Participating preferred stock and venture capital

Post on: 16 Март, 2015 No Comment

One of the more common types of securities used by venture capitalists is the participating preferred stock. This preferred stock is an accepted part of the startup financing landscape, although it has some pretty significant impacts on the value of the common stock (i.e. the stock owned by management and employees of the startup) at an exit. In particular, participating preferred stock can significantly impact the return profile of an investment for a venture investor at a smaller exit value. Exits have shifted from IPOs, where participating preferred holders usually are forced to convert to common shares, to smaller M&A exits, where participating preferred holders have certain special privileges. (See my recent post on VC backed exits in Q1 2009. )

Anything that provides extra return to a VC at an exit takes return from the founders, so it is important for entrepreneurs to understand participating preferred stock and its impact on the exit value of the common stock.

The one point that I would like startup CEOs to take away from this post is that:

The type of security your venture capitalist purchases will have different ramifications based on the size of your exit.

First of all,

What is participating preferred stock?

Participating preferred stock: Preferred stock where the investor receives back their invested principal (plus any accrued dividends) before common stock holders and then participates on an as-converted basis in the returns to common stock holders. In other words, participating preferred holders get their invested dollars back THEN get their % ownership in the remaining proceeds.

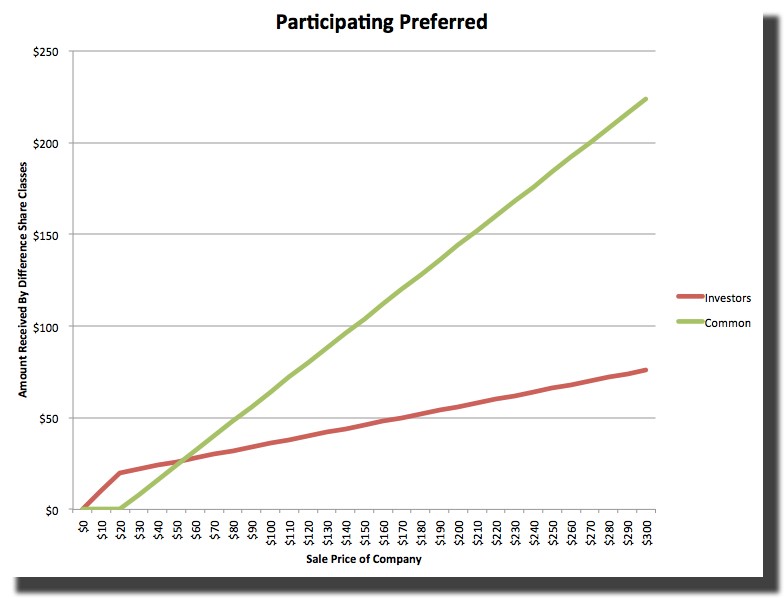

Ill run a math example down at the bottom of the page, but here is a chart showing returns to a company that raised $3 million on a $3 million pre-money valuation.* In this chart Ive plotted the percentage of the proceeds that go to the founders of the startup based on different exit sizes, ranging from $5 million to $1 billion. The bottom axis is the exit size; the left axis is the percent of the exit proceeds going to the founders.

Note that the founders technically own 50% of the business. However, it is pretty clear that the founders get a much lower percent of the proceeds at smaller exit values when they sell participating preferred equity to the investors.

A smart venture capitalist will usually ask for participating preferred equity. Foley Hoags Emerging Enterprise Center shows that participating preferred is a very standard security in venture transactions. I do not see it as unfair that VCs ask for participating preferred, and they can (sort of) make smaller exits more palatable for venture investors.**

The correct trade off for participation is valuation. In fact, a very good way to think about the participating preferred equity is to strip it into a bond component and an equity component. This will effectively derive a valuation discount in the eyes of the venture capitalist. If you as an entrepreneur want a higher valuation then you may be forced to accept a participating security.

The point is this: if you as an entrepreneur are raising venture capital, you will need to be very realistic on the exit value you think you will achieve for the business. If you think that you are going to make it to a huge exit then the participating preferred equity will have a tiny impact on your eventual returns. However, if you think a smaller exit is likely then you should think carefully when accepting a participating security.

*Here is the quick and way-over simplified math example:

A company raises $3 million at a $3 million pre-money valuation. Thus, 50% owned by investors and 50% owned by founders. Then the company is sold for $25 million. Returns to each group are calculated below. Im assuming that the founders do not give any of the company up to anyone else; obviously a major simplification.

If the investor owns participating preferred

Investor: $14 million = $3 million of participation + $11 million of common stock return (50% of the common return of $22 million ($25 million exit minus the $3 million that already went to the participating preferred))

Founders: $11 million (50% of the common return of $22 million)

If the investor owns convertible preferred

Investor: $12.5 million (50% of the $25 million exit)

Founders: $12.5 million (50% of the $25 million exit)

That is a pretty big difference for both the VC and the founders. The difference, as a % basis, really increases when the exit value gets lower.

**Participation also helps VCs mirror the structure of their funds. Venture capitalists do not make carry until they have returned their limited partners investments. The return of capital to the venture investor (and thus to the limited partner) via the participation mechanism at an investments exit is a lot like this carry hurdle

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D60&r=G /%