Momentum trading with the wave and chart patterns

Post on: 8 Июль, 2015 No Comment

was only after I embraced market cycles that I truly began to understand what to

do with all the lines and levels I had learned to draw on my charts. Early on

as I began teaching myself to trade in the late 1980s to early 1990s, there

were not many books available to read about the subject of charting. I found

myself gravitating towards price (instead of news) because my mother was a bit

If you are looking to trade one of the most powerful pullbacks strategies available to traders today, order our newly updated guidebook -The Long Pullbacks Strategy by clicking here today.

Price and the support, resistance, and trendlines they revealed made sense to me

and I ventured into charting armed with my fathers old engineering graph paper,

The

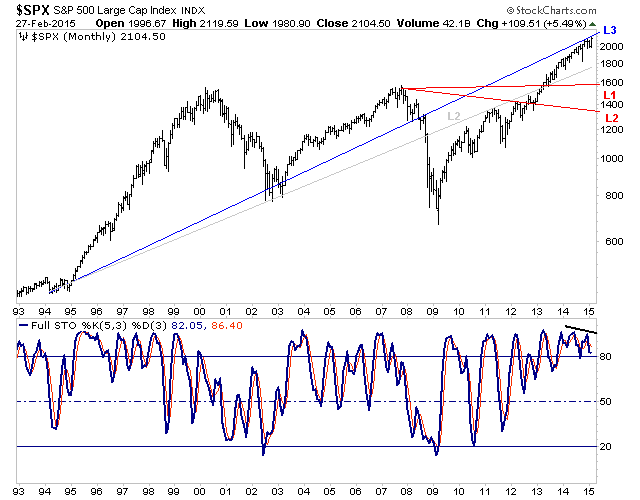

other pivotal moment in my trading as I alluded to earlier was the introduction

of market cycles to my chart analysis. My bread and butter trades are momentum

trades, and this is not only my favorite setup, but the one I will share here.

So lets first define what this is to me because there are so many definitions

of this that I want to be sure we are on the same page. Momentum trading is an

entry style that is based upon entering a market as it break out or breaks down

from a sideways market. Sideways markets are cycles of congestion or

consolidation. Congestion is typically a wider ranging sideways market with

higher volatility and a little more erratic support and resistance levels as

compared to consolidation. Consolidation is a narrower sideways market with

firm support and resistance levels; that is, the levels have little variance

between the highs that make up resistance and the low that make up support. It

is during these sideways markets that two of my favorite patterns for momentum

trading develop: triangles and rectangles. Both these sideways market

descriptions were born of the fact that they were initially discussing the stock

market, where there is a buy-side bias. So consolidation is that low volume,

quiet channel where a stock is typically bought with little notice. Congestion

typically follows an uptrend and is an interesting mix of selling muddled with

late-comers to the uptrend who are buying. However since there is not enough

interest and money chasing the market higher, the market levels off into a wider

range, as compared to the accumulation cycle. Now when talking about markets

such as commodity futures and forex, this is not as apparent, especially in the

forex market where the buy-side bias is not as prevalent.

Chart patterns are powerful tools as they are the visual embodiment of price

action on a chart. That being said I think that there is one distinction that

took my analysis of chart patterns to the next level. Early on I would memorize

the criteria, as well as nuances, of chart patterns such as my aforementioned

triangles, rectangles, wedges, flags, head and shoulders, and rounded

tops/bottoms. I would scan charts for hours a day looking for these gems on the

charts. Back then, that meant flipping through large, printed, daily charts

that were mailed to my home once a week. With pen and ruler in hand I would

Before entering any market, it is vital that a trader (or investor) know what

market cycle a chart is in. Markets travel in one of four market cycles at any

given time: accumulation (consolidation), distribution (congestion), mark up,

or mark down. Mark up is simply an uptrend and mark down is a downtrend.

Heres the next challenge every chartist faces: How to consistently determine

which market cycle a chart is in.

Looking back on price, its always easy to see what the chart has already

done. The key to charting analysis is being able to determine this as a

market is trending or as the market is heading sideways. I do this quickly and

easily with a simple visual tool I call the Wave. The Wave is made up of three

individual 34 period exponential moving averages one on the high, one on the

close, and one on the low. These three exponential moving averages create a

wave that travels across the chart and by looking at the direction the lines

are traveling I can determine if there is a trend and how strong it is. More

is important to go about identifying chart patterns by finding the building

blocks of the pattern. One thing I realized early on is that I dont want to

enter trades by looking for the specific patterns, like triangles or head and

shoulders. After all, what is a symmetrical triangle but the convergence of an

uptrend and downtrend. No matter the head and shoulders location, inverse or

otherwise, what is a neckline but support or resistance? Once all the trendlines, support and resistance levels are drawn on a chart, only then can I

enough at the clouds and your eyes will find a bunny. Look hard enough at the

charts with a specific pattern in mind and it will appear.

Its

only after drawing the lines and levels on the chart do I see that a triangle

pattern has formed and this is exactly the kind of pattern I like to see when

setting up momentum trades. Without this triangle pattern there would be no way

to mark and measure the potential breakout or breakdown on the chart. This

pattern †along with the sideways Wave †offers me a momentum set up on this 60

minute chart of the Pound. In a momentum set up I do not carry a bias as to

Let the charts dictate your stop losses and profit targets.

You now have learned how to begin using trendlines,

support, resistance, Fibonacci Levels, the Wave, psychological numbers etc. to

determine where your entries and exits should be. If the risk to reward ratio

are not appropriate for your account, neither is that trade set up.

(Deciding upon the risk to reward ratio requires that you know at what price

Recognize, React, Repeat. This is what

you want to do each day as a trader. Much of your time will, and should, be

spent recognizing the set ups. By doing this you are also training your eyes to

Exit at each predetermined profit target.

We want to exit when we can, not when we have to. I will place

my order †entry or exit as the market nears my predetermined level or

Margin accelerates yours winners and losers.

Theres a saying in motorcycling: Any Gomer can twist a

throttle. Anyone can push the limit, but its few and far between that you

So whats the answer? We know that trading, like

motorcycling, can be a high- risk activity. Just a like a new rider should

learn the art of riding a motorcycle on a smaller bike with less horsepower, so

Forget paper trading. It is absolutely

worthless as a trading substitute. If you wanted to acquaint yourself with an

execution platform and practice order execution, fantastic! Go ahead and

paper trade. If you wanted to test a new trading idea, great! Go ahead,

back-test and paper trade the idea. If you want to see how you can trade with an

established methodology, use a mini account. You will never be able to recreate

the feeling of being in a real money trade with paper trading. When you

trade with real money, even in a mini account, you will still feel the burst of

Find the trend before you enter any trade.

The scanning step of each trade set up is when we check for trend direction on

each of our time frames. The Prep Work step is vital for this very reason.

Finding the trend is directly related to the type of trade you will set up. The

Wave is the best way I have found to make sure I am in the ideal environment for

Use your ands your ors to plan your trade.

Any trade is a process of asking and answering questions. We want everything to

be right when we enter a trade. It reminds me of what my husband taught me

about fishing. I love to go fishing…if I got the Internet on our boat Id

probably never come back to shore. Sure you can go out and try to catch fish

but you wont necessarily catch anything just because you dropped your line in

the water. Its best to know what youre fishing for and have the right

bait and be out at the time of day the fish feed and in the right

water temperature and fish with the tide. Basically you want to put as

much as you can in your favor so youre in the right place at the right time.

Great fishermen do this, so do great traders. They line up all the ands. If

one or more of the things we look for change, it can affect our plan and

results. For example, we would not go fishing (or we would be less likely to

catch fish) if the water temperature is too low or the tide is wrong

or the bait is wrong or the barometer is dropping.

Dont chase a trade.

When we trade a twenty-four hour market we will find ourselves missing entries.