Popular Option Trading Strategies Trading Synthetic Call Options

Post on: 6 Май, 2015 No Comment

When to use a Synthetic Long Call Option?

- When you are very bullish, but want limited risk

- The more bullish you are the further from of the money (lower strike price put) you can buy, although a true synthetic call would involve an at-the-money put option

- This position is sometimes used instead of a straight long call option due to increased flexibility

- Like the Long Call it gives you substantial leverage with unlimited profit potential and limited downside risk

Synthetic Long Call Option Profit Profile

- Profit potential is theoretically unlimited

- The break even at expiration is equal to the futures price + premium paid

- For each point the market goes above breakeven, profit increases by one point

BE = Futures Entry Price + Premium paid

What is at Stake?

- This trade involves limited risk. However, it is possible to incur a “cash call” should losses on the futures contract exceed the available cash in the account. This is similar to a margin call, and would require liquidation or additional funding within three days.

- Your losses are limited to the difference between the entry price of the long future and the option strike price plus the amount paid for the option

- Maximum loss is realized if the market is below strike price at expiration

Synthetic Long Call Option Example

Traders typically use this strategy as a means of increasing the flexibility of a position. Although the payout of a synthetic long call option is theoretically identical to that of a call option, the ability to leg out of the trade can be a huge advantage. This approach works best in markets in which option premium is low, but keep in mind that markets are dynamic and those that are viable candidates for this strategy change quickly.

A trader looking to position himself ahead of the seasonal spring rally in the grains may look to go long a futures contract and simultaneously purchase a protective at-the-money put option. Doing so allows traders to participate in the futures market without the inconvenience of lost sleep and excessive stress.

In 2005 a trader may have been able to purchase a May 520 put near the end of January for about 25 cents, or $1250 ($50 x 25) and go long a futures contract from $5.20 per bushel. This creates a scenario in which they would make a profit anywhere above $5.45 (520 + 25) before considering commission, or about $5.46 ½ assuming a $40 transaction cost for each leg of the trade. If you are a bean trader, you know that 546 1/2 cents per bushel for May soybeans is definitely possible; in fact we haven’t seen prices that low in quite some time. In the event of a market drop after the trade is initiated, a trader could opt to take profits on the long put and continue holding the long futures contract. This is of course a form of “double dipping” and considered to be aggressive. Nonetheless, the ability is there and can be a valuable tool if timed correctly.

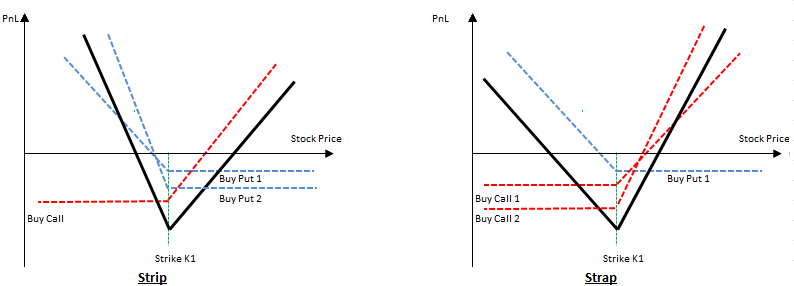

Figure 12

20figure%2012.png /%