Obama Details Raising Taxes on Gains Dividends

Post on: 16 Март, 2015 No Comment

Plan Would Expand Payroll Levy on Some High-Wage Earners

Deborah Solomon

Updated Aug. 15, 2008 12:01 a.m. ET

Democratic presidential contender Barack Obama sought to quiet critics by offering specifics about his tax plan, but his proposal to raise tax rates on investment income and expand payroll taxes is continuing to draw fire from some who say it will harm workers and the economy.

Sen. Obama outlined a plan Thursday to raise tax rates on capital gains and dividend income from 15% to 20% for individuals and families making more than $200,000 and $250,000, respectively. He also detailed a plan to levy payroll taxes on earnings above $250,000 at a rate between 2% and 4%, though that increase wouldn’t occur for at least a decade. Right now, payroll taxes, used to fund retirement benefits, are levied on income up to $102,000.

Jason Furman, Sen. Obama’s economic-policy director, said the plan would cut taxes to less than 18.2% of gross domestic product. That’s lower than the level of taxes when Ronald Reagan was president, he said.

The proposed rates are below the levels many had expected, given Sen. Obama’s campaign rhetoric. Nonetheless, critics said the plan would exacerbate an economic downturn and harm workers.

The U.S. economy is in a weak state. We’ve got a credit crunch, high oil prices. this is not the time to be raising anybody’s taxes, said John Taylor, a Stanford University economist who is advising Sen. Obama’s rival, Republican Sen. John McCain.

When the investment tax rate is higher it affects behavior because we see a retrenchment of companies paying dividends, said Bruce Josten, executive vice president of government affairs at the U.S. Chamber of Commerce.

Dividends and capital gains lure investors to participate in the stock market, and their investment provides capital for companies to use to expand their business. A reduction in that capital could hurt business and the U.S. economy, Mr. Josten said. He said the business community also is concerned that Sen. Obama’s broader tax plan would remove more individuals from the income-tax rolls, a situation that could lead to future tax increases on wealthier Americans.

The Obama campaign called on former Clinton administration Treasury Secretary Lawrence Summers to defend Sen. Obama’s plans. At a time when the 10-year interest rate is in the three’s, at a time when it is clearly lack of demand for products rather than the cost of capital that is inhibiting investment, the idea that a return to the tax policies of the 1990s would somehow damage the economy in a substantial way seems to me supported by neither theory nor evidence nor the longer-term history, Mr. Summers said.

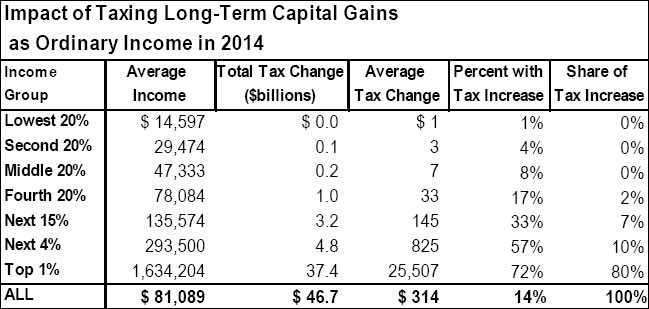

ENLARGE

The Securities Industry and Financial Markets Association, a trade group, criticized the proposed investment-income tax increases as dangerous. The next occupant of the Oval Office is going to face some tough choices on fiscal policy, but raising taxes on capital gains and dividends will only further endanger an already-weakening economy and punish the more than half of all American households that are invested in the stock market, said Travis Larson, a spokesman for the group.

Both Sens. Obama and McCain promise to cut taxes for the majority of Americans. Sen. Obama would skew his cuts toward lower- and middle-income groups, and has said his plans could remove as many as 17 million individuals from the income-tax rolls. He would roll back some of President George W. Bush’s 2001 and 2003 tax cuts and raise taxes on families earning more than $250,000. Sen. McCain’s plan would benefit wealthier Americans because he has vowed to keep all of Mr. Bush’s tax cuts in place.

The Obama campaign has said that repealing the Bush tax cuts would boost revenue by $100 billion a year, including $15 billion from higher capital-gains and dividend taxes. That money is expected to help finance Sen. Obama’s tax cuts and his health-care plan. His economic advisers said Thursday that by the fourth year of an Obama presidency they expect to save about $90 billion from ending the war in Iraq.

Sen. Obama has long said he planned to raise rates on investment income and payroll taxes. But many assumed, based on the candidate’s comments, that the rates might be between 25% and 28%. Mr. Furman, the campaign’s economic-policy director, said the campaign had been using the 20% figure internally in its budget numbers.

Bob Williams of the Tax Policy Center, an independent think tank in Washington, said there is no evidence that a higher capital-gains tax rate impacts long-term behavior. The biggest impact, he said, is over the short term, when investors try to realize gains before the increase goes into effect.