Nuveen Credit Strategies Income Fund A Solid Core Holding For CEF Investors Nuveen Credit

Post on: 16 Март, 2015 No Comment

Summary

- Based on our experience in uncovering value in closed-end funds, we have identified four criteria of the best such funds.

- The floating-rate CEF Nuveen Credit Strategies Income Fund amply meets all four of our criteria.

- JQC may be a particularly advantageous holding when interest rates start to rise.

When purchasing long-term closed-end fund (CEF) holdings, income investors should ideally find four attributes:

- Attractive discount to net asset value (NAV)

- Good long-term performance

- Strong earnings fundamentals

- Below-average expenses

We believe that the floating-rate CEF Nuveen Credit Strategies Income Fund (NYSE:JQC ) demonstrates all these attributes and would serve as a solid core holding in an income portfolio, particularly for investors concerned about the potential for interest rates to rise from historically low levels.

JQC invests in senior floating-rate debt. The idea of investing in floating-rate CEFs and JQC in particular has already been covered in an excellent article. which we recommend as good background material. We approach JQC from a few slightly different angles.

Attractive Discount

CEFs have an NAV, just like an open-end fund. However, CEFs trade on the open market at price which may be at a premium or discount to NAV. A discount of 10% means that an investor is paying $0.90 for $1.00 of asset value. A large discount to NAV benefits the investor in many ways.

CEFs discounted tend to trade in discount ranges, so if one buys at the wider end of the trading range, there is potential for capital appreciation as the discount narrows. What’s more, as discounts widen, value investors and CEF activists often step in buy and may force management to take measures to reduce the discount. This can lead to a floor on the discount level.

More importantly for income investors, a sizable discount means that they have more dollars at work for their actual investment, which can substantially improve their dividend yield. For example, owning a fund at a 10% discount means that you have an additional 11% of money working for you (actually you would have $1.00/0.9 = $1.111 for every $1.00 invested). Thus, a CEF yielding 6% on its NAV would yield approximately 6.67% on market price if priced at 10% discount. This yield advantage helps offset management fees and can make the discounted CEF extremely attractive versus open-end fund, ETF, and premium-CEF alternatives.

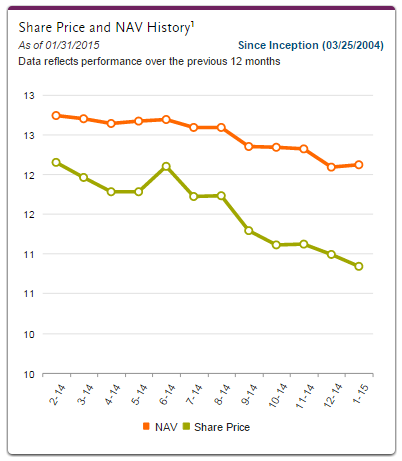

As of January 30, 2015, JQC traded at a 12.5% discount. JQC has been trading at the largest, or close to the largest discount, of all floating-rate funds and among the largest discounts in the income-CEF universe. Since it converted to floating-rate CEF in April 2012, JQC has traded in a range from 4.3% premium to 14.2% discount, so the current discount is near the bottom of the range.

JQC’s discount is therefore attractive both on an absolute and relative basis in our view.

Good Long-term Performance

Although past performance is no guarantee of future results, it may indicate skill and potential for future performance. We find one measure of investment skill by considering relative NAV performance among comparable funds with a similar investment mandate. We look at NAV performance, versus market performance, since NAV performance focuses only on management skill and the actual returns of the investment portfolio.

JQC converted to a floating-rate strategy on April 2, 2012. We thus decided to run weekly NAV returns starting 4/05/2012, the closest Friday following the conversion. We compared JQC’s NAV returns with the nineteen other floating-rate CEFs in existence over the period 4/5/2012 to 1/23/2015.

With a total return of 24.3% over the period, JQC was the second-best performer, slightly lagging its sister-fund JRO, at 25.2%. The average return was 18.5%.

Strong Earnings Fundamentals

CEF investors should invest in funds that can maintain or even increase dividends and avoid funds that might cut dividends. Not only do investors want a steady, reliable income stream, but the market typically reacts strongly to dividend changes, punishing funds that cut their dividends and rewarding funds that raise them.

JQC is over-earning its dividend by 19%, earning 0.0520 cents per share per month versus a dividend of 0.0435. (Source: Nuveen’s December 31 earnings and undistributed net investment income (UNII) fact sheet.) JQC had cut its dividend in 2013 to compensate for a negative UNII balance that had been nagging the fund since before the change to a new strategy. At current earnings rates, however, the negative UNII should be earned back in just over seven months, at which point JQC could be due for a hefty dividend increase.

While this dividend catalyst may be distant it is comforting to know that if anything, the fund is more likely due for a dividend increase in the future. In the meantime, we believe it is probable that the discount will narrow as the negative UNII is eliminated and the chance of a dividend increase becomes more likely. This analysis also excludes the possibility of Federal Reserve rate increases. Federal Reserve rate increases have the potential to further increase the yield of the underling portfolio of floating-rate debt and, hence, the earnings power of the fund longer term. What’s more, JQC is still earning 7.2% for its investors even if it is only playing out a 6.0% yield. The extra 1.2% does not disappear but builds NAV penny for penny as the fund clears out its negative UNII balance. In other words, JQC investors are poised to earn 7.2% over the next year based off of the current portfolio — 6.0% in dividends and 1.2% in NAV appreciation (not including market fluctuations).

Below-Average Expenses

Expenses eat away at returns and particularly income. Every dollar spent to management fees is a dollar less in shareholder income. Portfolio managers have to demonstrate extraordinary skill and/or take on extra risk in order to make up yield lost to high expenses, particularly in a low-rate environment. For that reason, we recommend buying funds with low expenses and avoiding funds with high expenses.

With a baseline expense ratio of 1.25%, JQC was the fourth cheapest fund out of 24 floating-rate CEFs and well below the sector average of 1.54% (Sources: CEFConnect and N-CSR financials. Note that we do not include interest expense in the calculation, since borrowings are used to purchase yielding securities and thus are offset by additional income.)

Summary

JQC has all the attributes of an attractive CEF investment: attractive discount, good performance, strong earnings fundamentals, and lower-than-average expenses. We believe it should be considered for purchase as a core holding in an income-CEF portfolio, particularly for those interested in investing in floating-rate CEFs for protection against higher interest rates.

Risks

Risks include credit risk on the underlying fund portfolio and discount widening due to continued negative investor sentiment for floating-rate CEFs.

Matt Crouse and Art Lipson