Options and Futures

Post on: 27 Апрель, 2015 No Comment

Options and Futures Flow into the Portfolio Mainstream

Its All in the Strategy

Today, options and futures, created specifically as tools to offset price risk, are definitely becoming more mainstream, adding to the toolboxes of those with portfolios where risk is a given. However, too many investors have turned away because of nave media coverage and, yes, because traders say they didnt understand/know/realize the potential risks of trading. Thats where the difference in market strategies comes in. Some are specifically constructed for risk management, and, indeed, some are speculative. Yet the two are entirely different animals. According to Andrew Wilkinson, director of media communications/senior market analyst for Interactive Brokers Group, Greenwich, Conn. In this day and age, Id tell investors to move away from brokers who are telling you not to try options. Though they are not for the unsophisticated investor, they are an extremely capital-efficient means of hedging risk.

When people say options are risky, I always say Id rather have been long Enron calls than Enron, remarks Joe Cusick, senior vice president, education, and senior market commentator for optionsXpress in Chicago. What investors dont realize is that they can use options to accomplish several objectives including generating income, protecting their portfolios or attempting to enhance returns. Once they know their objectives, they can find the right strategies. Its really not that difficult once the goal is in place.

Futures, used for more than 150 years to manage price risk, also bring benefits to the table. Russell R. Wasendorf, Sr. chairman and chief executive officer of brokerage firm PFGBEST.com, highlights the emotional repercussions for the buy-and-holder when the markets take a sudden decline. Its during those times that some investors bail out of their portfolios and watch the gains that they have waited so long to achieve evaporate. At times like that, futures markets can be instrumental in taking the emotions out of their investing decisions, enabling them to take short-term short positions in either a broad index or individual stocks.

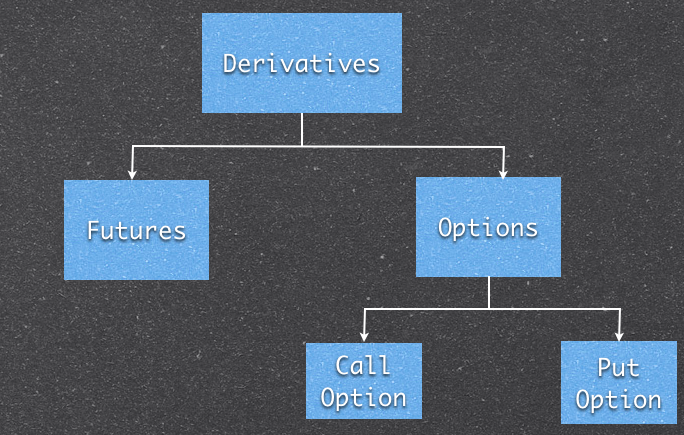

Derivatives Grow with Underlying Markets

Today, both individual equity options and equity index options contracts on six U.S. options exchanges number more than 3,000, and a broad global listing of large, mid- and small-cap stock index futures and options and other equally valuable financial instruments on futures exchanges give investors risk-management choices they never had 30 years ago.

In 1973, the Chicago Board Options Exchange (CBOE) debuted the first U.S. exchange-traded options on a scant 16 stocks. In 1982, Chicago Mercantile Exchange (now CME Group), launched S&P 500 stock index futures, and by 1983, CBOE answered with its first equity index contract, S&P 100 options (OEX). These early introductions led to the creation of many other successful index products in subsequent years on both futures and options exchanges.

The growth of these options and futures tools has been impressive. In just 15 years, U.S. futures volume has grown 700 percent, and security options volume, 1,000 percent. Thus, investors need not look far for financial tools that are standardized and highly liquid, that would allow them to enter and exit a number of markets at will. In addition, if handled properly with a plan in hand and rigorous adherence to it futures and options can remove some of the sweat from the brow when the going gets tough.