Online Futures TradingCOT Report

Post on: 2 Май, 2015 No Comment

Mention the word COT report to a group of traders and investors, and you will generally be met by one of three reactions. First, there are those traders who have never heard of the report or the CFTC. Second are those who have, and having spent some time trying to analyse and understand the raw numbers give up, and look for another indicator elsewhere, whilst finally there are the COT disciples, who profess that it is the Nirvana of trading, acting on any signals with fervent zeal. However, ask a group of active traders what they dislike most about the COT report, and all would give the same answer the breakdown of the trading groups is meaningless, and over simplistic, whilst the data presentation itself is crude in the extreme. This last point has been enough to frighten many traders off, despite the fact that even with all the problems outlined above, the CFTC data provides nuggets of information which can be invaluable in both our timing and also direction of trades.

So whats changed? Well I am delighted to say virtually everything, and I hope the following will provide a brief explanation of the changes, what they mean for us as traders, and how we can use the new data sets to provide more detailed and meaningful analysis of all the various markets we trade.

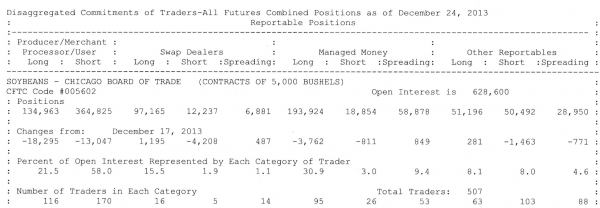

For those of you who have never come across the COT report, or perhaps heard of it but never really investigated it further, it provides and overview of all the futures and options traded by various designated groups, and is issued weekly every Friday afternoon at 15.30 Eastern Time, by the Commodity Futures Trading Commission in the US, which is the regulatory body for all futures and options trading. The data is based on open interest trading volumes up to and including the previous Tuesday of each week, and until recently the report used three crude categories to report, namely large speculators, commercials and small traders. Over the years these groupings had become increasingly meaningless with many traders discrediting some of these completely, and partly as a result of industry pressure, coupled with Government demands for reporting transparency on speculators activity in the markets ( particularly from hedge funds), the CFTC was finally forced to provide a new and more meaningful report, which came into effect on 4th September 2009 late last year. To use the CFTCs own words ; “ the new disaggregated data has been produced to increase transparency and promote market integrity,”. For those of you familiar with the old reporting style, these are still available and running in parallel with the new reports which have now been kick started with over three years of historic data.

So, what are the new groupings and how do they differ from the old ones, and what are the opportunities for us as traders to use this deeper insight into the futures and options world to provide more meaningful analysis and more accurate analysis and trading signals? First lets start with the new groups which are as follows :

- Producer, Merchant, Processor, User . Examples in this group, for gold for example, would include gold bullion producers, bullion banks, refiners, large bullion users. The CFTC itself explains this group as an entity that predominantly engages in the production, processing, packing or handling of a physical commodity and uses the futures markets to manage risks associated with those activities

- Swap dealers . This is perhaps the most contentious and interesting of the new groups, as it is this one alone that has seen spectacular growth in the last few years, with this group accounting for for over 37% of the futures and delta options on NYMEX, an increase of almost 10% from three years ago. For those of you unfamiliar with the term, a swap dealer is the individual who acts as the counterparty between two parties involved in a swap contract, generally in commodities, and uses the futures market to manage or hedge these risks. Swap contracts are generally privately negotiated between two parties and therefore an OTC trade with the swap dealer acting for a fee referred to as the spread. The swap dealers counter parties could be anyone from a speculative trader such as a hedge fund, to a more traditional type of trader such as a commercial client managing risk on a physical commodity. (If you would like to read about a real case, then simply follow the link here to a recent article in the Finanical Times which is interesting reading!) It is the rise of this single group that has made previous analysis of the COT data almost meaningless with the commodities and futures market now dominated by the financial players rather than the traditional producers and consumers, making much of the previous analysis meaningless and unreliable. Most of the growth in swap dealers has come from from an increase in volumes of time spreads, rather than more conventional long or short positions, with spread positions being more closely associated with the growth of commodity indices ETFs and other forms of investment strategies, far removed from the original concept of hedging risk for producers and suppliers. Finally, it is this group that has been responsible for the breakdown in price structure within the commodity markets, with resultant contangoes in crude oil and related products.

- Money Manager . The money manager grouping primarily contains those traders who are registered commodity trading advisers, registered commodity pool operators, or unregistered funds identified by the CFTC, and as a group are identified as managing futures trading on behalf of other clients. In general this group would include portfolio managers, hedge funds and institutional funds.

- Other Reportables . This is basically the catch all category for all other large traders that fail to fit into one of the above.

Outside of the above four major groups there are of course the non-reportable traders these are the small private investors or traders who are not required to report their positions. So, what are we to make of the new report and more importantly how are we going to use the new groupings to obtain better insights for you in your trading, whether in commodities or in forex?

Like many other commodity and forex traders we are still analysing the new data to some extent, and looking at all the possible opportunities that this may present for us as traders. However, those of you who follow my trading regularly will know that I like to keep things as simple as possible, as the more complex an analysis becomes then generally the less insight it provides. As a result I have decided to start my weekly analysis of the new COT data with a comparison of Open Interest volumes against price, which provides a valuable insight into possible turning points and changes in market sentiment. Over the next few months I will be expanding this analysis to look at the new disaggregated groups in more detail, and if you would like to be updated with the analysis direct to your inbox, then simply fill in your details below, and you will receive my weekly analysis regularly, which I hope will prove to be a useful addition to your trading toolkit.

What is the best platform for gold trading? In my view it is Metatrader 4. Download your free demo copy of the metatrader 4 software by clicking on the following link, download metatrader free, and get started today.

cborder=

iorder=link,date,desc,image,