Oil And NatGas ETFs Buck Seasonal Trend

Post on: 1 Июнь, 2015 No Comment

By Cinthia Murphy

Summer months tend to be good for energy prices thanks to a pickup in demand linked to the summer driving season, and the need for air conditioning amid summer heat. But so far this year, that hasn’t happened. Instead, natural gas and oil prices-as well as the ETFs that track these markets-are under downward pressure.

Consider that in the past three months alone, a fund like the United States Natural Gas Fund (NYSEARCA:UNG ) has plunged a whopping 20.8 percent. The recent performance all but erased sharp gains the fund had seen during what was deemed one of the coldest winters in U.S. history.

Year-to-date, UNG is now up only 0.9 percent, back to levels not seen since late 2013.

UNG, which invests in near-month natural gas futures contracts, is the market’s largest and most liquid natgas ETF, with more than $663 million in assets, but it’s not the only fund in the segment. Its competitors-funds such the iPath Pure Beta Seasonal Natural Gas ETN (NYSEARCA:DCNG ) and the $15.8 million United States 12 Month Natural Gas Fund (NYSEARCA:UNL ) are facing similar losses. DCNG has only $1.25 million in assets, and trades under $43,000 a day, on average, which explains the periods of flat price action in the chart above.

Dropping natural gas prices aren’t all that surprising in the summer, says Sumit Roy, analyst at HardAssetsInvestor. But milder-than-normal temperatures have added to what should have been just modest seasonal weakness. Roy said:

Natural gas prices tend to decline during the summer if you look at the seasonal performance-prices typically peak in June as people anticipate summer demand, but they then decline during the hottest months of July and August.

That is, he says, unless we see especially hot temperatures, which spur people to turn up their air conditioners and use more electricity than usual:

This year has been anything but hot, with extremely mild temperatures seen in many parts of the U.S.

Investors Seem To Buy Into Upward Move Ahead

Despite the bleeding, investors have continued to pour assets into the fund. In the past three months alone, more than $161 million in net new assets have landed into UNG, according to ETF.com’s Fund Flows tool. Roy states:

Natural gas may recover during the winter, when demand reaches its highest point as people use the fuel to heat their homes.

Oil Prices Struggling To Find Upside Thanks To Libya

Oil prices tend to rise during the summer, but concerns over a possible supply glut has both WTI and Brent oil under pressure, even if in recent days both markets have found some respite. Roy states:

Since oil is a global market with many moving parts, a lot of things can derail those seasonal trends. This month, we’ve seen a steep plunge in prices due to anticipation of increased exports from Libya.

That expectation is linked to the fact that recent unrest in that country had kept Libya’s output below normal levels by more than 1 million barrels a day for about two years. Now, a recent truce between the government and rebels is leading to anticipation that the country’s output may rise significantly in the coming months, Roy says.

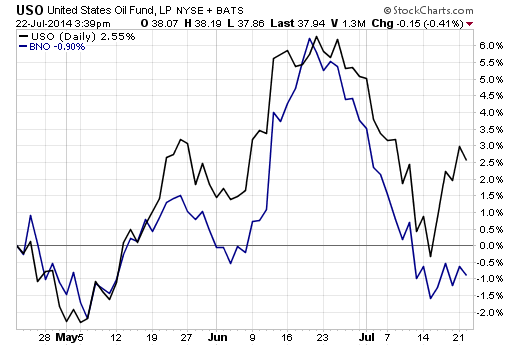

USO, BNO Performance Far Cry From Year-Earlier Gains

Funds like the United States Oil Fund (NYSEARCA:USO ) and the United States Brent Oil (NYSEARCA:BNO ) have struggled to find upside momentum. The two funds, which compete in a segment populated by at least nine ETFs, invest in near-month WTI crude oil futures contracts, and nearby Brent oil futures, respectively. That makes them a good, if imperfect, proxy for spot oil prices in ETF wrappers.

In the past three months, USO raced higher just to retrace its steps completely in recent weeks. In all, the fund has managed to capture total returns of only 2.5 percent in the three-month period-a relatively weak performance given the season.

BNO has actually delivered a negative performance in the period, as the chart below shows. At the end of the day, while Libya weighs on both oil markets, WTI continues to benefit from tight supplies in Cushing. the delivery point for Nymex-traded oil futures contracts. Said Andy Lebow, senior vice president for energy at Jefferies Bache LLC, referring to the narrowing of the WTI-Brent spread:

The markets at long last are reflecting the tightness at Cushing. It doesn’t appear as if the tightness at Cushing is going to be alleviated anytime in the next few weeks.

By comparison, in the same three-month period a year earlier, USO rallied nearly 21 percent, while BNO tacked on gains of roughly 10 percent between mid-April and mid-July 2013. That’s a far cry from the unimpressive gains investors have seen so far this summer.

Still, assets are flowing into these funds. Both USO and BNO have managed to attract fresh net assets in the past three months-$159 million and $31 million, respectively.

This article originally appeared on ETF.com and is republished here with permission.