Risks of a Forex Trader

Post on: 17 Июль, 2015 No Comment

Risks of a Forex Trader

Every kind of investment really involves risks; the risk of losing in the forex can be described as substantial. As a trader before you actually participate in the forex, one should at least comprehend the basic risks that come with trading because understanding the risks can help the traders make a sound decision on their investments.

As mentioned at the beginning of this article, forex trading involves many risks of high levels which make this activity not suitable for everyone. The funds that should be utilized for investments which involves speculation are the funds that represents the risk capital like the funds that the trader can risk losing without it having an effect on the current financial condition of the investor. Trading in Forex could not be the right investment for just about anyone because of specific reasons which are stated below.

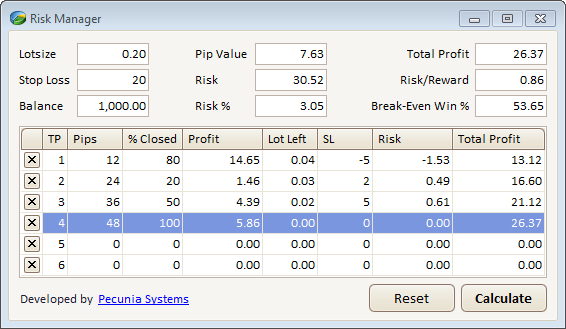

Money is being traded in Forex in quite substantial amounts and there is the constant possibility that the trade may not be in the investor’s favor all the time however there are many tools for trading that can help lessen the risks even if it can’t be eliminated. The trader can indeed trade at large profits if he exercises caution and educate his self how to lessen the risks and keep losses at a minimum.

The Fraud and Scams The Scams in the FOREX is a typical occurrence in the past and since then the forex industry has been cleaned however every trader should still practice caution particularly when dealing with a broker, a trader can have assurance by having a background check first.

The brokers in the Forex that has a famous reputation are usually associated with the big financial establishments and institutions like the insurance corporations or banks. They are usually registered with the right agencies in the government. The Commodities Futures Trading Commission is usually the agency that the brokers in United States get registered with. They can also be registered with the National Futures Association. The necessary thing to do as an investor is to check with the local consumer protection bureau.

The market moving against your trade Nobody can definitely predict with accuracy the way the exchange rates will move thus this makes the market very volatile.

There are even fluctuation that can happen with the forex rates while placing the trade and then closing it, these fluctuations affect the price of the contract and the expected profit.

Losing the whole investment A trader is required to make a deposit for the security; this is known as the security deposit others call it as the margin. This is done with the dealer so as to either buy or sell the contract. As mentioned, a small sum of money can make a trader hold a position that position in the forex which is worth more than the value of the account; this is called gearing or leveraging. The leverage is usually greater with smaller deposits but if the price acts in the direction which is unfavorable then a high leverage could result in huge losses. The truth is even the smallest move against the trader’s position can result in a big loss sometimes even losing the whole deposit this however all depends on the arrangements made with the dealer.