Peabody Energy Good News For A Change Peabody Energy Corporation (NYSE BTU)

Post on: 16 Март, 2015 No Comment

Summary

- China has started taxing domestically produced coal, making foreign-sourced coal more competitive.

- Trading near half of its book value and exhibiting good fundamentals under pressure, BTU deserves a second look at these prices.

- Don’t try to catch the falling knife just yet, but BTU may very well shape up to be a longer-term value play.

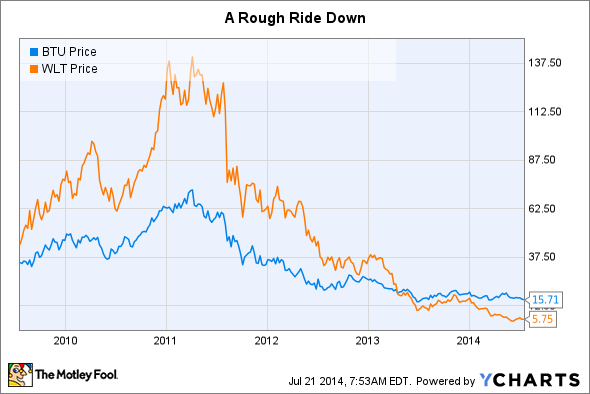

Peabody Energy’s (NYSE:BTU ) investors are certainly used to bad news by now. Amidst falling prices. massive coalfield flooding. aggressive Australian environmentalists. and unpredictable Chinese policy over the years, the company — and the industry as a whole — can’t seem to catch a break.

BTU data by YCharts

For a long time already, we have been wondering how much downside can possibly be left. As of January 2015, BTU is trading at around half of its book value, and we think this may be a good time to assess long-term prospects.

In light of a new (yes, another) Chinese tax policy, we see a glimmer of hope from the macro side of things, especially as regards metallurgical coal. First, the news, then a brief look at the competition.

Changes in China

In the last few years, Chinese legislation has been a source of chagrin for portions of the international coal industry. This is unsurprising, as China is the largest consumer of coal in the world and a net importer, accounting for nearly half of the world’s coal consumption (albeit mostly of its own provenance). For BTU in particular, which has been focusing much of its attention on Chinese demand via Australia, the news has not been good. For instance:

Just this past September, China banned low-grade coal . Though the market did not seem to realize it, this ban was relevant only for Indonesian low-grade coal and Australian coal originating from Victoria (lignite). Though BTU does not have operations in Victoria (or all that much in Indonesia), the news was broadly detrimental to the market. The share price fell from 15.29 to 12.38 through September.

BTU data by YCharts

Then, in October, broad import duties were imposed. This time, Peabody’s metallurgical coal export outlook actually worsened. A 3% tariff on anthracite and coking coal would inevitably make Chinese met coal imports less competitive in relation to domestic supply. Peabody’s New South Wales and Queensland operations, which target the Asian met coal market, started to look less and less appealing.

But then. this January, something a bit different happened to start the new year. New Chinese policies began levying significant, variable taxes on domestically produced coal. The upshot is that 65% of China’s 3.7 billion annual metric tons of domestic production will now be taxed, on a price basis, at a rate between 6% and 9% by regional government.

New Provincial Rates (65% of total national production)