Play an Oil Price Drop with These Inverse ETFs ETF News And Commentary

Post on: 15 Июль, 2015 No Comment

Zacks Equity Research — ZACKS — Thu Sep 11, 9:04AM CDT

- Article Comments (0)

Oil prices witnessed a continued ascent in the first half of the year. A stretched and severe winter in the northern hemisphere, and prolonged geo-political tensions from Russia to Iraq that disrupted supplies helped the commodity to register a triple-digit mark (per barrel) in early 2014.

However, the momentum was recently snapped with Brent oil dropping to a 16-month low to $100.34 per barrel (on September 2, 2014) and West Texas Intermediate (WTI) crude oil slipping 3.2% to $92.88 per barrel on the same day. WTI prices represented the lowest level since January.

Increased production resulting in plentiful supplies, strength in the greenback, slower manufacturing activities in Europe – which is buckling under deflationary pressure – and a sluggish Chinese economy took a toll on the oil prices despite moderate threats of supply disruption from the ongoing turmoil in Iraq, Russia and Gaza.

Notably, the said nations play a strong role in regulating global oil prices as these are oil rich (read: Uprising in Iraq Puts These Oil ETFs in Focus ).

What is Dragging Down Oil?

Manufacturing activity in the Euro zone slackened to a 13-month low in August, indicating faltering economic recovery. Though the activity grew in Germany and Spain, the rate of growth has been slow (read: Where Will Europe ETFs Go After Portugal Banking Woes? ).

Not only this, the cooling Chinese demand has also been weighing on the oil prices. Manufacturing activity in China – the second largest economy in the world – fell shy of expectations in August. reinforcing the trend.

Moreover, the value of the U.S. dollar peaked to the eight-month high with respect to yen as investors wager on speeding U.S. growth. As we know oil price shares an inverse relationship with the greenback, the recent slide is self explanatory.

Oil inventory remains in a good shape in the U.S. Per Bank of America. the U.S. will likely be the world’s biggest oil producer this year leaving Saudi Arabia and Russia behind thanks to its shale-oil boom (read: Play the U.S. Oil Boom with These Energy ETFs ).

U.S. production of crude oil including liquids separated from natural gas exceeded almost every country in the first quarter producing more than 11 million barrels a day. Another source indicated that 2015 could be the biggest crude oil output year for the U.S. after 1972 (read: High Output and Weak Demand Hitting Oil ETFs ).

If these were not enough, the prediction for favorable weather outlook in the U.S. hinted at reduced energy demand. Investors should note that the U.S. enjoyed the coolest summer in five years from June through August. This sapped the cooling demand in the U.S.

Market Impact

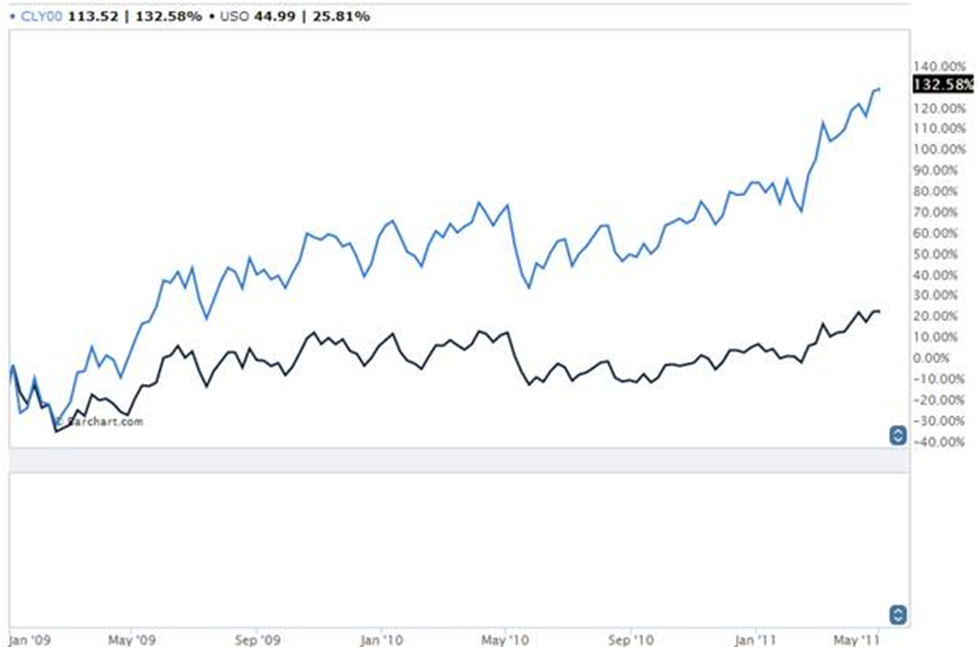

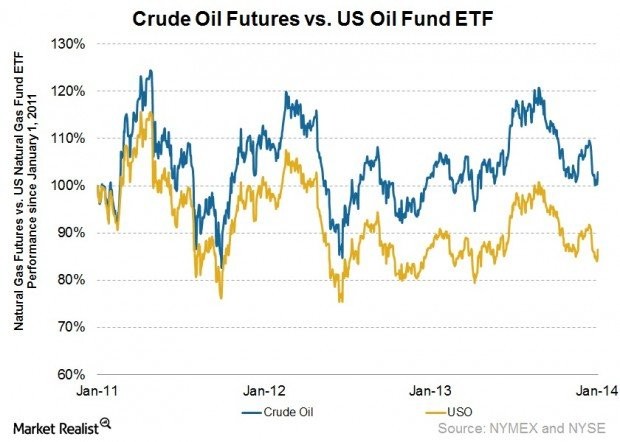

Per Bloomberg. gasoline futures plunged to the lowest level for a front-month contract since November. ETFs tracking oil futures United States Brent Oil Fund (BNO ), United States Oil Fund (USO ) , PowerShares DB Oil Fund (DBO ) and iPath S&P GSCI Crude Oil Index ETN (OIL ) shed 2.5%, 2.7%, 2.3% and 3.1%, respectively, on September 2. Notably, ETF tracking natural gas futures – United States Natural Gas (UNG ) – lost 4.3% in recent trading.

How to Play?

With the positive supply trends in the market and no radical change expected in global geo-politics and macroeconomics, oil could further fall in the near term. That is why investors may want to think about shorting oil as a way to take advantage not only of the stronger dollar, but some of the special features that are impacting the oil market in particular.

For them, we have highlighted four choices for a short play on oil. However, as a caveat, a short play in the futures market requires a strong appetite for risks.

ProShares UltraShort DJ-UBS Crude Oil ETF (SCO )

SCO is easily the most popular product in the short oil ETF market. The product looks to track the daily performance of the Dow Jones-UBS Crude Oil Sub-index. This approach gives twice the inverse performance, on a daily basis of WTI crude oil.

The ETF charges 95 bps in fees for this exposure. The fund has so far amassed about $225 million in assets. Its trading volumes are also great at 900,000 shares a day.

PowerShares DB Crude Oil Double Short ETN (DTO )

For an ETN approach to inverse crude oil investing, consider the popular DTO for exposure. This product follows a benchmark of crude oil futures contracts with -2x exposure that rebalances on a monthly basis.

It is a relatively cheap choice in the space, coming at 75 basis points a year in fees. Its AUM and volumes are relatively low at $93 million and 100,000 million shares a day.

VelocityShares 3x Inverse Crude ETN (DWTI )

This product is one of the riskier plays in the short oil market, utilizing -3x exposure with daily rebalancing. This is accomplished by following the S&P GSCI Crude Oil Index, which offers exposure to WTI crude oil.

This note is also a bit on the pricier side, as costs come in at 1.35% a year, which is on the higher end even in the leveraged market. Expectedly, volume and assets are quite low at 20,000 shares a day and $20.0 million, respectively.

PowerShares DB Crude Oil Short ETN (SZO )

This is possibly the least risky choice in the cluster, offering investors -1x short exposure to WTI crude. The ETN is rebalanced on a monthly basis though, so decay rebalancing issues are reduced.

The product charges investors 75 basis points a year for exposure, making it a reasonably priced option in the inverse ETF market. SZO is an unpopular fund in the space with about $7 million in assets while about 2,000 shares change hand daily.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report