Operating income v income

Post on: 16 Март, 2015 No Comment

Q: In a few days, the accounting firm that we have hired will submit the financial statement of the company. How will I know if my business is actually earning? Is it enough that I have a high net income? Are there other indicators I should look at?[question|answer]

A: Reading your companys income statement your eyes immediately look at the net income as it is a very common profitability indicator because[question|answer] it represents the residual income that the company receives after all the expenses have been accounted for.

But when analyzing your companys financial performance on a monthly or yearly basis, following movements in your net income is not enough to evaluate its overall earning capacity. This is because the net income reported in your income statement includes income and expenses that are not part of your core operations.

It is possible for a company to report a positive net income despite losing heavily from its core business on a one-time gain on, say, a sale of a piece of property. If you were an investor looking to buy the company and presented with only net income comparisons, you might be deceived into thinking that the company has consistent earnings.

Operating Income

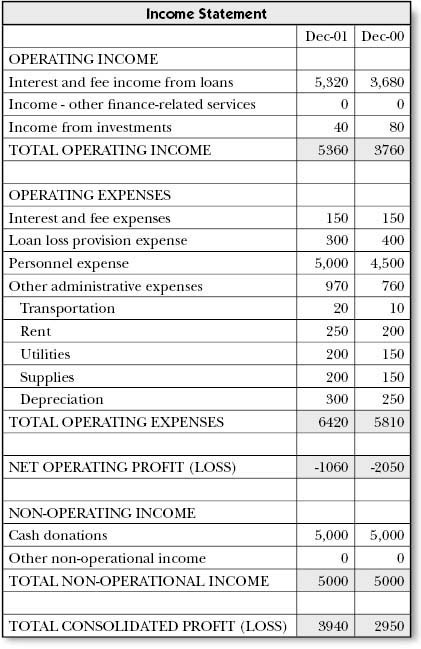

So what should you look for in the income statement other than the net income? You should consider the operating income as the better indicator of your companys earning power. The operating income is the income that the company realizes from its core business before other items are accounted, as computed below:

Sales Cost of Sales = Gross Profit Operating Expenses = Operating Income

Using the operating income margin as an indicator—computed by simply dividing operating income by total sales—will allow you to measure managements efficiency in running the business. The higher the margin, the more efficient—this means that operating expenses are consciously guarded as sales grow.

The operating income margin also helps you to compare your position against your competitors in the same industry. For example, if you are in the food business, you may compare your margins with the industry average of 25 percent.

Net Income

While operating income captures only items that directly affect the core business operation, the net income captures everything. As an indicator, net income margin will not allow you to accurately compare your business with your competitors, since you may have different capital structures.

For example, you may be financing your business by borrowing money from the bank, while your competitor might be using its own money. Your net income would then be lower than your competitors because you are paying interest expense while your competitor has no such expense. Your net income margin will therefore differ greatly, making such comparison difficult. From operating income, the net income is computed as follows:

Operating Income + Other Income Other Expenses = Pretax Income Income Tax = Net Income

Other income in the equation above includes interest income from money market placements, gain from sale of stock market investments or one-time non-recurring income. This one-time booking may be due to a gain from a sale of properties owned by the company. Other expenses , on the other hand, include interest expenses on loans, foreign currency exchange losses, investment losses, or loss from sale of capital assets.

If you can distinguish net income and operating income, you will be able to identify opportunities for growth. A debt-laden company may be suffering back-to-back losses not because of declining sales but because of rising interest expenses. Buying out this company might be a good idea, as long as its operating income margin is attractive. This is a good chance to acquire the business at a good price.