Primer on Gasoline (Part One) Watch Crude Oil Prices Instead Be Wary of Retail Stocks Ignore

Post on: 3 Апрель, 2015 No Comment

by Dee Gill March 21, 2012

It’s popular political strategy now to use the rising price of gasoline as a call for more domestic oil drilling, as if giving voters cheaper gas is just a matter of getting more rigs into home turf. But investors who fall for this dubious linkage are sure to be disappointed. More U.S. drilling won’t lower the price of a gallon of gas. And it won’t raise the prices of all those gas-price dependent stocks.

It’s an important distinction as gas prices climb at alarming rates and presidential candidates of all stripes promise to fix the problem. Pump prices are up about 15% this year. On Friday, the government blamed an overall increase in February’s consumer prices mainly on gasoline. If the climb keeps up, this cost could crimp an overall economic recovery. Gasoline futures prices indicate it will.

Such a rise inversely affects the fortunes of all sorts of businesses, from basic goods companies like Family Dollar Stores (FDO ) and Smithfield Foods (SFD ) to restaurants and fashion stores like BJ’s Restaurants (BJRI ) and Ross Stores (ROST ). Consumers that feed these businesses are seeing money they might spend on fun or new clothes sucked away at the gas pump. The Cato Corp. (CATO ), which runs lower-end fashion and accessory stores, already cited higher gas costs as a key reason for a weak 2012 outlook.

Investors might be tempted to see higher gasoline prices as a reason to snap up shares of big oil, and it’s an impulse that makes a roundabout kind of sense. More production (drilling) would help big oil profits. The price of gasoline, though, is all but irrelevant. Gasoline represents is a tiny fraction of earnings for companies like Exxon Mobil (XOM ) and Chevron Corp. (CVX ), so $6 a gallon gasoline will do little for their share prices. Big oil makes more money when gasoline prices are higher simply because that means crude oil prices are higher. Gasoline is a refection of crude prices, not the driver of them.

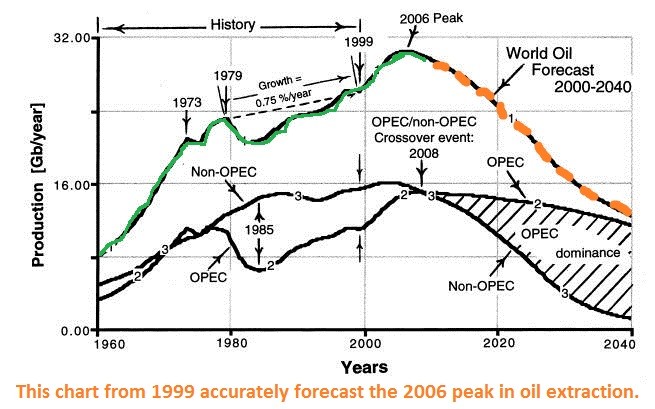

In other words, the only number that truly determines the price of a gallon of gas is that price of crude oil. And no U.S. policymaker – not Obama nor Romney nor Santorum nor Gingrich – has the power to price a barrel of crude. Those prices are set by world markets, which at the moment are looking at China’s insatiable appetite for the stuff and Middle Eastern conflicts that might restrict supply. OPEC, a group of 12 nations that holds the vast majority of the world’s oil reserves and accounts for almost half of all production, still plays an outsized role in setting oil prices. The U.S. is not one of the 12.

Really, if U.S. drilling made any difference to the price of a barrel, gasoline here would be cheap. The number of rigs drilling for oil has been rising. (We’ll leave it to the two political parties quibble over whether the U.S. has a “record number” of oil rigs drilling now. That the numbers have risen is not in dispute.)

The latest gas price run-up has had a limited affect on corporate profits so far. If it continues into the summer, however, expect phrases like “due to the high price of gasoline” to appear after disappointing earnings announcements from all sorts of companies. Shares of Darden Restaurants (DRI ) and other casual diners, several of which are trading near 52-week highs now, tend to get sold when gas prices are high. Analysts already downgraded Family Dollar Stores and Kraft Foods (KFT ) because with more customer money going to gasoline, less will be leftover for non-essentials and brand-name foods. We’ll see that logic again with $5 gas.

So as the president and the president-wannabes roll out domestic drilling programs aimed at fixing this problem, there are all sorts of reasons to pay attention. The potential to break dependence on foreign oil, or the possibility of doing irreversible environmental damage both come to mind. But don’t expect these plans to pad your wallet. Or your portfolio.

Read more articles about: Investing Ideas