OPTIONS IDEA How Delta Affects Option Profits

Post on: 17 Апрель, 2015 No Comment

By: John Summa

This review of how the option Greek Delta affects the underlying equity can help traders better measure risk on both long and short option positions.

This article takes a closer look at Delta as it relates to actual and combined positionsknown as position Deltawhich is a very important concept for option sellers. Below is a review of the risk measure Delta, and an explanation of position Delta, including an example of what it means to be position-Delta neutral.

Lets review some basic concepts before jumping right into position Delta. Delta is one of four major risk measures used by option traders (called Greeks). Delta measures the degree to which an option is exposed to shifts in the price of the underlying asset (i.e. stock) or commodity (i.e. futures contract). Values range from 1.0 to 1.0 (or 100 to 100, depending on the convention employed).

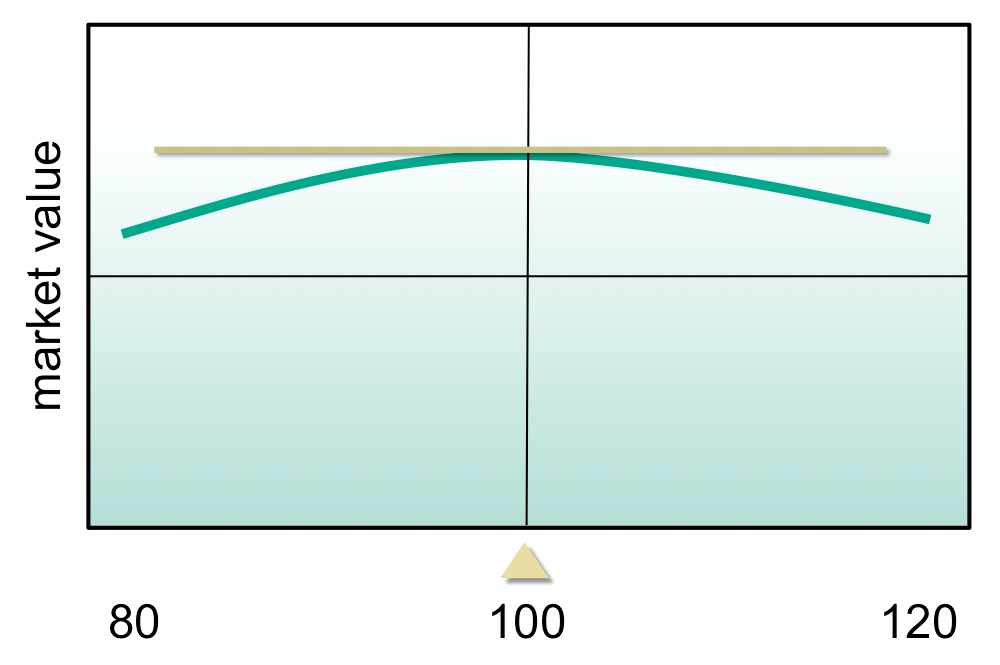

For example, if you buy a call or a put option that is just out of the money (i.e. the strike price of the option is above the price of the underlying if the option is a call, and below the price of the underlying if the option is a put), then the option will always have a Delta value that is somewhere between 1.0 and 1.0. Generally speaking, an at-the-money option usually has a Delta at approximately 0.5 or -0.5.

Click to Enlarge

Figure 2 below contains some hypothetical values for S&P 500 call options that are at, out, and in the money (in all these cases, we will be using long options). Call Delta values range from 0 to 1.0, while put Delta values range from 0 to 1.0.

As you can see, the at-the-money call option (strike price at 900) in Figure 2 has a 0.5 Delta, while the out-of-the-money (strike price at 950) call option has a 0.25 Delta, and the in-the-money (strike at 850) has a Delta value of 0.75.

Keep in mind, these call Delta values are all positive because we are dealing with long call options, a point to which we will return later. If these were puts, the same values would have a negative sign attached to them. This reflects the fact that put options increase in value when the underlying asset price falls. (An inverse relationship is indicated by the negative Delta sign.)

You will see below that when we look at short option positions and the concept of position Delta, the story gets a bit more complicated.

Article Continues on Page 2