New Alternative Fixed Income ETFs Reduce Duration Balance Risks

Post on: 26 Июнь, 2015 No Comment

By DailyAlts Staff

In a statement to the Senate Banking Committee yesterday, Federal Reserve Chairwoman Janet Yellen indicated that an interest rate hike is drawing nearer as the U.S. economy improves. But Ms. Yellen’s commentary was more dovish than expected, and as a result, bonds rallied and the yield on the 10-year Treasury dipped below 2% again after rising sharply from its recent lows of 1.68% seen at the beginning of the month.

Nevertheless, the rate-hike decision is now being taken on a meeting by meeting basis, and when rates are eventually hiked, yields will be driven higher which means bond prices will fall.

This is the dilemma facing fixed-income investors in early 2015, which is roughly the same dilemma they found themselves in a year ago. The only difference is that we’re that much closer to the eventual Federal Reserve rate hike, whenever it comes. Luckily, there are liquid alternatives to passive investing in the broad bond market, and two such products launched earlier this month:

Sit Rising Rate ETF (NYSEARCA:RISE )

The Sit Rising Rate ETF is designed specifically to provide investors with an easily accessible and effective tool for hedging their portfolios against rising interest rates. The fund uses a basket of derivative instruments and short positions in U.S. Treasury instruments to achieve a specific duration target, as follows:

RISE is a strategic interest rate-hedging tool that gives investors the opportunity to benefit from the rise in the interest rates of U.S. Treasury notes. The portfolio targets a negative 10-year duration using futures and options on 2, 5 and 10-year maturity Treasury futures contracts.

With a negative duration, the fund’s price will move in the opposite direction of interest rates. According to a statement issued by RISE, with negative 10-year duration, which is the fund’s target, the price moves nearly 10 times the change in yield.

A small allocation of 10 to 20 percent in RISE can significantly reduce the interest rate risk within a bond portfolio, said Sam Masucci, founder and CEO of ETF Managers Group, which launched the ETF in partnership with Sit Investment Associates. With the Sit Rising Rate ETF, we bring Sit Investment Associates’ institutional portfolio management expertise to an expanded range of investors interested in hedging interest rate volatility.

The fund carries an expense ratio of 1.50%, after waivers, which includes a management fee of 0.50%.

iShares U.S. Fixed Income Balanced Risk ETF (BATS:INC )

The iShares U.S. Fixed Income Balanced Risk ETF will be the first smart beta income ETF from BlackRock, the world’s largest asset manager. The fund, which launched today, February 26, will use a systematic, rules-based approach to balance interest rate risk and credit spread risk, which are the two primary drivers of bond returns.

Finding balance between the two is increasingly difficult. Given the low interest rate environment, investors continue to take on more credit risk as they seek out higher yielding opportunities. At the same time, they are often taking on interest rate risk at a historically low level for interest rates. The iShares U.S. Fixed Income Balanced Risk ETF will attempt to navigate the current interest rate and credit risk environment by investing in a diversified portfolio of corporate bonds, U.S. Treasuries, MBS (mortgage-backed securities) and high-yeild fixed bonds; and balancing allocations across market sectors according to their historical volatility. Like the RISE ETF, the iShares U.S. Fixed Income Balanced Risk ETF can also use short positions to adjust the portfolio’s holdings and manage the fund to the targeted 50/50 weighting between interest rate and credit spread risk.

We are excited to launch iShares U.S. Fixed Income Balanced Risk ETF to address investors’ need for income and their concern about rising interest rates, said Matt Tucker, head of fixed income investment strategy at BlackRock. This ETF offers investors a new option for core fixed income portfolios in a low cost, transparent, ETF structure that can be paired with market cap weighted strategies to help increase diversification and potentially increase income.

The fund will hit the market with a 0.25% expense ratio, after fee waivers of 0.06% that expire in one year.

Conclusion

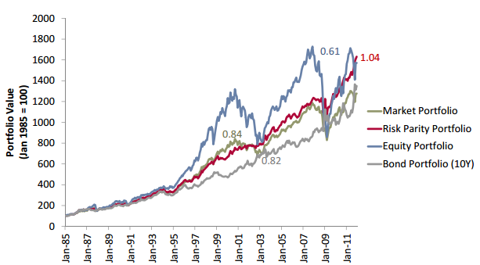

Interest rate risk is a subject that’s often overlooked, or misunderstood, by many investors. Under the traditional 60/40 stock/bond approach, interest rate risk is simply something that you live with, and the rule that bonds go down when interest rates go up is a fact of life. But by pursuing alternative fixed-income strategies, such as those employed by the Sit Rising Rate ETF and the iShares U.S. Fixed Income Balanced Risk ETF, investors can have more control over the effect interest rates have on their portfolios.