Point and Figure charting A computational methodology and trading rule performance in the S P 500

Post on: 1 Июль, 2015 No Comment

Page 1

***PRELIMINARY DRAFT – DO NOT QUOTE***

POINT AND FIGURE CHARTING:

John A Anderson*

Abstract: Point and Figure charting is one of the oldest practitioner techniques for

analysing price movements in financial markets, yet has received almost no coverage in

I I

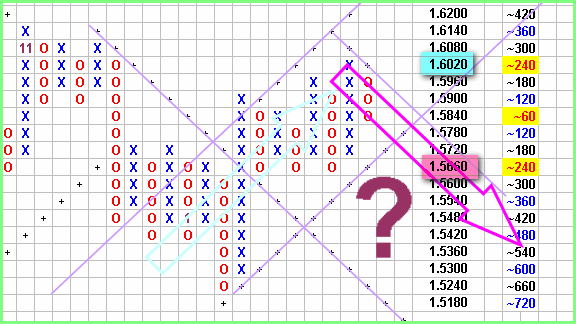

Point and Figure charting is a technical analysis technique in which time is not

I IN NT TR RO OD DU UC CT TI IO ON N

represented on the x-axis, but merely price changes (independent of time) are recorded

via a series of X’s for increasing price movements and O’s for decreasing price

movements. Evidence suggests that the technique is over 100 years old and is now a

standard feature on many widely-used professional market analysis software systems

such as Bloomberg, Reuters, TradeStation and MetaStock.

Taylor and Allen (1992), surveyed foreign exchange dealers in London about their

analytical techniques and found that over 90% of survey respondents relied on technical

analysis at some point for asset allocation decisions. Given Point and Figure’s place as a

standard feature on popular market analysis software, presumably some of those buy/sell

decisions were made on the basis of Point and Figure techniques although this has not

been specifically documented. Therefore, although we may assume that Point and Figure

does play some role among financial markets practitioners, the academic literature has

left the question of the usefulness of this technique largely ignored.

Point and Figure dispenses with time on the x-axis and concentrates solely on changes in

The relevant literature on Point and Figure is particularly small with only two works

appearing in the academic literature, both being published in German by Hauschild and

Winkelmann (1985) and Stottner (1990). The remainder of works have been published as

books of varying quality by authors including Aby (1996), Cohen (1960), Dorsey (1995),

Seligman (1962), Wheelan (1954), Zieg and Kaufman (1975) and Davis (1965). These

works are discussed in more detail below.

This paper is designed to bridge that gap between the practitioner and academic literature

by providing a rigourous test of the various Point and Figure chart ‘patterns’ said to

produce profitable trading opportunities. These are tested by mathematically specifying

each of the patterns, then simulating the trades specified by the trading rules on S&P500

The earliest reference in Point and Figure charting appears to be deVilliers (1933), who

journals. Examples of poor methodology include the use of spurious trendlines that have

little a priori value, vaguely defined/subjective chart ‘patterns’ and trade entry/exit

‘rules’ which become so onerous in their specification that they are unlikely to be of

practical value due to the rarity of such complex conditions being met. Just as technical

analysts working with bar charts claimed the existence of patterns that were subjective

and/or poorly specified, such as the only recently quantified Head and Shoulders patterns

(see Osler, 1998), Point and Figure has also attracted its share of essentially subjective

and unreplicable patterns.

Examples are provided in Cohen (1985) who discusses nebulous and ill-defined patterns

including the ‘Inverse Fulcrum’ and the ‘Saucer’ with their vaguely parabolic shapes and

the ‘Compound Fulcrum’ with trading producing two local minima of roughly equal

values. It is suspected that the subjectivity which plagues many popular ‘charting’ works,

including most of those above, have correctly attracted considerable scepticism from

academics requiring standards of replicability and objectivity.

In Anderson (1999) the problem of managing ultra-high-frequency data1 in 24-hour

markets was considered and Point and Figure was chosen as a continuous data filtering

device. There, the basic methodology of Point and Figure was applied as a filtering tool

to ultra-high-frequency data. For the Sydney Futures Exchange’s Share Price Index, 3

Year Bond and 10 Year Bond futures contracts filtering of data produced compression to

less than 5% of original observations for the smallest filtering level. All price change

information was recorded (except for the 10 Year Bond futures where half points were

removed in the filtering2), but with the loss of time characteristics due to the

methodology of Point and Figure.

Some research in this area has provided a structured and replicable methodology which

provides a valid testing framework for assessing the profitability of Point and Figure

1 For a definition of Ultra-High-Frequency data see Engle (2000).

2 Note that Australian Interest Rate Futures are quoted as 100 – Yield and so a half point is considerably

smaller in dollar value than that observed in US Interest Rate futures contracts.

charting for trading rule researchers. Only two such works examining trading rules using

Point and Figure appear to have been published in refereed finance journals and these

were published in German by Hauschild and Winkelmann (1985) and Stottner (1990).3

Hauschild and Winkelmann (1985) examined several simple Point and Figure trading

rules using daily data on 40 companies listed on German equity markets between 1970

and 1980. Their use of daily data can produce some problems with the calculation of

Point and Figure results. For example, when dealing with Open, High, Low, Close data

inferences/guesses must be made about whether the day’s highest price was traded before

the day’s low to determine whether a price reversal has occurred during that day.

Furthermore, if only closing prices are used then trading activity through the day (which

may have produced a buy/sell signal) is not recorded reducing the accuracy of the

recorded price movements. Therefore these limitations arising from the use of daily data

can achieve only a limited approximation to the more accurate use of intra-day data

which is able to capture all price movements for an asset.4

Hauschild and Winkelmann (1985) did not present results for individual firms and so the

composition of the component results are not available for discussion. On the aggregated

results across all firms the Point and Figure technique was unable to outperform a simple

buy-and-hold strategy for the period.

Stottner (1990) also examined equity markets examining 445 German and overseas

companies. The data set comprised closing data for periods of between 70 months and 14

years prior to the conclusion of the test in February 1989. Stottner (1990) used Point and

Figure charting but in a manner more akin to a simple filter-rule strategy with no

complex pattern assessment. As with Hauschild and Winkelmann (1985), he also found

that Point and Figure produced trading results inferior to a simple buy-and-hold strategy.

3 Both articles gratefully translated by Ralf Becker, an econometrics PhD student at Queensland University

4 The techniques for using daily data with Point and Figure are discussed in most of the books referred to in

this literature review section.