Payment for Order Flow and TradeAt Rule Crucial to MakerTaker Discussion Modern Markets

Post on: 21 Август, 2015 No Comment

Payment for Order Flow and Trade-At Rule Crucial to Maker-Taker Discussion

Tuesday, April 15, 2014

A recent article in the Wall Street Journal, “Regulators Weigh Curbs on Trading Fees,” correctly explains that exchange-charged trading fees, including the “maker-taker” fee plan used at many U.S. Equities exchanges, is a part of market structure that some regulators and other market participants are interested in reviewing. However, the article and its accompanying explanatory graphic could imply that the maker-taker model only provides rebates to high frequency trading. This is not true and needs to be clarified to prevent further incorrect assumptions of unfair advantages.

Explanation of Maker-Taker

Maker-taker is quite simple: the resting (passive) order receives a rebate, while the order that crosses the spread (aggressive) pays a fee. The rebate is offered to the passive order to encourage displayed liquidity. The difference between the fee and the rebate is revenue kept by the exchange.

In the maker-taker model, the fees are not only paid by certain types of traders, just as the rebates are not only gathered by certain types of traders. Any resting order – no matter what type of strategy or entity placed it – receives the rebate at the time of the fill. In fact, many brokerages have developed algorithms that allow them to efficiently work their customers orders passively, thus collecting rebates and avoiding paying fees when getting filled. Some of these brokers pass the rebates received on to their clients, but many do not. It is because many brokers keep the rebate gained from the order that, as the article points out: “A primary criticism is that the fees pose a conflict for brokers, who might choose to route an investors order to an exchange with the goal of earning a payment, not to get the best deal for the client.”

Why HFT Does Not Rely on Maker-Taker

High frequency trading is often linked to maker-taker because many high frequency trading strategies rest their orders and at many exchanges it is the resting orders that receive the rebate. However, it is important to know that HFT strategies do not rely on the rebate to be profitable. There are some equities exchanges that have an inverted pricing model referred to as taker-maker. High frequency trading is still used to rest orders on these exchanges, even though the resting order pays the fee and the order that crosses the spread gets the rebate. Furthermore, high frequency trading is used extensively in markets that offer no rebates. In most, if not all, futures markets, both orders in a transaction pay a fee and strategies using high frequency trading are prevalent in these futures markets. As noted in the Wall Street Journal article, this is why many experts say “It isnt clear if a ban of maker-taker would harm high-speed traders.”

The maker-taker pricing intends to incentivize displayed liquidity on the lit exchanges that use it. Displayed liquidity allows for a publicly viewable continuous negotiation for fair prices and is an important aspect of transparency in todays modern markets. However, this does not mean the markets should be wed to maker-taker. Rather, it means that maker-taker should not be evaluated in a vacuum. There are other important aspects of market structure that should be considered in any discussion of maker-taker.

Difference Between Rebate and “Payment for Order Flow”

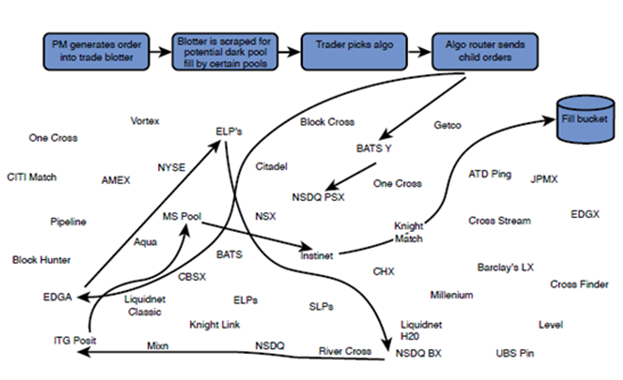

Maker-taker often comes up in conversations around “payment for order flow”, which MMI has previously addressed. Many consider the rebate as being similar to payment for order flow because exchanges are using rebates to entice order flow to their exchange. However, there is one key difference: orders that receive a rebate from an exchange are transparent and visible to all whereas most payment for order flow ends up with the orders being internalized or transacted on dark pools, which does not aide in public, transparent price discovery. There is a valid concern that if maker-taker was banned from the market but payment for order flow is allowed to persist then we would see even more orders and volume move from transparent, lit exchanges into the dark of internalization.

“Trade-At” Rule for Dark Pools

Similarly, maker-taker often comes up in conversations around a “trade-at” rule for dark pools and internalization, as explained in the article. The reason for this is that dark pools and internalization can match orders at slightly better prices than the exchanges displayed best bids and offers. In maker-taker the rebate to the resting order is similar to this small price improvement, so it allows exchanges to compete with dark pools for liquidity. Without maker-taker there is a fear that there would be a greater flight of liquidity away from lit exchanges and into the dark.

A trade-at rule could combat this flight of liquidity, by requiring dark pools and internalizers to only match if there is substantial price improvement, such as mid-point matching. A mid-point match is less likely to occur than a match that offers only slight price improvement because resting orders will most likely not want to sacrifice that much of the spread. Without a trade-at rule a ban on maker-taker could force more volume to the dark, but with a trade-at rule we could see much of the dark volume shift back to lit exchanges. This is why KOR Group LLC, the financial-market consulting group, mentioned at the end of the article is right to tell SEC officials that the two rules must be discussed in unison.

High frequency trading brings many benefits to the market and can continue to do so without maker-taker pricing in place. However, maker-taker is one of the few remaining incentives exchanges have to attract displayed liquidity. The rebates have no discrimination, are distributed to all matched resting orders, and allow exchanges to compete with dark pools for liquidity. In reviewing maker-taker, it is crucial that we also consider other market structure issues such as payment for order flow and trade-at; otherwise we run the risk of damaging our markets when we should be working to make them better.