Nadex First To Offer Bitcoin Derivatives Trading To Us Retail Investors 2015

Post on: 10 Апрель, 2015 No Comment

3A%2F%2Fforexmagnates.com%2F?w=250 /% According to a company announcement, IG’s CFTC regulated exchange, the North American Derivatives Exchange (Nadex), proclaimed that subject to a filing with the U.S. Commodities and Futures Trading Commission (CFTC), it will offer its clients the ability

3A%2F%2Fwww.safehaven.com%2F?w=250 /% Nadex has seen strong consumer demand from retail follow suit and offer Bitcoin derivatives in the U.S. on a larger scale, just as derivatives for commodities (including precious metals) are offered. If this is the case, Bitcoin trading will become

3A%2F%2Fwww.fxstreet.com%2F?w=250 /% Nadex has seen strong consumer demand from retail follow suit and offer Bitcoin derivatives in the U.S. on a larger scale, just as derivatives for commodities (including precious metals) are offered. If this is the case, Bitcoin trading will become

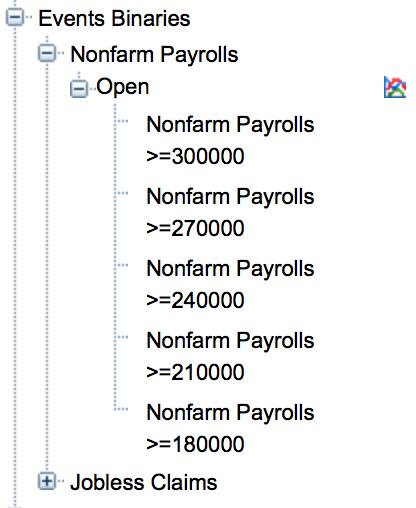

3A%2F%2Fwww.futuresmag.com%2F?w=250 /% CME currently prohibits freshening by requiring that, beginning on the day following the first Nadex has seen strong consumer demand from retail traders looking for new ways to trade bitcoin. Similar to other binary options contracts on Nadex

3A%2F%2Fwww.fiercefinanceit.com%2F?w=250 /% Trading of the bitcoin derivatives on TeraExchange is based on the TeraBit Index, which was developed by TeraExchange and includes prices from the nine existing bitcoin exchanges. The company has already licensed out the TeraBit Index to Nadex, a straight

3A%2F%2Fwww.coindesk.com%2F?w=250 /% Nadex will offer daily and weekly bitcoin binary options contracts, taking prices from the bitcoin price index published by TeraExchange, a derivatives trading platform. Both Nadex and TeraExchange are regulated by the US Commodity Futures Trading

3A%2F%2Fwww.businessinsider.com%2F?w=250 /% Buying shares in diamond mining companies remains the most popular route for retail investors he was probably the first person in Europe to engage in financial futures, now commonly called derivatives. In so doing he helped lay the foundations for

3A%2F%2Fcointelegraph.com%2F?w=250 /% The company is currently going under filing review from the US Commodity Futures Trading Commission (CFTC). Nadex said the new offering is in response to a strong demand from retail the world’s first regulated platform for Bitcoin derivatives with

3A%2F%2Fwww.bizjournals.com%2F?w=250 /% Tera has played a leading role in the development of bitcoin derivatives. In September 2014, Tera launched on TeraExchange the first regulated Bitcoin derivative products, and a spot Bitcoin price index. Trading world’s most prominent investors

3A%2F%2Fleaprate.com%2F?w=250 /% FTT has developed an interface between its services and First Derivatives trading solution to banks and brokerages in the retail FX market. For this initial implementation FTT have developed an interface between their services and Delta Flow to offer