Overview Key iron ore indicators to watch Market Realist

Post on: 29 Март, 2015 No Comment

Plumbing new lows: Key iron ore indicators to watch (Part 1 of 17)

Overview: Key iron ore indicators to watch

By Annie Gilroy Nov 28, 2014 12:15 pm EDT

Prices at five-year low

Year-to-date, iron ore prices have fallen

46%. Increased supply from the four major iron ore companies has been an issue with the markets for a while now. The weaker-than-expected demand growth from China, underlined by recent disappointing manufacturing and credit data, has also taken its toll on iron ore prices.

We’ll discuss the reasons for these two trends later in this series.

Iron ore industry

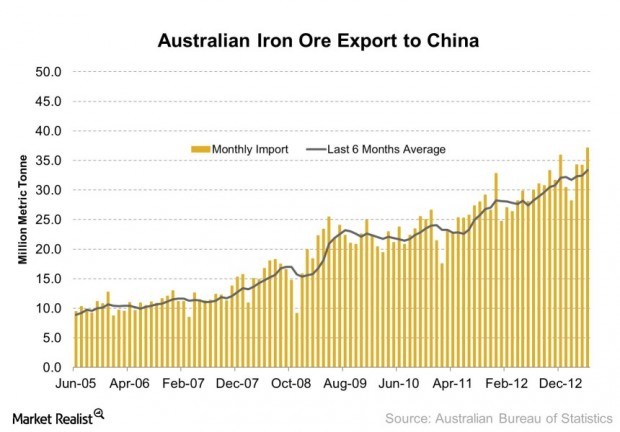

The iron ore industry is influenced by a number of factors including demand and supply, growth, and the development stage of world economies. Of all world economies, China’s consumes the most iron ore and constitutes about two-thirds of the seaborne iron ore imports. As a result, whatever affects China affects the iron ore industry.

On the supply side, Vale SA (VALE ) from Brazil, and Rio Tinto plc (RIO ), BHP Billiton Limited (BHP ), and Fortescue Metals Group Ltd. (FSUGY ) from Australia, are the major companies. Combined, these companies contribute more than 70% of seaborne iron ore supplies.

Key indicators

In this series, we’ll discuss some of the important demand and supply indicators that drive the iron ore industry:

- On the supply side, we’ll talk about production and future supply plans for the major companies.

- On the demand side, we’ll look at factors such as China’s inventory levels, steel production, iron ore imports, and PMI (or purchasing managers’ index).

- In a broader context, we’ll talk about factors such as the credit situation and the real estate market that have fall-out impact on demand and supply for steel and ultimately, iron ore.

- Lastly, we’ll look at iron ore futures and see how these move with current industry dynamics.

Most of these indicators are published monthly, while others are reported weekly or quarterly. Regardless, these indicators should be looked at collectively. They give investors cues about the direction of iron ore prices and ultimately, the share prices of companies including RIO, BHP, VALE, and Cliffs Natural Resources Inc. (CLF ). Some of these companies are included in the SPDR S&P Metals and Mining ETF (XME ).