Oil prices What’s the futures market is telling us Smarter Investing

Post on: 2 Апрель, 2015 No Comment

Oil prices: What’s the futures market is telling us

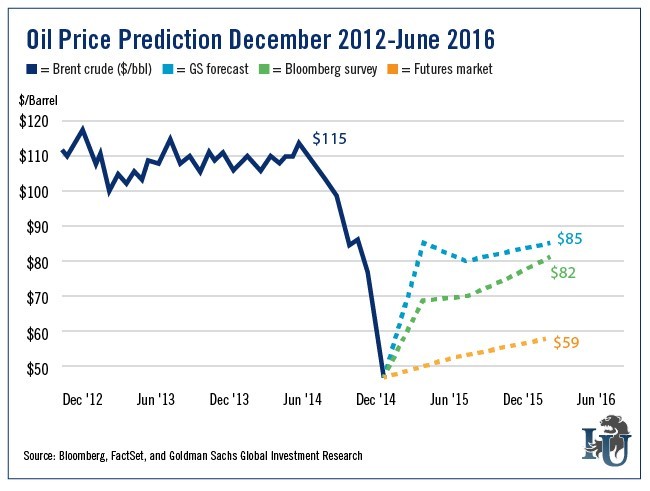

The crude oil market has experienced a significant amount of volatility over the past six months.

After closing at $107.26 per barrel on June 20th, one key oil futures contract dropped more 30%, falling to $74.58 as of November 19.

So what should we expect going forward?

Energy Outlook

Coming out of an early summer market driven by uncertainty over Russia and into a fall market dominated by oversupply concerns, it is clear that the only certainty is that market conditions are uncertain.

However, since the earnings strength of the exploration and production sector is so heavily tied to crude prices, it is important to have a handle on the probability of where prices might go.

Although we may not be able to accurately forecast the direction of future prices, the crude oil options market gives us a very rich source of information about the probability and potential magnitude of future price moves.

To the uninitiated, options trading can be pretty confusing, with lots of arcane jargon and terminology.

In isolation, a single options trade might only reveal a bet between two traders about the likelihood of prices exceeding some threshold.

Market wisdom

In aggregate, however, the options market reveals a probability distribution of future price settlements.

Here is a simple example. The December 2015 crude oil futures contract most recently settled around $75, and the premium for a $100 call option was almost $1.

Embedded in that premium is the market’s assessment of the likelihood of the December 2015 crude oil futures contract exceeding $100, and the magnitude by which it might exceed $100.

Let’s assume that the premium had been $2 instead. That would imply a greater likelihood of the December 2015 contract exceeding $100, and by an even greater magnitude.

So right now, the collective wisdom of the market predicts the chances of oil prices exceeding $100 per barrel is low.

I conducted an analysis of the November 19th crude oil futures and options markets, and used the implied volatility of the at-the-money option contracts to generate the following chart.

It shows the likelihood of crude oil prices settling below certain thresholds. As you can see from the chart, even though the market has fallen quite dramatically in recent months, there is still a significant chance it could fall further.

HCB Investment Management

Stuck in low gear

The probability (yellow line) of crude oil prices settling below $70 is greater than 40 percent starting in mid-2015 through 2016.

In addition, the odds (red line) of 2016 prices breaching $60 are slightly greater than 20 percent. Of course, prices can go in the other direction as well.

The crude oil options market is implying that there is an approximately 10 percent chance that futures contracts with a 2016 settlement will exceed $100 upon expiration.

It is ultimately unknowable how accurate these probabilities are. However, the options market reflects the aggregation of the biases and interests of speculative traders, energy producers and consumers of crude oil.

Serious investors in the energy exploration and production sector would be wise to look to these markets for an indication of future energy price scenarios.