, so does your distribution.

Though a RT is not forever, they dont shut down in a year or two. Usually they last for decades. Pick a trust that has not reached its end-of-life period.

You dont pay taxes till you sell your shares and your distributions are taxed as capital gains and not as income which is a good thing since capital gains taxes are lower than income tax.

Ok, You Have Me Hooked! How Do I Invest In Royalty Trusts?

Royalty Trusts trade like stocks. Buying an RT unit is exactly like buying stocks. Enter symbol and number of shares and press buy!

Can I hold Royalty Trusts In A Retirement Account (ROTH, IRA, 401K etc.)?

Yes! Royalty Trusts are best suited for retirement accounts as they dont generate UBTI unlike MLPs. Keeping Royalty Trusts in a tax-deferred account shields you from tax complications as well.

Anything Else I Need To Know?

Yes, one last thing. There are two kinds of Royalty Trusts, US based and Canadian based. Canadian Royalties are different and laws are changing in 2011. Taxes on Canadian Royalties are different as well. Know this before investing.

Why BPT?

This is not a recommendation to buy BPT! I own BPT and know more about this RT than others. There are many more. SJT, HGT and PBT are some other RTs worth considering.

Conclusion

RTs are a great way to add income component to a portfolio. The yields are some of the best and is a safer alternative to the futures market. For a little bit of extra tax prep time, you get great returns. If the price of the unit goes up (like BPT did) thats an added bonus!

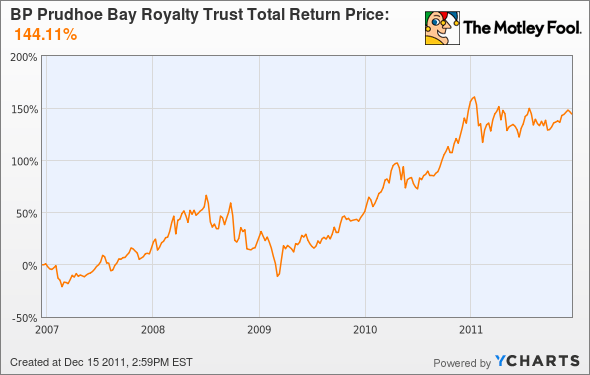

When I invested in BPT, I wasnt looking for share price appreciation only income through dividends. Yet, BPT has been one of the best performing stocks of 2010!

Recommended Read:

This post is a part of a series of posts on Unconventional Income From Uncommon Stocks . Stay tuned for more investing ideas in the coming weeks! You can get the articles delivered straight to your inbox via email (you can unsubscribe any time you wish and your email id will not be used for any other purposes), or if you prefer, you can subscribe via RSS .