Mortgage REITs get crushed as rates increase Market Realist

Post on: 16 Март, 2015 No Comment

Mortgage REITs get crushed as rates increase

The 10-year bond has sold off dramatically since May 1st as the yield has increased from 1.67% to 2.13%. This has driven mortgage rates to 3.88%. The conventional wisdom for the move has been that the market is discounting an end to quantitative easing. The sell-off started on a better than expected jobs report. and continued as companies announced generally good first quarter earnings. Economic data over the month has been mediocre, certainly nothing that would cause the Fed to change course. Finally, Federal Reserve Chairman Ben Bernake testified before Congress and was pressed as to when the Fed would start tapering asset purchases, or quantitative easing. His response was that he would follow the data, and when the labor market improves materially, then he would consider tapering quantitative easing. The questioner asked if that could be as soon as Labor Day. Bernake said that it could, provided the economic data was strong. That caused a swoon in the bond market that is still going on.

Mortgage REITs and interest rate risk

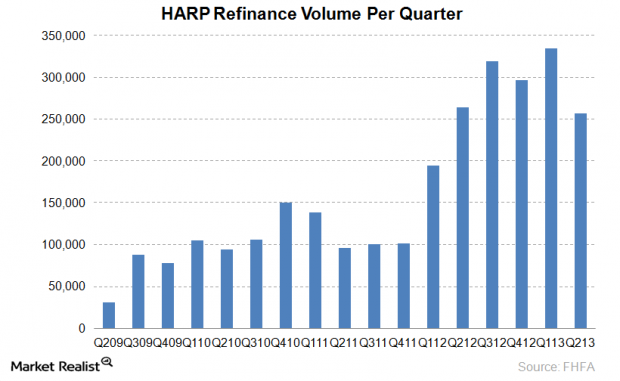

The Fed has been buying around $3 billion dollars a day of mortgage backed securities, primarily in the To Be Announced (TBA) market. TBA prices are the basic input that mortgage originators use to price their mortgages. So, if the Fed is purchasing TBAs, they are essentially lowering mortgage rates. The idea was to help people refinance into lower mortgage rates, which would give them additional disposable income which they would (hopefully) spend.

The steepening of the yield curve can be a double-edged sword for mortgage REITS. On one hand, a steepening yield curve increases their net interest margin – if their borrowing rates stay steady, and the rate earned on new asset purchases increases, then their profitability will increase as that spread increases. On the other hand, REITs are subject to mark-to-market risk. So, while they are getting increased income, they also are forced to recognize losses on their portfolio of mortgages. Given the high leverage employed by most REITs, mark-to-market losses can overwhelm income gains.

Convexity risk – the new buzzword?

One issue with mortgage backed securities in general is that prepayments make hedging interest rate risk difficult. Because a borrower is allowed to prepay a mortgage early, the actual life of the mortgage backed security is uncertain. While most mortgages are 30-year mortgages, in practice very few ever make it that far. The typical duration of a newly issued mortgage backed security is anywhere from 7 to 10 years. To hedge their interest rate risk, REITs generally short Treasuries in some manner. The problem is that mortgages and Treasuries behave differently as interest rates change. When rates fall, mortgage backed securities will underperform Treasuries as investors assume that borrowers will prepay. However, when rates increase, mortgage backed securities will also underperform, as their duration increases when prepayments dwindle. Since longer duration securities are more sensitive to interest rate moves than shorter duration securities, REITs will underperform as rates rise. REITs outperform Treasuries in a stable interest rate environment. The difference between Treasuries and mortgage backed securities is described by “convexity.” And “convexity risk” is what blew up Orange County in 1994.

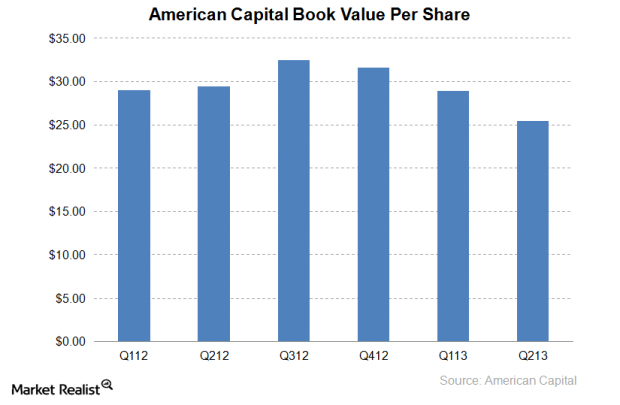

The mortgage REIT (MORT ) has gotten clobbered since rates started increasing in early May. American Capital (AGNC ) is down over 20%, Annaly (NLY ) is down 12%, and even Hatteras (HTS ) – which focuses on much less sensitive adjustable rate mortgages – is down 5.6%. The market is sensing that REITs will have to re-balance their portfolio and sell either Treasuries or mortgage backed securities. The market is betting that they will sell mortgages, which is why MBS are getting hit as well. In other words, when the market sells off (rates increase), mortgage REITs are forced to sell along with the market. And when the market rallies (rates fall), they will have to buy Treasuries or MBS to become balanced again. This “buy high/sell low” phenomenon explains why REITs are so sensitive to interest rate shocks; it also explains why they are getting hit so hard on an unexpected bond market sell off.