Mebane Faber How to Invest Like a Top Endowment ELEMENTS S&P Commodity Trends Indicator ETN

Post on: 19 Май, 2015 No Comment

Mebane Faber is portfolio manager at Cambria Investment Management, an independent investment advisory firm based in Los Angeles. He is also the author of the recently published book, The Ivy Portfolio: How to Invest Like the Top Endowments and Avoid Bear Markets .

He spoke recently with the editors of HardAssetsInvestor.com about how individual investors can invest like the Harvards and Yales of the world, including why they should consider having 20% of their portfolio in hard assets.

HardAssetsInvestor.com [HAI]: What’s the new book about?

Mebane Faber (Faber): The book takes you through how the leading endowments in the world manage their money. There are already good books out there by endowment managers like David Swensen and Mohamed El-Erian, but I felt like they were lacking. Swensen, for one, says individual investors shouldn’t pursue market timing or security selection, and he doesn’t mention commodities for individuals either.

I felt there was room for a book that looked at the strategic asset allocation policies of the top endowments, and talked about how individuals can achieve similar results. These endowments have been the best investors, bar none, over the past 20 years: Yale’s endowment, to take one example, has delivered 16% returns per year, killing other markets, with about 10% volatility. That’s amazing.

I wanted to show individuals how they could create a strategic asset allocation plan using ETFs that would mimic the endowments. and then how they could improve on that model.

HAI: How exactly are endowments tackling the market?

Faber: The one thing the top endowments do that most investors fail to do is to create a widely diversified portfolio. Endowments invest not just in U.S. domestic securities stocks and bonds but in foreign stocks, foreign bonds, real estate, commodities, etc. In general, they have much less U.S. and stock exposure and much more commodity, real estate and alternative investment exposure, by which I mean private equity and hedge funds. The big endowments have almost a third or over a third of their portfolios allocated to alternatives, and large allocations to commodities, much more than a typical investor.

HAI: But individuals don’t have access to the same kinds of tools as endowments.

Faber: That’s true to an extent, but one nice thing about endowments is that they do publish their strategic asset allocation plans. And the good thing is that you can pretty much match that allocation using exchange-traded funds.

The first thing you do, as you mentioned, is that you net out the private equity and hedge funds, because individuals can’t invest in them. There are ETFs that operate in those areas, but they are limited and imperfect.

That leaves you with five asset classes: U.S. stocks, foreign stocks, real estate, bonds and commodities. There are a lot of caveats, but the allocation that endowments have historically made to these is approximately 20% in each.

You can take that simple 20% allocation and backtest it from 1985, which is the start of the modern endowment era. And you can do that using major indexes for each asset class, each of which is investable with an ETF: S&P 500 (U.S. equities), MSCI EAFE (foreign equities), NAREIT (real estate), 10-year Treasuries (bonds) and [the S&P] S&P GSCI (commodities).

If you run that portfolio, it returns about 4% less than the endowments, with the same volatility. In other words, you’re getting 10+% annual returns on 10% volatility. That’s pretty good. It’s right at the upper bound you reach on strategic asset allocation over time.

That portfolio has a 0.8 correlation to the endowment portfolios, so you’re capturing their beta but not their alpha.

HAI: What about that private equity and hedge fund piece?

Faber: Private equity is really an institutional game. We don’t advise it for individuals, unless you have $50 million or more. Unless you can pick the top 25% of funds, the returns on private equity are the same or worse than investing in the stock market. It’s a game that has enormous benefits if you can get into the top funds, but otherwise, it doesn’t make a lot of sense. That’s why we think the private equity ETFs are a bad idea.

The same goes for hedge funds. We don’t consider hedge funds a separate asset class; it’s just active management applied to other asset classes. Describing the average hedge fund is like describing the typical dog: They all have four legs and a tail, but beyond that, they are very different.

The problem in the U.S. is that there are not a lot of listed options for hedge funds or hedge-like funds. In Europe and Canada, it’s completely different: Even U.S. managers like Goldman Sachs have hedge funds that trade on those exchanges, and anyone can buy them. It is unfortunate that U.S. investors either can’t or don’t invest in them. We hope you start to see them soon in the States.

HAI: For the commodities piece, how do you think investors should go about accessing the space?

Faber: The endowments make large allocations to real assets, and obviously, they do it a little differently than individual investors, using oil and gas partnerships and such. But we think investors can approximate that return pretty closely through publicly traded real estate and commodity ETFs.

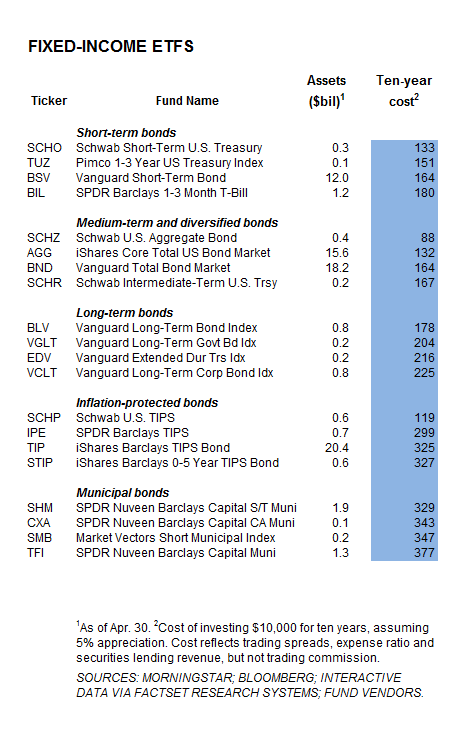

The way we talk about it in the book is the broad-based indexes, not so much S&P GSCI because it is so heavy in Energy, but any of the other indexes are possible. In-house and with clients, however, we only manage active portfolios, and in commodities and currencies, we think long/short makes more sense than long/flat.

To access the space, we use the managed futures ETN [the ELEMENTS S&P CTI ETN (NYSE Arca: LSC)); Claymore is now putting out an ETF on the same index. We really like the managed futures product. The only downside is that it only goes long/flat Energy; it won’t go short, like it does in the other commodity sectors. It’s a ridiculous thing; they’ve optimized for backtested performance. Still, it is what it is, and it’s a good product.

HAI: Anything else investors should know?

Faber: There are a few more steps to our process. To improve upon the base return, we take investors through our tactical trend-following model that keeps investors out of bear markets. We use the 10-month moving average.

Using that, you get the same returns as with buy-and-hold, but you are able to bring the volatility down substantially. Going back to 1973, the 10-month moving average gets better returns than buy-and-hold, and drops the volatility of the portfolio down to the mid-6s. The max drawdown falls to less than 10%, down from 30%+. This system helps move you into T-bills and bonds as the market declines.

Basically, though, it’s easy: You start with a strategic asset allocation that follows the endowments into a portfolio that is widely diversified and very efficient. You then rebalance every once in a while, and layer on risk management, something the endowments might have been a little guilty of not doing themselves.