Partnership Audit Technique Guide Chapter 2 Initial Year Return Issues (Published 122002)

Post on: 2 Апрель, 2015 No Comment

NOTE: This guide is current through the publication date. Since changes may have occurred after the publication date that would affect the accuracy of this document, no guarantees are made concerning the technical accuracy after the publication date.

Each chapter in this Audit Techniques Guide (ATG) can be printed individually. Please follow the links at the beginning or end of this chapter to either return to the Table of Contents or proceed to the next chapter.

In the initial year of a partnership, several Code sections limit or preclude a current deduction for costs incurred prior to the actual operation of a business.

This chapter deals with three specific types of expenses:

- Organizational Expenses

- Syndication Expenses

- Start Up Expenses.

Other issues covered in this chapter include the tax implications of payments made to partners:

- IRC section 707(a) ─ Partner or Non-Partner

- Receipt of a Capital or Profits Interest

- Payments Capitalized, Deducted, or Distributed?

- Guaranteed Payments

ISSUE: INITIAL YEAR EXPENSES

Under prior law, organization, syndication, and start up costs were not deductible. Through a series of litigation, it became firmly established that these were capital costs and were recovered as a part of the partner’s basis on disposal of the partnership interest. Subsequently, Congress enacted IRC section 709 and IRC section 195, which provide guidance for these expenses.

Section 709 ─ Organization and Syndication Expenses

Applicable after 1975, IRC section 709 provides for the tax treatment of the costs of organizing a partnership and promoting the sale of a partnership interest.

Under IRC section 709(a) a current deduction is not allowed for the cost of organizing a partnership and promoting the sale of partnership interests.

Subsequently, IRC section 709(b) provides that organization expenses may be amortized over a period of not less than 60 months. The partnership must capitalize these costs and timely elect the 60 month rule. The partnership is not allowed to elect amortization treatment after the return has been filed, such as during the audit process.

Syndication expenses are not included in IRC section 709(b). They cannot be deducted or amortized.

Syndication Costs

These are the costs of syndicating a partnership and its related investment units. Syndication costs are normally items incurred for the packaging of the investment unit (the partnership unit), and the promotion of it. These include marketing costs as well as the production of any offering memorandums or promotional materials. Included is the training of any brokers/dealers who will sell the partnership units, plus the actual sales commissions paid to the sellers of the partnership (whether they are unrelated third parties or the individuals who promoted the investment). Other costs normally incurred as a part of syndication could include legal costs associated with the offering, tax opinions, due diligence, costs of transferring assets to the partnership, printing and preparation of offerings/prospectus, etc.

Organization Costs

Organization costs include the legal and accounting costs necessary to organize the partnership, facilitate the filings of the necessary legal documents, and other regulatory paperwork required at the state and national levels.

There is a fine line which exists between syndication costs and organization costs. Generally, syndication represents those costs associated with the sale of the actual investment units, while organization costs are those costs necessary to legally create the partnership.

Election to Amortize Organization Expenses

The election to amortize organization expenses is made on the return for the year in which business commenced. It is made by completing Part VI of Form 4562, Depreciation and Amortization. A separate statement must be attached to the return containing the following information:

- A description of each cost

- The amount of each cost (costs of less than $10 may be aggregated)

- The month the active business began, (or the month the business was acquired)

- The number of months in the amortization period (not less than 60).

An amended return cannot be filed to subsequently elect amortization of organization expenses. However, an amended return can be filed, including additional organization expenses, when a timely election has previously been made.

IRC section 195 Start-Up Expenditures

IRC section 195(a), added in 1980, denies a deduction for start-up costs.

IRC section 195(b) however, specifically allows the taxpayer to elect to treat these costs as deferred expenses and amortize them over a period of not less than 60 months.

IRC section 195(c) provides the definition of the terms start-up costs and beginning of trade or business.

Start-up costs are costs for creating an active trade or business or investigating the creation or acquisition of an active trade or business. Start-up costs include any amounts paid or incurred in connection with any activity engaged in for profit or for the production of income before the trade or business begins, in anticipation of the activity becoming an active trade or business. The expenditures must be of such a nature that they would be deductible if they had been incurred in the operation of an existing business.

When an active trade or business is purchased, start-up costs include only costs incurred in the course of the general search for or preliminary investigation of the business. Costs incurred in the attempt to actually purchase a specific business are capital expenses and are not amortizable under IRC section 195.

Investigatory expenses are those incurred in the review of a prospective business before a decision to acquire the business has been made. See Revenue Ruling 99-23 for a definition of allowable investigatory expenses.

Start-up expenses and pre-opening expenses include costs incurred after a decision has been made to acquire or enter into a business. These would include salaries and wages for training employees, travel for obtaining prospective distributors, suppliers, or customers. Generally this term is given to expenses that would be deductible currently if they had been incurred after actual business operations had begun.

Expenses specifically not included in start-up costs are those costs allowable under IRC section 163(a), interest expense; IRC section 164, taxes; or IRC section 174, research and experimental costs.

Election to Amortize Start Up Expenses

The election to amortize start up expenses must be made no later than the due date of the return (including extensions). It is made by completing Part VI of Form 4562. A separate statement must be attached to the return containing the following information:

- A description of the business to which the start-up costs relate

- A description of each start-up cost incurred

- The month the active business began, (or the month the business was acquired)

- The number of months in the amortization period (not less than 60).

If a revised statement is required, it cannot include any costs treated on a return as other than a start up cost. Accordingly, the only costs that can be added to the original statement are costs incurred in a subsequent year that are added to the total start up costs to be amortized. An amended return cannot be filed to reclassify costs to start up costs.

Cash Basis Taxpayers and Start Up Costs

A partnership using the cash basis cannot take an amortization deduction until the organization or start-up cost has been paid. If paid in a year after the business has begun, they can deduct an amount equal to the number of months beginning with the effective date of the IRC section 709(b) election. This will catch up the amount of amortization on items paid in subsequent years with the amortization on costs paid in the initial election year.

Dispositions before the End of the Amortization Period

If a business is completely disposed of before the end of the amortization period, the remaining unamortized balance of properly elected organization and start-up expense is deductible as an ordinary loss under IRC section 165. Syndication expenses paid outside the partnership by the partner, must be added to the partner’s basis and will affect gain/loss on disposition or increase the basis in distributed assets on liquidation.

GAAP versus Tax Accounting Start Up and Organization Costs

Under generally accepted accounting principles, organization costs and start up costs are expensed as incurred.

Specifically, the AICPA, in Statement of Position (SOP) 98-5 defines in broad terms what are start up costs and requires that such costs be expensed. This broad definition would include most of the expenditures that are required to be capitalized for tax purposes. Therefore, GAAP versus tax differences generally exist and should be reflected on the partnership Schedule M-1.

Payments To A Partner: IRC section 707(A) ─ Partner Or Non-Partner

IRC sections 702 and 704 provide that a partner includes in income his or her distributive share of partnership income or loss, and the amount of that distributive share is usually determined by the partnership agreement. IRC section 731 provides that no gain is to be recognized as a result of distributions by the partnership so long as those distributions do not exceed the partner’s basis in his or her partnership interest. While these provisions represent logical and equitable approaches to the taxation of businesses operated in partnership form, they have been used by some taxpayers to circumvent capitalization requirements and to avoid reporting income.

By treating various payments to a partner as a deduction or a distribution of profits, a partnership may attempt to change the nature of a payment. Examples of these recharacterizations would include transforming capital items to deductible expense and fee income into portfolio income.

IRC section 707 (a) was enacted to prevent such potential abuses.

IRC section 707(a)

IRC section 707(a) was originally intended to prevent misuse of IRC sections 702, 704 and 731. It requires that transactions between a partnership and a partner, who is not acting in his or her capacity as a member of the partnership, to be considered as occurring between the partnership and one who is not a partner. That is, an outsider or unrelated party. IRC section 707(a)(1) can encompass loans, leases, sales, and employment relationships.

The wording of IRC section 707(a)(1) is very brief, and the regulations for this subsection provide very little explanation except to state in the last sentence of Treas. Reg. section 1.707-1(a): In all cases, the substance of the transaction will govern rather than its form. In general, services involving a partner’s particular technical expertise are considered non-partner.

Apparently the law and regulations were not specific enough to accomplish the desired effect, so, as part of the Tax Reform Act of 1984, a second paragraph was added to IRC section 707(a) which is reflected as IRC section 707(a)(2).

The law specifically provides that payments to a partner for either services or property will be treated as a transaction between the partnership and an outsider so long as he is acting other than in his or her capacity as a member of the partnership. This forces the partnership to treat the payment as if it were paid to an unrelated third party and removes any option to treat the payment as a partner’s distributive share as shown in the Examples 1 through 4 in this chapter.

Payments To A Partner: Receipt of a Capital or Profits Interest

During the course of partnership formation, it is not uncommon for the partner who is to manage the partnership’s affairs to receive an interest in partnership profits in exchange for the performance of past or future services. Since it is the combination of labor and capital that creates a business, this is to be expected. Over the years, taxpayers, the Service, and the courts have struggled with the tax consequences of the many variations of these partnership agreements.

A “Bare” Profits Interest ─ An interest in partnership profits with no interest in partnership capital is a “bare” profits interest. Generally, the receipt of a partnership interest in exchange for services is taxable under IRC section 61(a)(1) and Treas. Reg. section 1.61-2(d)(1) as property received for services.

However, Treas. Reg. section 1.61-2(d)(6) provides an exception in the case of property subject to a restriction that has a significant effect on its fair market value under IRC section 83.

A capital interest in a partnership is generally not subject to a substantial risk of forfeiture under IRC section 83 and will not meet the exception. Therefore, it will be included in the income of the recipient at its fair market value (Treas. Reg. section 1.721-1(b)(1)).

Since the value of a profits interest is contingent on the realization of profits in the future, it is difficult to value and is generally considered to be IRC section 83 property. Under IRC section 83, at the time the profit is determined and added to the service partner’s capital account, it is taxable to the partner and deductible by the partnership.

To provide further guidance, the Service announced in Rev. Proc. 93-27 that they would not attempt to tax the receipt of a profits interest except where the income is fairly certain, the interest is disposed of within 2 years of receipt, or it is publicly traded.

When is a Partner not a Partner? ─ Rev. Proc. 93-27 did not put an end to all of the controversy regarding receipt of a profits interest. The receipt of a profits interest does not automatically make one a partner. A similar agreement could be made with an independent contractor. Someone who receives a “guaranteed payment” of so much a month plus a percentage of the profits may in fact be an employee with profit -sharing.

Pursuant to Rev. Proc. 93-27, the receipt of a profits interest in exchange for future services should generally be accepted. However, if the partnership appears to be designed primarily to provide tax benefits to one or both parties, careful analysis should be applied to ensure that partner status for tax purposes is warranted.

Regulations regarding performance of services have not yet been issued, but the Section 707 Committee Reports contain significant guidance. The Committee was concerned with transactions that avoid capitalization requirements. Other concerns were situations where a service partner received a portion of partnership capital gains in lieu of a fee, the effect of which converted ordinary income into capital gain. The Committee was not concerned with non-abusive allocations that reflect the various economic contributions of the partners. The rules apply both to one- time transactions and continuing arrangements that utilize purported partnership allocations and distributions in place of direct payments.

The Committee believed that the following factors should be considered in determining if the purported allocation is received by the partner in his or her capacity as a partner.

Generally, the most important factor is whether the payment is subject to an appreciable risk as to amount. An allocation and distribution provided for a service partner which subjects the partner to significant entrepreneurial risk as to both amount and payment generally would be recognized. Other factors indicating that the payment may be a fee include:

- Transitory (temporary or short-term) partner status

- The payment is made close in time to the performance of the services

- Whether, under all the facts and circumstances, it appears that the recipient became a partner primarily to obtain tax benefits for himself or the partnership which would not have been available had the services been rendered in a third party capacity. The fact that a partner has significant non-tax motives is of no particular significance

- The recipient’s interest in continuing partnership profits is small in relation to the allocation

In applying these factors, one should be careful not to be misled by self-serving assertions in the partnership agreement, but should look to the substance of the transaction.

In cases where allocations are only partly related to the performance of services, the above provisions will apply to the portion related to services. Even where the service partner has contributed some capital, the “profits interest” may still be carved out and treated as compensation.

In Smith Est. et. al. (63-1 U.S.T.C. 9268), the Eighth Circuit Court of Appeals held that a common fund, from which the manager received a percentage of the profits from trading commodities futures, was a partnership but that the manager’s share of the profits was compensation, not capital gain. To the extent that partners of the manager invested cash in the common fund, they were entitled to treat the income from their investment as capital gains and losses.

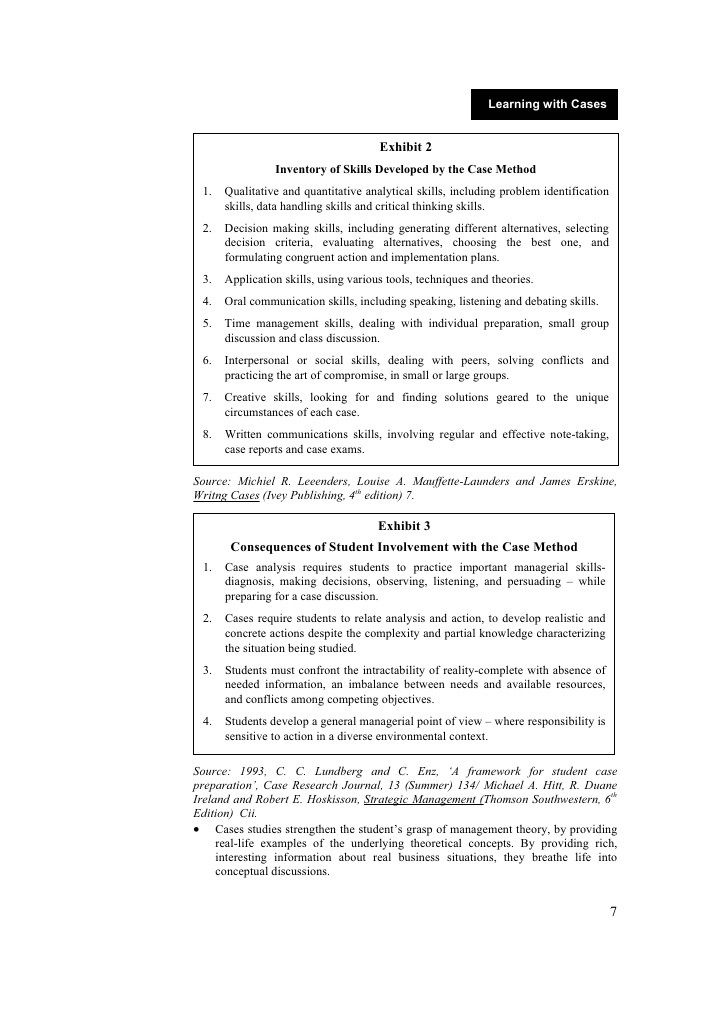

Payments to Partners ─ Payments Capitalized, Deducted, or Distributed?

Capital Item Shown as a Deduction or Distribution

In the early years of a partnership, it is common to see payments or reimbursements to partners that are properly capital in nature.

Examples are payments to partners for the following:

- Organization Expenses, IRC section 709

- Syndication Expenses, IRC section 709

- Start-up costs, IRC section 195

- Capital Assets, IRC section 263

- Uniform Capitalization Rules, IRC section 263A

Assume that a broker is a 25 percent interest owner in a partnership that plans to construct a building. She provides services including packaging and promotion of the investment units, resulting in the sale of all the planned partnership units. For her services she is paid a fee of $40,000. Assume that partnership income for the year of payment amounted to $100,000 before considering the $40,000 payment to broker partner. Proper treatment of this $40,000 expenditure would be to capitalize it as a nondeductible syndication expense, with no direct effect on the partnership’s total income of $100,000. Of course, the broker partner would also include the $40,000 fee in her income, probably on a Schedule C. The total effect on the partners’ returns would be as follows: