Natural Gas ETF Launches; A Natural Gas Primer The United States Natural Gas ETF LP (NYSEARCA

Post on: 3 Апрель, 2015 No Comment

The Natural Gas ETF (NYSEARCA:UNG ), formally the United States Natural Gas Fund, LP, launches today. UNG’s investment objective is to reflect the changes in percentage terms of the price of natural gas via futures contracts. The ETF is run by Victoria Bay Asset Management, the same firm that manages the US Oil ETF (NYSEARCA:USO ). The prospectus contains a useful primer on the natural gas market:

What is the Natural Gas Market and the Petroleum-Based Fuel Market?

Natural Gas. Natural gas accounts for almost a quarter of U.S. energy consumption. The price of natural gas is established by the supply and demand conditions in the North American market, and more particularly, in the main refining center of the U.S. Gulf Coast. The natural gas market essentially constitutes an auction, where the highest bidder wins the supply. When markets are “strong” (i.e. when demand is high and/or supply is low), the bidder must be willing to pay a higher premium to capture the supply. When markets are “weak” (i.e. when demand is low and/or supply is high), a bidder may choose not to outbid competitors, waiting instead for later, possibly lower priced, supplies. Demand for natural gas by consumers, as well as agricultural, manufacturing and transportation industries, determines overall demand for natural gas. Since the precursors of product demand are linked to economic activity, natural gas demand will tend to reflect economic conditions. However, other factors such as weather significantly influence natural gas demand.

The New York Mercantile Exchange is the world’s largest physical commodity futures exchange and the dominant market for the trading of energy and precious metals. The Benchmark Futures Contract trades in units of 10,000 mmBtu and is based on delivery at the Henry Hub in Louisiana, the nexus of 16 intra- and interstate natural gas pipeline systems that draw supplies from the region’s prolific gas deposits. The pipelines serve markets throughout the U.S. East Coast, the Gulf Coast, the Midwest, and up to the Canadian border. Because of the volatility of natural gas prices, a vigorous basis market has developed in the pricing relationships between the Henry Hub and other important natural gas market centers in the continental United States and Canada. The New York Mercantile Exchange makes available for trading a series of basis swap futures contracts that are quoted as price differentials between approximately 30 natural gas pricing points and the Henry Hub. The basis contracts trade in units of 2,500 mmBtu on the New York Mercantile Exchange ClearPort® trading platform. The New York Mercantile Exchange ClearPort® is an electronic trading platform through which a slate of energy futures contracts are available for competitive trading. Transactions can also be consummated off-New York Mercantile Exchange and submitted to the New York Mercantile Exchange for clearing via the New York Mercantile Exchange ClearPort® clearing website as an exchange of futures for physicals or an exchange of futures for swaps transactions.

WTI Light, Sweet Crude Oil. Crude oil is the world’s most actively traded commodity. The oil Futures Contracts for light, sweet crude oil that are traded on the New York Mercantile Exchange are the world’s most liquid forum for crude oil trading, as well as the most liquid futures contracts on a physical commodity. Due to the liquidity and price transparency of oil Futures Contracts, they are used as a principal international pricing benchmark. The oil Futures Contracts for WTI light, sweet crude oil trade on the New York Mercantile Exchange in units of 1,000 U.S. barrels (42,000 gallons) and, if not closed out before maturity, will result in delivery of oil to Cushing, Oklahoma, which is also accessible to the world market by two major interstate petroleum pipeline systems.

The price of crude oil is established by the supply and demand conditions in the global market overall, and more particularly, in the main refining centers of Singapore, Northwest Europe, and the U.S. Gulf Coast. Demand for petroleum products by consumers, as well as agricultural, manufacturing and transportation industries, determines demand for crude oil by refiners. Since the precursors of product demand are linked to economic activity, crude oil demand will tend to reflect economic conditions. However, other factors such as weather also influence product and crude oil demand.

The price of WTI light, sweet crude oil has historically exhibited periods of significant volatility.

Heating Oil. Heating oil, also known as No. 2 fuel oil, accounts for 25% of the yield of a barrel of crude oil, the second largest “cut” from oil after gasoline. The heating oil futures contract, listed and traded on New York Mercantile Exchange, trades in units of 42,000 gallons (1,000 barrels) and is based on delivery in the New York harbor, the principal cash market center.

Gasoline. Gasoline is the largest single volume refined product sold in the U.S. and accounts for almost half of national oil consumption. The gasoline Futures Contract, listed and traded on the New York Mercantile Exchange, trades in units of 42,000 gallons (1,000 barrels) and is based on delivery at petroleum products terminals in the New York harbor, the major East Coast trading center for imports and domestic shipments from refineries in the New York harbor area or from the Gulf Coast refining centers. The price of gasoline is volatile.

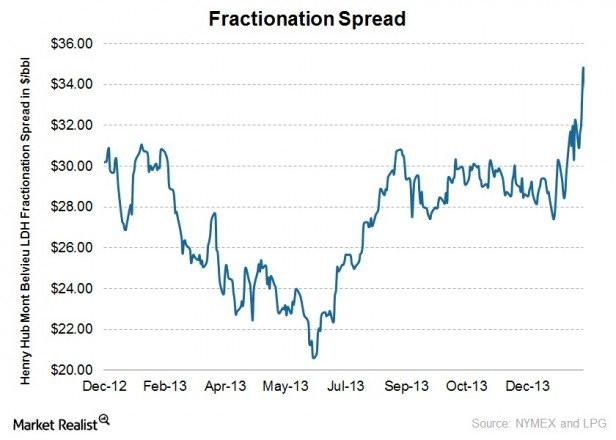

As illustrated by the following graph, there is a correlation among natural gas futures contracts, crude oil futures contracts, gasoline futures contracts, and heating oil futures contracts.