Obscure Economic Indicator the price of copper

Post on: 1 Август, 2015 No Comment

The metal tells us almost everything we need to know about the global economy.

For the nervous among us, looking at the headlines of the Financial Times can be a form of torture, what with high oil prices, global instability, trade imbalances, and the murky threat of China. But optimists should take cheer from the price of copper, a vital and frequently overlooked metal. It costs less per pound than coffee or hamburger meat. But as an investment, in the last few years it’s been pure gold.

Copper is a cheap, plentiful metal with lots of useful properties: It resists corrosion and is an excellent conductor of heat. As a result, it can be found in the intestines of a good chunk of the world’s industrial economy. Plumbing, radiators, electrical wiring, and air conditioners all require copper. And copper has been benefiting from some pretty significant trends. First, there’s the global housing and construction boom. According to the Copper Development Association. almost half of the copper in the United States goes for building construction. (The pattern of copper use in the United States is roughly analogous to the global pattern of use.) China, which is currently undergoing a building boom, is also playing a major role. About 20 percent of copper goes into electrical and electronic products—telephones, televisions, connectors, earphones. As Chinese consumers acquire the taste for telephones, stereos, air conditioners, and plumbing, they are stimulating growing demand. Other heavy users are the transportation sector—Andrew Kireta, the chief executive officer of CDA, notes that every car contains close to 50 pounds of copper—and industrial machinery. And, of course, all major U.S. coins contain some copper.

So consumption and production of copper have been rising. This chart shows global copper consumption between 1993 and 2002. And the CDA notes in this data-packed report that global copper production rose 20 percent between 2002 and 2004. That’s been very good news for Chile. which supplies about a third of the world’s copper, and for companies like Phelps Dodge. the U.S.-based copper giant. Phelps Dodge just reported an impressive quarter. and its stock has quadrupled in the last three years.

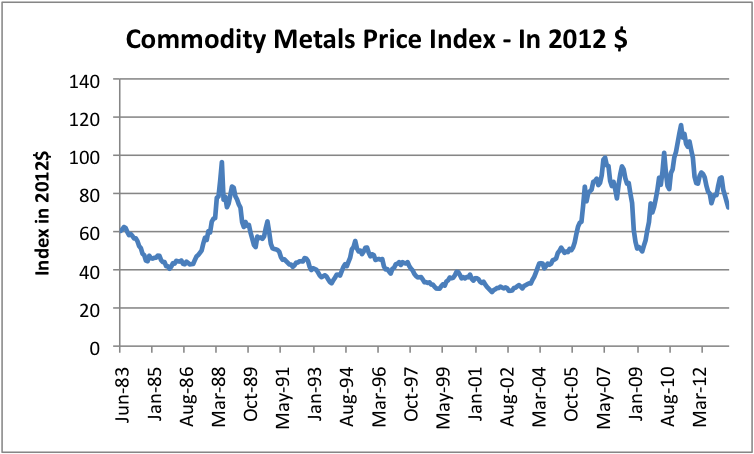

The rising demand has also been good news for copper traders. This monthly chart plots copper’s rise over the last several years, and this vertigo-inspiring chart illustrates how the price of copper has doubled in the last year.

The copper charts may look like the charts of Internet stocks circa early 2000, which heralded bad news for the economy and investors. But the copper price hikes don’t necessarily signify rampant speculation that is bound to end with a crash. The price of copper generally represents a pretty accurate barometer of the demand for it in the real world, rather than an irrational bet on its future value. Why? As Howard Simons. a strategist for Chicago-based Bianco Research, notes, copper is cheap, heavy, and plentiful. So you don’t stockpile it, you use it as needed. Nobody bothers to hoard it. (You’d need a massive warehouse to store any meaningful amount of copper.) And while some hedge funds are doubtlessly speculating on copper, nobody goes out and takes a flyer on it, the way you would with more expensive metals like gold and silver, says Simons.

When commodities vault into highly speculative mode, or when there’s a short-term mismatch in supply and demand, the price for delivery this month (the spot price) can get way ahead of the price for delivery in future months (the futures price). That tends not to happen with copper. If the price for near-term delivery gets way ahead of the future price, then companies that are sitting on some inventory will sell it.

So the charts and the data from CDA tell a story of steadily rising demand, steadily rising production, and steadily rising prices. Like reasonably efficient markets, the copper market responds nicely to trends in supply and demand. So, as long as the price of copper remains high, it means that companies the world over are buying plenty of copper to turn into wiring, plumbing, and coils. When the price tapers off, it means that some core sectors are probably cooling. Right now, copper is sending a message that is being transmitted by plenty of other data, but that many analysts find difficult to digest: Despite all the tensions, despite the huge imbalances in trade and capital flows, despite all the world’s apparent economic troubles, the global economy continues to grow at a steady and impressive pace.