Repo 105 True Sales or Massaging Balance Sheet

Post on: 25 Июнь, 2015 No Comment

Repo 105: ‘True Sales’ or Massaging Balance Sheet?

On March 16, 2010, the U.S. courts released a report (1) by Anton Valukas, the Chairman of Jenner & Block and the court-appointed examiner investigating the bankruptcy of Lehman Brothers. The primary objective of the report is to determine if Lehman’s creditors have colorable claims which could be made against parties that may have acted improperly and bear responsibility for Lehman’s bankruptcy.

The report alleged that there is sufficient evidence to support two such claims that 1) Certain of Lehman’s officers breached their fiduciary duties by exposing the firm to potential liability by filing materially misleading periodic reports and 2) Ernst & Young, the firm’s external auditor, was professionally negligent in allowing those reports to go unchallenged. At the root of the misleading reports were transactions known as Repo 105 and Repo 108, which had the effect of removing billions of liabilities off Lehman’s balance sheets. While these repo instruments differ from the traditional repos only in the amount of collateral posted, their existence and possible misuse have implications, beyond corporate governance, from accounting to legal issues.

What Constitutes a Sale?

In a traditional repo transaction, Lehman would give securities, typically Treasuries, worth $102 to its repo counterparty for cash of $100, with an agreement to repurchase the securities back at a later maturity date. At maturity, the transaction is unwound with Lehman receiving the securities that it transferred to its counterparty and the counterparty receiving cash amounting to $100 plus interest from Lehman (See Figure 1). Traditional repo transactions cannot be booked as a sale of securities as defined under Statement of Financial Accounting Standards (SFAS) 140 (2). since Lehman maintains effective control over the transferred assets through its agreement to repurchase the securities at maturity.

To properly effect and book a sales, SFAS 140 paragraph 9 applied to Lehman by requiring that a) the transferred assets have been isolated from Lehman and put out of the reach of Lehman and its creditors, even in bankruptcy or other receivership, b) Lehman’s counterparty has unconditional rights to pledge or exchange the transferred assets, which only provides Lehman, at best, trivial benefit and c) Lehman does not maintain effective control over the transferred assets through an agreement that entitles Lehman to repurchase the transferred assets before their maturity. However, the Financial Accounting Standards Board (FASB) also provides, on paragraph 218 of SFAS 140, that the transferor’s [Lehman’s] right to repurchase is not assured unless it is protected by obtaining collateral sufficient to fund substantially all of the cost of purchasing identical replacement securities during the term of the contract. The intent of this accounting rule is to ensure that the initiator of the repo contract is protected and retains control over its assets, such that even if its counterparty defaults, it has sufficient cash to replace the assets. In spite of such provisions, even the FASB acknowledges that judgment has to be exercised as to what constitutes ‘substantially all’, since repo arrangements of readily obtainable securities have collateralization ranging from 98% to 102% of the market price of the transferred security, all of which fall within the FASB 140 guideline of assuring the right to repurchase.

Traditional repos transactions satisfy both SFAS 140 paragraph 9 a) and b) but not c). Lehman’s position was that by increasing the collateralization from 102 to 105 in the case of interest rate products and to 108 in the case of equity products, Lehman’s counterparty would not have provided Lehman with sufficient cash to fund ‘substantially all’ the cost of the purchase of identical replacement securities and there would be no assurance of Lehman repurchasing the assets (3). This would satisfy paragraph 9 c) of the SFAS 140 and allow the repo to be re-characterized as a sale of securities with a forward contract to repurchase the assets later.

However, despite being able to circumvent legal issues to make Repo 105 and 108 a technical True Sale, Lehman’s management was unable to obtain a legal opinion supporting their views in the U.S. possibly due to the fear of litigation if Lehman were to get sued for using Repo 105 to misstate its financial results. In the U.S. technically complying with accounting rules is not a shield against litigation when it is done to intentionally misstate results. Thus, Lehman had to shop for other legal jurisdictions to get the most favorable rule set. According to Lehman’s Accounting Policy Manual dated December 1, 2004, Lehman was able only to get a True Sale opinion, covering Repo and Reverse Repo trades executed in London, from the U.K. solicitors, Linklaters (4). Hence, Lehman did all its Repo 105 and Repo 108 trades in the U.K. under Lehman Brothers International (Europe) (‘LBIE’). Accordingly, if U.S.-based Lehman entities wished to engage in a Repo 105 transaction, they transferred their securities inventory to LBIE in order for LBIE to conduct the transaction on their behalf.

Creative Accounting

Counter-intuitively, on the accounting front, Lehman would record, for Repo 105 that it had done a reverse repo worth $100, funded with an inventory sale worth $105 and a long derivatives inventory position equal to the amount of overcollateralization, since Lehman was required to purchase the sold securities back under a futures contract. Unlike traditional repos which have no effect on the balance sheet — since traditional repos requires Lehman to record (credit) a repo liability before recording an increase in cash assets — Repo 105 allowed Lehman to increase sales without any increase in liabilities. Lehman could then use the cash it had received from the ‘sales’ to pay down its liabilities, understating its leverage. At maturity, the Repo 105 trade was unwound by Lehman paying its counterparty cash, of $100 plus interest, to ‘buy back’ inventories, worth $105 plus interest, and closing the derivative position.

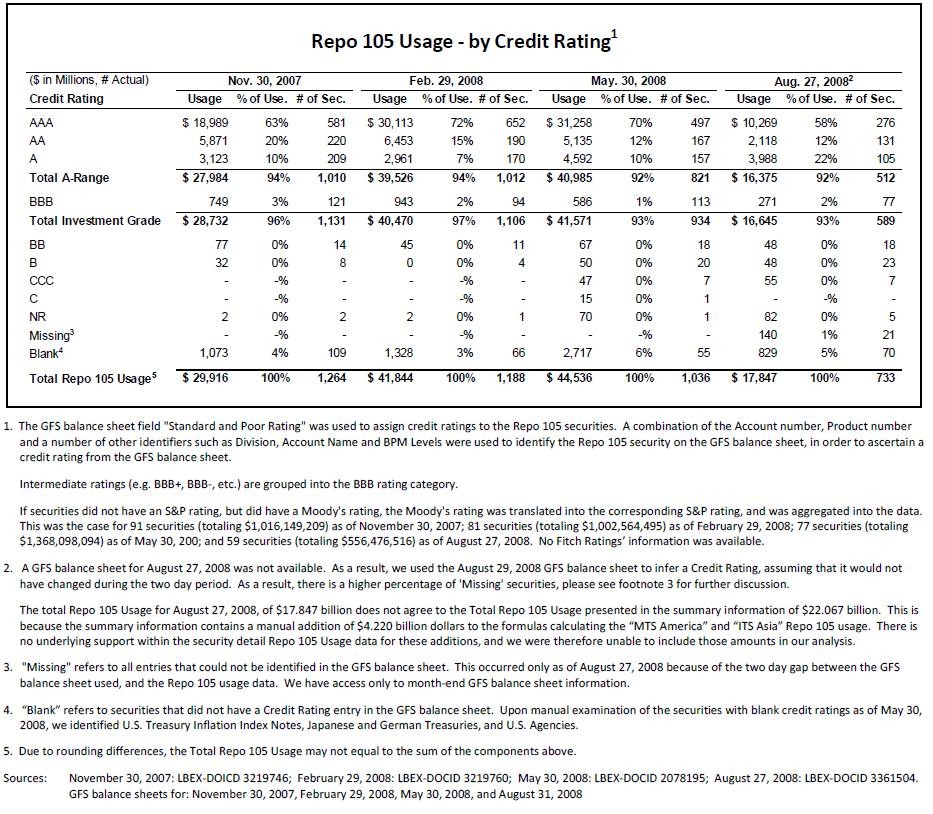

Given the two-fold benefits of increasing accounting revenues while reducing accounting liabilities, Repo 105 saw increased usage from $38.6 billion in Q4 2007 to $50.38 billion Q1 2008 (p748, Valukas Report). The increased usage was especially prominent before accounting periods (See Table 1, p733, Valukas Report). Indeed, Lehman even published a reference (See Table 2) in its Accounting Policy Manual on the minimum requirements for each class of repo transactions to qualify as a Repo 105 or 108. Repo 105 also had the effect of understating the net leverage by about 9% to 13% from Q4 2007 to Q2 2008, meaning the ‘real’ net leverage at Q2 2008 was 13.9 instead of 12.1.

The Defense for Using Repo 105

Lehman’s former executives defended their use of Repo 105 with their perception that almost all financial firms practice some form of window-dressing to adjust their balance sheet at the end of a quarter (5). Hence, the decision to use of Repo 105 as a vehicle for misrepresenting their financial statements was simply not a big deal. In fact, they argued that the $50 billion taken off the balance sheets temporarily was a drop in the ocean compared to the catastrophic loss of wealth in the 2009 financial crisis.

The main motivation behind using Repo 105 was to mislead the credit rating agencies by lowering net leverage, given the rating agencies’ focus on leverage numbers (p5, Appendix 13, Valukas report). During the period from March to September 2008, the rating agencies took turns to downgrade Lehman’s credit outlook and credit rating (Appendix 13, p7, Valukas report). Lehman’s Board was concerned about the negative impact a rating downgrade would have on the firm. In fact, management estimated that a loss in confidence due to rating downgrades could result in Lehman having to post additional collateral of around $1.1 billion to $3.9 billion.

However, Lehman had little choice but to do more Repo 105 trades since many of Lehman’s inventory positions had grown sticky (difficult to sell without incurring substantial losses). Selling sticky inventory at reduced prices would only lead to a further loss of market confidence as investors would doubt Lehman’s valuations for inventory remaining on the firm’s balance sheet (p737, Valukas report).

Conclusion

The Valukas report prompted various financial commentators to weigh in on the lessons to be drawn from the apparent abuse of Repo 105 transactions. For instance, Michael Pomerleano believed that the existence of Repo 105 demonstrates a lack of transparency, which is the foundation of a well-functioning financial system. Transparency depends on having a competitive global gatekeepers industry. The shrinking of the gatekeepers industry to just four big accounting firms and three big ratings agencies has clearly concentrated the services to a few firms and made the industry less competitive. Moody’s, Standard & Poor’s and Fitch also have extensive authority under the Basel II regime and, together with the Big 4 accounting firms, the gatekeepers have the regulators and financial industry over a barrel, as they know regulators will not dare to provoke their demise. Pomerleano hopes that real reform in regulations will occur as current reforms will only increase the distortions in the gatekeepers industry by raising barriers to entry and codifying rigid structures and procedures for accounting firms and rating agencies (6).

Lehman had also clearly exploited the incoherence in international financial regulations and Pomerleano hopes that the authorities on both sides of the Atlantic will investigate the culpability of lawyers and accountants and pursue action so as to end future regulatory arbitrages. Commenting on the legal aspects, David Reilly opined that Repo 105 has shown that rule-based systems suffer from issues such as legal opinions shopping. Reilly believes that regulators need to move toward a system where companies are judged by the substance of what they are trying to achieve, rather than meeting the definition of accounting rules (7).

REFERENCES:

lehmanreport.jenner.com/

www.fasb.org/pdf/fas140.pdf

3) Margaret Sear (2008, February 13), Accounting Policy Manual, Lehman Brothers Holdings Inc,

lehmanreport.jenner.com/docs/DEBTORS/LBEX-DOCID%20647239.pdf

blogs.ft.com/economistsforum/2010/04/the-lehman-bankruptcy-examiner-report-and-then-there-were-none/

online.wsj.com/article/B10001424052748704131404575117733017612228.html

TABLE 1

Source: p733, Valukas Report