Nikkei 225

Post on: 19 Май, 2015 No Comment

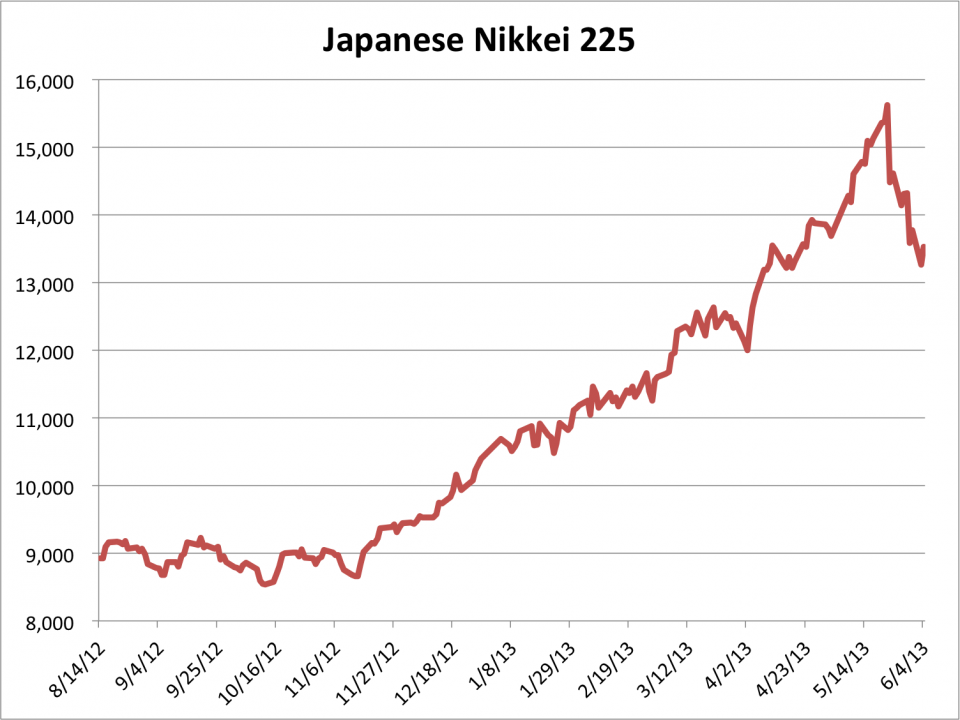

Nikkei 225

The Nikkei 225 is the stock market index for the Tokyo Stock Exchange, and it is very similar to the Dow Jones Industrial Average. The index has been calculated each day since 1950, and is updated every 15 seconds during trading sessions. The Nikkei 225 is an internationally recognized index that is respected around the world.

The Nikkei 225 is a stock market index that is affected by many variables. Wars, droughts, and other events outside of Japan can affect the Nikkei 225. When stocks in the United States move from earnings announcements, stocks in Japan usually follow. Additionally, when spending in the U.S. increases, Japanese stocks increase as well.

Recently, the Nikkei 225 stock average rose due to housing starts increasing in Japan. Two of Japan’s largest real estate firms rose in value more than three percent when data from the Japanese government stated that housing starts jumped over 20%.

Another way that Nikkei 225 is affected by the global economy can be seen with the recent case of American private sector jobs decreasing by 39,000. This spurred the Nikkei 225 to drop one percent which was a concern to buyers and sellers alike, despite the small drop. Both Canon and Panasonic dropped by this amount. This small decrease in American jobs was a clue to a job trend that Nikkei 225 buyers and sellers continually watch – especially sellers since buyers from the U.S. purchase many Japanese items, such as cars made by Nissan, Honda, and Mitsubishi. If even a small number of U.S. citizens lose their jobs, Nikkei 225 futures market sellers are aware that this could be an indicator or a larger trend in jobs in the U.S. Of course, loss of jobs means less money to buy new cars, printers, computers, and other items.

The Nikkei 225 futures market and all futures markets are settled at the end of each day. Both seller and buyer are charged or granted losses or profits. The dealings of this futures market, and all futures markets, do not carry over to the next day.

There are reasons why the Nikkei 225 futures market is very important to the Japanese investors, sellers, and citizens. One reason is that futures contracts help sellers know how much of a product to produce. Japanese car manufacturers will only produce as many cars as they have contracted to make through futures market contracts. The risk is reduced because the price is pre-set, so these car manufacturers will not have to accept less for their cars than the contract states. On the other hand, buyers of Toyotas in the U.S. and Canada, who buy around one-third of all Toyota cars, will not have to pay more for their new car because the Japanese manufacturers will not be able to change their pre-set prices in the futures contracts.

The futures market in Nikkei 225 and around the world helps determine prices based on supply and demand. They depend on constant, updated information from around the world.

Japanese buyers have the same benefits of futures contracts through Nikkei 225. They are able to buy products from around the world at pre-set prices that they will pay in the future even if worldwide costs rise. Although the futures stock market is very complex and risky, it is also a place where hedges and speculators can try to make a profit from other investor’s gains and losses. Nikkei 225 is not without risk, but it has benefited many investors, both in Japan and around the world.