Overview of HighFrequency Trading

Post on: 16 Май, 2015 No Comment

If you are an investor, high-frequency trading plays a role in your life, whether you realize it or not. More than likely, you have purchased shares provided by a computer or sold shares to a computer that instantly sold them to another computer.

High-frequency trading is a controversial subject. Traders around the globe tend to disagree with each other and market studies seem to contradict one another. Regardless of your stance on the subject, it is important to understand the impact high-frequency trading has on your money.

What is High-Frequency Trading?

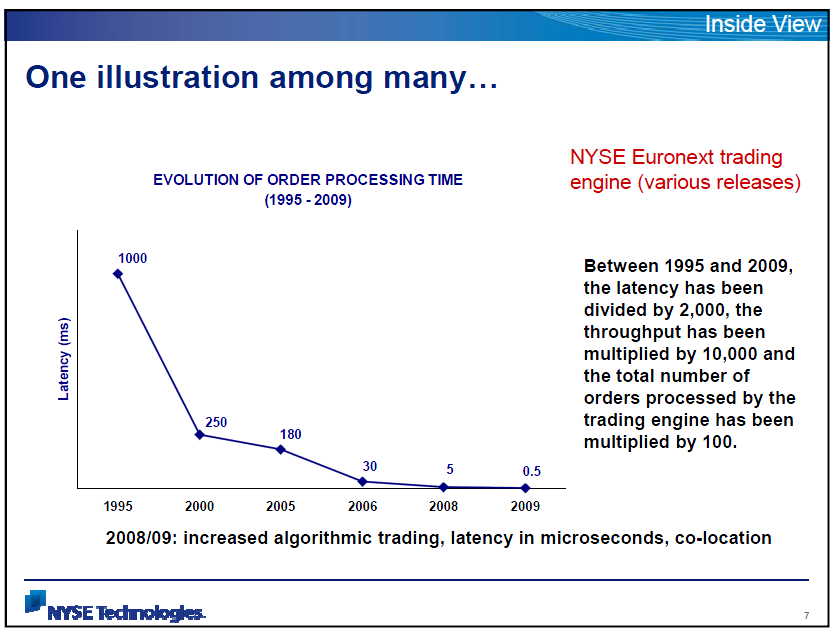

High-frequency trading is a broad term used to describe several trading strategies involving the buying and selling of securities at lightning fast speeds. Modern computers are able to identify market patterns and place buy or sell orders based on their advanced algorithms in only a few milliseconds.

One popular high-frequency trading strategy is to become a market maker, which occurs when a high-frequency trading firm provides both buy and sell products. By buying an asset at the bid price and selling it at the ask price, traders involved with high-frequency trading can profit from less than a penny per share. When multiplied by millions of shares, this can easily equal large profits.

Does High Frequency Trading Negatively Affect the Market?

It is easy to assume that the digital paper trail left by high-frequency traders would make it easy to view their practices and gain a clear answer to this question, but this is not the case. Due to the shroud of secrecy surrounding the trading activities of high-frequency trading firms and the extremely high volume of data, regulators find it nearly impossible to piece together all of the trading activities that take place each trading day. People who have debated the issue of the impact of high-frequency trading on the market often harken back to the “flash crash” for evidence.

On May 6, 2010, stocks on the Dow Jones Industrial Average plummeted by a staggering 10 percent in a matter of minutes and inexplicably rebounded in the same short amount of time. At one point in time, some very large blue chip companies were trading for a mere penny. On October 1, 2010, the SEC officially blamed one huge e-mini futures trade on the S & P 500, which created a cascading effect for hundreds of high-frequency traders. When one algorithm rapidly sold shares, another was triggered. As more and more sell orders hit the market, every trader from the institutional to retail level were selling off shares as well.

The remarkable incident led to changes adopted by the SEC, which effectually placed surge protectors on financial products if they fall below a specified level in a very short period of time. As the dust settled around the flash crash, many pondered the idea of imposing stricter regulations on high-frequency trading, especially since smaller similar crashes regularly take place throughout the market.

Does High-Frequency Trading Hurt Retail Investors?

Most of the investing public is concerned about how high-frequency trading may affect them. Investors of this kind may be people who have their retirement savings invested in the market or those who invest simply to see better returns than they can from non-existent savings account interest.

According to a story reported by the New York Times, a premier government economist concluded that high-frequency trading firms are actually taking substantial profits away from traditional retail investors or investors who do not use complex computer algorithms.

When they studied the S & P 500 e-mini contracts, financial researchers discovered that high-frequency traders average $1.92 in profit for every contract that is traded with institutional investors, and these traders made an average of $3.49 on every contract traded with retail investors. According to data collected in 2010, this allows ultra-aggressive high-frequency traders to average up to $45,267 per day in profit, which comes largely at the expense of other traders.

Although the authors of the study did not delve into the equity markets, where up to 70 percent of trading volume is attributed to high-frequency traders, they said they believe they would have reached the same conclusions.

The Bottom Line

Thanks to high-frequency trading, the belief that small investors do not stand a chance in this market is beginning to proliferate. Some look to the huge sums of unvested cash as proof that people no longer have confidence in the markets. This has proliferated to such an extent that even some high-frequency traders are turning to other world markets to find the liquidity they need to successfully operate.

Regulators around the world are searching for ways to restore confidence in the world’s stock markets. Some are toying with the idea of following Canada’s lead by charging increased fees for high-frequency trading firms, while others are thinking of implementing a per share trading tax. Thankfully for penny stock investors, high-frequency trading rarely takes place outside of the major exchanges, allowing them to trade confidently while knowing that their investments will not be manipulated by today’s market pirates.