Opening Range Breakout Market Geeks

Post on: 16 Март, 2015 No Comment

Back To Basics

Most of you know I like simple trading methods that make sense. I posted an article about 3 bar retracement entry strategies and got tons of positive feedback. You can read the article by clicking here . Some of the feedback was from traders who were pleasantly surprised that such simple entry methods could be so effective. The great majority of the feedback I received were requests for additional entry methods that were simple to interpret, execute and manage.

Keep It Simple

The reason Im focusing on simple strategies is because so many times I see beginning traders who believe that complex strategies equate to profitable strategies and that is not the case. In reality, the more complex the strategy the more difficult it is to interpret, execute and manage, therefore; more often than not complex strategies do not equate with accuracy or profitability as often believed to be the case. Take for example Gann Lines or Elliot Wave Theory, I know a few traders who traded using these methods, but never for more than a few months at most, moreover I have never seen a professional fund manager utilize these methods effectively or profitably in the past.

Opening Range Breakouts Withstood Test Of Time

This is what led me to write about the opening range breakout method. This simple entry strategy has been around for more than 50 years and remains one of the most popular entry strategies to this day. As a matter of fact, I know several professional traders and fund managers who use the opening range breakout as their primary entry method.

The opening range is the highest price and the lowest price traded during the first half hour of the trading day. I sometimes refer to the first half hour trading range as the opening price bracket. This particular trading period is important because more often than not it sets the tone for the remainder of the trading day. Between the closing of the previous trading session and the opening of the current session several intervening events can occur. These events can have a major impact on the upcoming trading session. For example government reports, stock earnings, overseas markets news and dozens of other fundamental and technical factors play a vital role in the U.S economy and more relevantly on market sentiment.

There Is Strong Build Up From Overnight Markets

Typically, during the first half hour of the trading day, which happens to be the most emotional part of the trading session, markets absorb the overnight information and reflect this information in their price. Even though most markets are open virtually around the clock, the majority of volume and volatility does not appear during the overnight session but begins after the stock market opens each day at 8:30 central time. This is when institutional traders come into the market, buying and selling enormous quantity of shares through computerized trade executions systems called program buying and program selling. The volume is so enormous that it can have a very strong impact on the short term movement of the stock market. These institutional buy and sell programs do not get executed during the overnight session, therefore it is very difficult to truly see what impact the overnight market will have on the stock market till the stock market actually opens and begins trading during the regular day session.

There have been numerous times when the overnight market is pointing in one direction with a very strong bias, only to open and move completely in the opposite direction within the first half hour of the trading session. Therefore, overnight markets offer strong clues into the direction the market is headed but ultimately, there is no better indicator of market direction than the market itself after the first half hour of the trading session.

Conditions Must Be Met Before Execution

To trade the opening range breakout, I prefer to use a 5 minute bar chart and place a buy stop a few ticks above the highest price reached during the previous six bars and simultaneously place a sell stop a few ticks below the lowest price reached during the past 6 trading bars. In addition, I need to make sure three additional conditions are met before I enter the market in either direction.

Avoid Trading Late In The Day

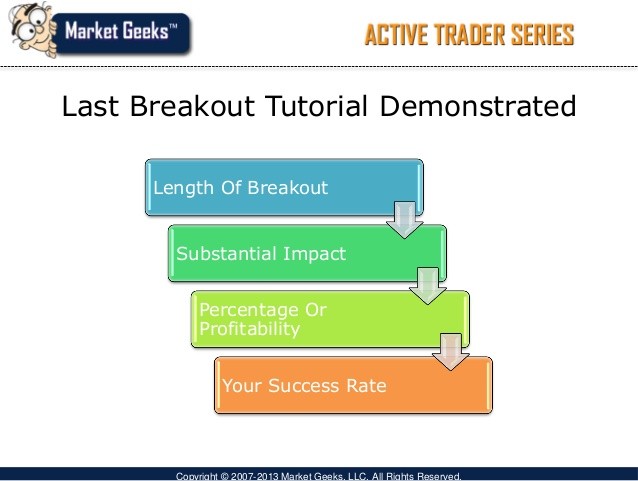

The first condition to market entry is time. The market must hit the buy stop or sell stop within one hour of defining the high and low of the opening range bracket or one and half hour after the opening bell. From years of observation and computer back testing several different markets, I concluded that the quicker the market breaks above or below the opening range bracket, the better the odds of the trade working out. In addition, most breakouts that occur later in the day, do not carry sufficient momentum to sustain the volatility and direction that is worth the risk of entering the trade after the first hour and a half of the trading day.

Bias Towards One Side

The second condition prior to placing my entry order that I like to see is continues bias towards one particular direction. I often times see markets swing back and forth between the high and the low of the opening range. The majority of the time when I see this type of market action I avoid entering the market even though all other conditions have been satisfied. The ideal market action prior to breaking out of the opening range occurs when the market tests either the high or the low on more than one occasion or trades close to that level repeatedly, making higher highs and higher lows in anticipation of breaking out to the upside or alternately making lower lows and lower highs for the majority of the first half hour leading to a breakdown to the downside. What I dont want to see is market that keeps swinging back forth in a choppy trading range between the high and low bracket.

Volume Drying Up Is Not Good

The third and final condition to entry is volume. There must be a substantial and gradual build up or increase in volume leading up to the breakout or breakdown in price outside of the opening range price bracket. The vast majority of the time market volume peaks during the first 15 minutes and the last 15 minutes of the trading day, as a result the volume at the 30 minute mark typically begins to fall off substantially, making it difficult to gauge volume at the 30 minute mark accurately, even when markets are making new highs or lows. My solution to deal with volume drying up is simple, as long as volume is dropping off gradually and is still within the range that existed during the first 15 minutes of trading, I dont consider it a trade breaker. If however, I find that volume is barely moving compared to how it was during the first 15 minutes, I reconsider placing the order. While monitoring volume is not an exact science, with time you will develop a good feel for how volume comes into the market and how markets react to volume.

Always remember that breakout entries are typically accompanied by increase in volatility, make sure your stop loss takes into account the added volatility and adjust your stop loss levels accordingly.

Good luck in your trading!