Practical Issues in Implementing FASB 133

Post on: 20 Апрель, 2015 No Comment

Angela L.J. Hwang, PhD, is assistant accounting professor at Wayne State University, Detroit. Her e-mail address is aa2919@wayne.edu. John S. Patouhas, CPA, is a financial reporting manager with MCN Energy Group Inc. His e-mail address is john.patouhas@mcnenergy.com.

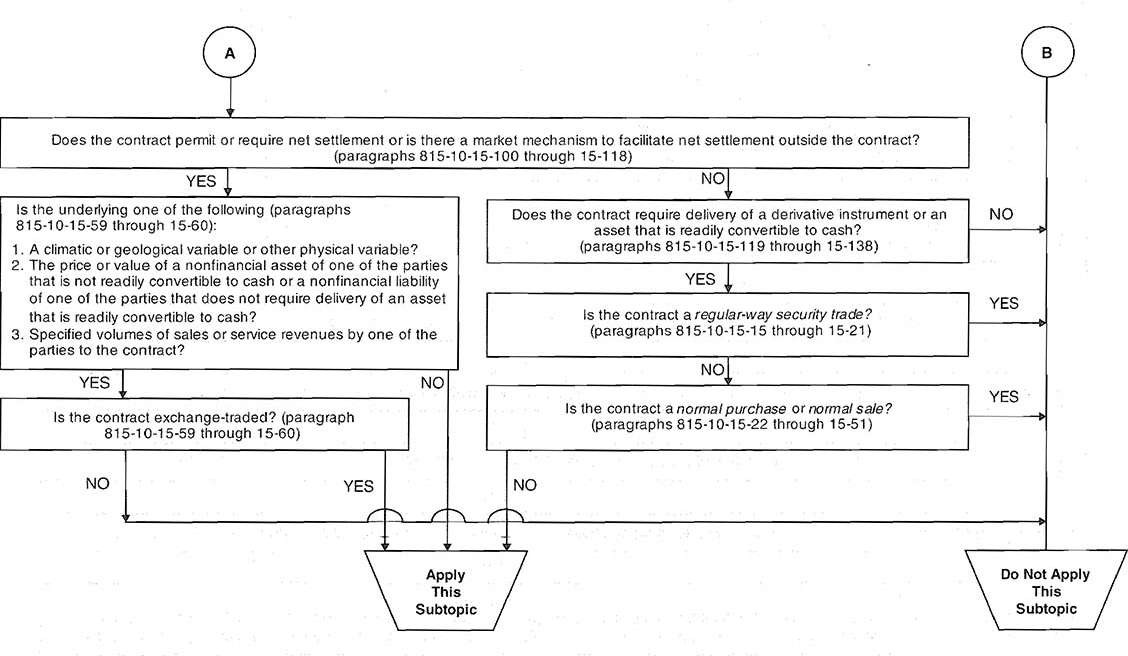

orporate hedging activity should be about risk management. It should not be an opportunity for earnings management, which became the public perception when certain cases of staggering losses involving derivatives made the news some years ago. After six years of extensive research and deliberation and to achieve its objective of measuring all financial assets and liabilities at fair value, the FASB issued Statement no. 133, Accounting for Derivative Instruments and Hedging Activities in June 19 98 (see “The Decision on Derivatives,” JofA, Nov.98, page 24 ). Statement no. 133 is one of the most complex FASB standards, and the board created the Derivatives Implementation Group (DIG) to assist in resolving implementation questions companies raised in advance of the standard’s effective date ( see “Special Task Force Addresses Implementation on Issues” ). The new accounting standard is effective for fiscal years beginning after June 15, 2000 (January 1, 2001, for companies with calendar-year fiscal years.)

CPAs need a blend of accounting and financial analysis skills and knowledge of specialized industry risk management practices to understand Statement no. 133. Companies preparing to adopt the standard had to coordinate the efforts of business units beyond treasury and audit to include, at a minimum, tax, investor relations and senior management. The SEC expects that Statement no. 133 will give investors, analysts, top management, public boards and creditors a clearer indication of the uses and effects of derivatives. CPAs are likely candidates to be the company representative with knowledge of the new standard to help achieve a successful implementation.

Under the old standard, FASB Statement no. 80, Accounting for Futures Contracts, many companies became lax in maintaining documentation of their hedge gains and losses. Now, says CPA James Bean, director of accounting policy at California Federal Bank in San Francisco, Statement no. 133 has focused management’s attention on determining exactly how effective their approaches have been. “I would expect that many companies, particularly smaller institutions, just assumed that their hedging strategies were at least 80% effective without actually calculating the correlation rate, and their outside accountants were reluctant to challenge their clients on the issue of documentation. Because Statement no. 133 articulates very specific requirements and requires the identification and recording of the exact level of any ineffectiveness, it was a wake-up call, forcing these companies to make an in-depth analysis of their hedging strategies. Quite often, a redesign of the existing hedging strategy and an increase in the overall level of effectiveness resulted from preparing to implement the new standard.”

Statement no. 133 may also prove valuable in the audit process. Bernard J. Schumacher, CFA, at AHCC Corp. in Middlebury, Connecticut, says, “The standard can improve the auditing process because it will clarify the definition of hedge accounting and reduce the need for interpretation. In the past, users of derivatives had little guidance from the audit side in terms of how to apply and document hedge accounting. As a result, conflicts would arise. The new standard should reduce the need for interpretation and ensure a more consistent and credible audit process.”

Cornerstone Principles of

Statement no. 133

Derivatives are contracts that create rights and obligations that meet the definitions of assets and liabilities.

Fair value is the most relevant measure for derivatives.

Special hedge accounting should be provided, but limited to transactions involving offsetting changes in fair value or cash flows for the risk being hedged.