Merck Cost Basis Calculator

Post on: 16 Март, 2015 No Comment

Online Portfolio Management

POPULAR

NEW!

Netbasis will automatically calculate your adjusted cost basis for Merck & Co. or any Merck & Co.-affiliated company.

A purchase of one Netbasis transaction for $25.00 will provide you with:

- The information and documentation needed to calculate your capital gains for tax purposes

- An historical reconstruction of your investment including all corporate actions and dividend re-investments

- The ability to optimize your tax strategy by selecting from a variety of sale methods

- Pricing and corporate actions for your securities

Netbasis contains all of the pricing and dividend history including all splits, mergers and any other corporate action. Netbasis does not contain your personal purchase and sale history.

You will need to enter:

- The purchase date

- The number of shares (or dollar amount) you sold

- The sale dates

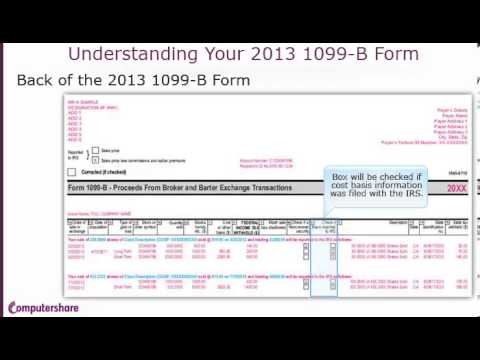

This information can often be found on several types of investment documents including: broker and transfer agent statements, your 1099 statement or pay stubs.

ePortfolio Manager is a powerful web application delivered through a user-friendly format that allows you to manage your entire financial portfolio online.

For just $4.95 a month, you can manage a digital overview of multiple accounts all in one application.

- Assess trends & run alternative investing scenarios based on risk and investment attitudes

- Alerts for company news, trading limits & out-of-balance assets

- Asset-rebalancing feature aids calculations to redistribute through asset classes

- Equity positions displayed on open or closed basis

- Optimize your tax strategy by selecting from a variety of sales methods

- Calculate adjusted cost basis for all investments in your portfolio

With the consolidation of your assets and investment accounts in one place, financial planning and investment strategy can be viewed from a holistic perspective.

- The number of shares (or dollar amount) you originally purchased

- Holdings arranged by asset classes

- View simultaneously with your financial professional from remote locations

ePortfolio Manager is the ultimate in portfolio management – from the company that brought you Netbasis.

Two versions available: one for ESPP employee-shareholders and one for individual investors.

$25.00 / Calculation!