PowerShares Dollar Bullish Fund (UUP) Hits Record Lows

Post on: 5 Апрель, 2015 No Comment

PowerShares Dollar Bullish Fund (UUP) Hits Record Lows

Volume might be light on the day before Thanksgiving. Yet a record low for the PowerShares U.S. Dollar Bullish Fund (UUP) is still a record low.

In mid-July 2008, UUP closed at a price point of 22.27. U.S. dollar devaluation coincided with the peak of the commodity bubble, particularly in oil. The spot price of crude was close to $140 per barrel and the United States Oil Fund (USO) was in spitting distance of a record top.

Of course, the residential housing market collapse, lending fiasco and global credit crisis changed the direction for the U.S. dollar and commodities. In essence, commodities slipped and slid down an epic water-slide for 8 months whereas the PowerShares U.S. Dollar Bullish Fund (UUP) raked in 21% over the same period.

Here on Thanksgiving eve, however, the U.S. dollar has cratered all the way back to new low points. The 22.27 level set back on 7/15/08 was momentarily breached last week (11/16/09), but it looks as though the dollar struggled to resist further debasement as it closed today at 22.02.

And, true to the U.S. dollar carry trade trend , many stock benchmarks keep pushing 52-week highs. The S&P 500 registered a new 52-week at 1110.63.

Granted, the PowerShares U.S. Dollar Bullish Fund (UUP) does not represent the precise value of the U.S. dollar on a given day. UUP invests in long futures contracts designed to replicate the performance of the US Dollar versus the Euro, Yen, Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

That said, UUP has done an outstanding job of offering strong dollar advocates the exposure they desire. Even the more popular US Dollar Index (USDX) tracks the U.S. dollars performance against the exact same currencies. However, the USDX record low is $71.32 and it is still trading 4% higher at $74.23.

Regardless of whether you are tracking UUP or the USDX, theres no technical support for the U.S. dollar. Traders looked at USDX $74.50 and thats gone. Others looked at UUP $22.27 and thats toast.

Indeed, there are those who view the dollars downtrend as orderly; further, they see it as beneficial to the U.S. economy as well as helpful to stocks across the board. Moreover, they dont see the possibility of a speculative asset bubble.

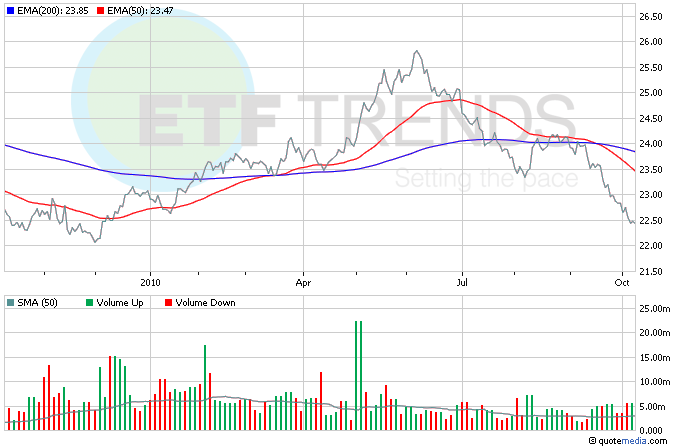

Yet investors need to pay attention here. If the PowerShares U.S. Dollar Bullish Fund (UUP) were to hold above its 50-day MA for a week or two, thatd make things a bit tough for growth/momentum investing. Note: UUP is currently below its 50-day trendline.

More critically, if UUP were to climb above and hold above a price point of 24 the price point of its 200-day trendline the dollar-carry trade could unwind precipitously. Stocks, bonds, currencies, commodities everything that worldwide investors have been flocking towards could be liquidated.

If you’d like to learn more about ETF investing… then tune into “In the Money With Gary Gordon.” You can listen to the show “LIVE”, via podcast or on your iPod .

Disclosure Statement: ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. The content does not represent investment advice, nor are the securities discussed suitable for every investor. Pacific Park Financial, Inc.. a Registered Investment Adviser with the SEC, may hold positions in the ETFs, mutual funds and/or index funds mentioned above. Investors who are interested in money management services may visit the Pacific Park Financial, Inc. web site.

Share this post: