Quadra Safe Trading Strategy By Savant Garde

Post on: 16 Март, 2015 No Comment

By JP on March 12, 2015

This trading strategy was personally designed by Savant Garde and published in Traderji forum. Like I said earlier, best trading strategies are hidden within traders mind, Quadra Safe trading strategy is the best example. Personally speaking, today also I love to use this strategy for delivery based short term to midterm trading. Quadra safe trading strategy is easy to understand and simple to use. While proceeding with this strategy, I will try to stick to the authors methology and language akin to original.

Important Disclaimer. Quadra Safe Trading Strategy was originally described by Savant Garde (SG), a super dynamic trader, investor and a writer in Traderji forum . It is one of the best methodologies written by him. All credits for trading setup goes to original author Savant Garde. Chart screens have been derived from original source and used under fair use policy.

Introduction

Quadra trading strategy is for those Traders/Investors who already have a job that brings in Bread & Butter but are looking for Jam minus the Bread & Butter time spent on ever elusive jam. Nonetheless, covers most types of Traders/Investors quite admirably, except those who are primarily Day Traders. Does one have to know Technical Analysis to follow Quadra? Short answer is no. While the main components of the system consist of two types of Moving Averages, one doesn’t have to be a Technical Analyst to follow the strategy, as we discuss the various components and how to identify them on the charts, including Entry Setup, Stop Loss (SL), Trailing Stop Loss (TSL), Re-entry, Adding to existing positions and Position Sizing later in this documentation.

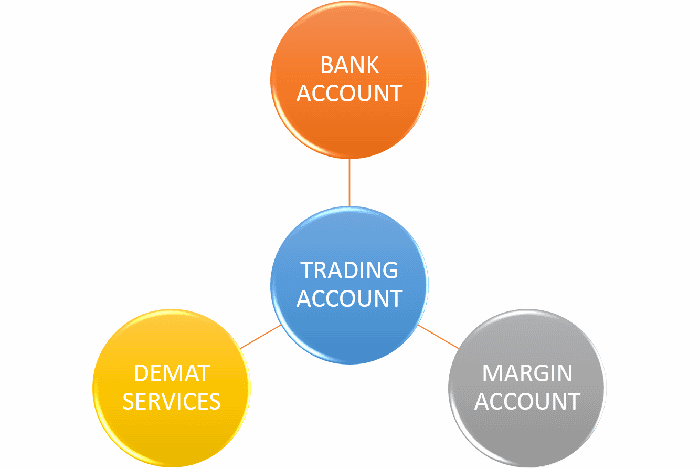

Components

Quadra consists of two different types of Moving Averages and four different periods. Three lines of Moving Averages of different periods on the chart are “Welles Wilders Moving Average” henceforth simply referred to as WWMA. One line of Moving Average is “Exponential Moving Average” henceforth referred to as EMA. In all we have four differently colored lines each representing a Moving Average of a particular period. These lines are overlaid on the Candlestick Chart. The periods used for these four Moving Averages are:

Fig 1

- WWMA of 5 days represented by Bright Green colored line

- WWMA of 8 days represented by Orange colored line

- WWMA of 13 days represented by Red colored line and

- EMA of 50 days represented by Light Grey colored line

All that is required is to identify which colored lines represent WWMA and EMA on the chart and their periods. It is not necessary to know “What” or the history of WWMA or EMA as long as one is able to identify which is which is good enough for Quadra.

Anatomy of candles

This has been extensively discussed already here in how to read candlestick charts and in important candlestick patterns . Readers are suggested to go through these articles before proceeding further.

Conditions for entry, initial and trailing stoploss

Long Entry

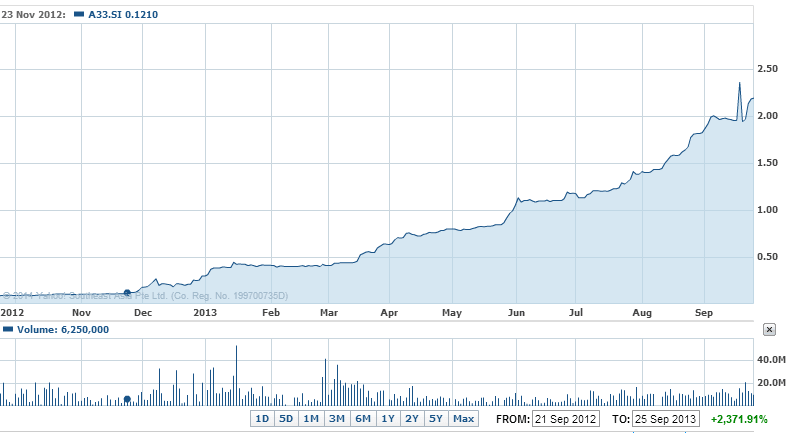

Let us take Long Entry first. We have three different WWMAs with periods 5, 8 and 13 days and a 50 day EMA. How these Moving Averages are positioned on the chart is of utmost importance. While the three WWMAs should have crossed over such that 5-day WMA (Bright Green line) is above the 8-day WWMA (Orange line) and the 8-day WWMA (Orange line) should be above 13-day WWMA (Red line). This is the basic condition for Entry. Then we look at the 50-day EMA. If it has a slight upward slope then it is time for entry. Upward tilt of 50-day EMA is important.

Fig 2

In the Figure 2 above notice how the WWMAs are positioned in the circled area (indicated by the lower Yellow Arrow). The 5-day WWMA (Bright Green) is above the 8-day WWMA (Orange) and the 8-day WWMA (Orange) is above 13-day WWMA (Red). The 50-period EMA (Light Grey) is tilted slightly upwards. The candle corresponding to this condition is indicated by the upper Yellow arrow. It is called “Trigger Candle”.

When you have a setup like the above it is time to go Long. All you have to do is place a BUY order above the High of the Trigger Candle. The Entry is marked by a small Green horizontal line above the Trigger Candle on the chart in Figure 5. Put a Stop loss below the previous Swing Low immediately preceding the Trigger Candle. The Initial Stop loss is marked on the chart by a small Red horizontal line below the Swing Low candle in Figure 2.

Short Entry

Nothing but, reverse of what has been described for long entry. With 50-period EMA (Light Grey) is tilted slightly downwards, when 5-day WWMA (Bright Green) is below the 8-day WWMA (Orange) and the 8-day WWMA (Orange) is below 13-day WWMA (Red), it time for bear run.

Trailing Stoploss for Long Entry

Fig 3

The Figure 3 above is similar to Figure 2 but with the stop losses shifted to new Swing Lows (marked by small pink colored horizontal lines). In Figure 3 we see that the third candle after Long Entry we got a new Swing Low which is higher than the previous Swing Low. So, we moved the Initial Stop loss to below this New Swing Low. This new Stop loss is called “Trailing Stop loss” (TSL). Again the fifth candle from this new swing low candle made a higher Swing Low and we shift the Trailing Stop loss to below this newer Swing Low. We continue this shifting of Trailing Stop loss to higher Swing Lows till a SELL condition is created (which will be explained later) or the Close is below the latest Trailing Stop loss.

Therefore, once a Long Entry is active all we need to do is keep looking for new higher Swing Low and adjust the Trailing Stop loss to below the new Swing Low till the condition for exiting is created. The Figure 4 below illustrates the shifting of TSL with new Swing Lows. The exit occurs when the candle closes below the latest TSL which is marked on the chart in Figure 4.

Fig 4

Conclusion

With proper money management, position sizing, entry, re-entry, stoploss and trailing stoploss, this strategy can do wonders. Many a times this is the earliest reliable signal seen in a candlestick chart. As no strategies can be perfect, readers are requested to use it judiciously and only after achieving good results in paper trading.