Measure Volatility With Average True Range

Post on: 10 Июнь, 2015 No Comment

J. Welles Wilder is one of the most innovative minds in the field of technical analysis. In 1978, he introduced the world to the indicators known as true range and average true range as measures of volatility. Although they are used less frequently than standard indicators by many technicians, these tools can help a technician enter and exit trades, and should be looked at by all systems traders as a way to help increase profitability.

What Is the AverageTrueRange?

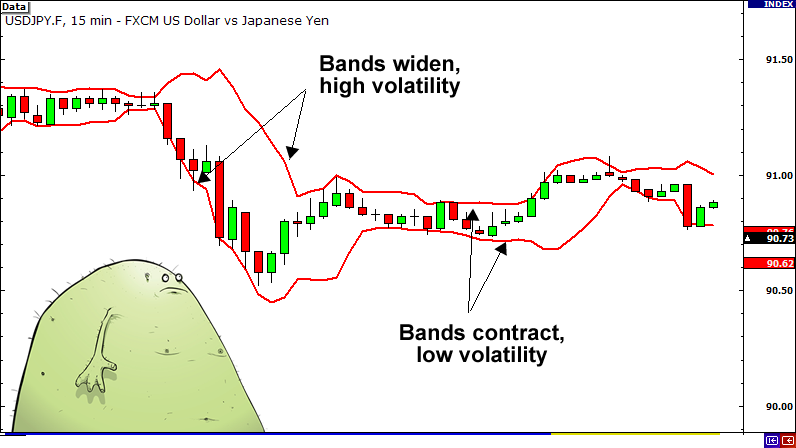

A stock’s range is the difference between the high and low price on any given day. It reveals information about how volatile a stock is. Large ranges indicate high volatility and small ranges indicate low volatility. The range is measured the same way for options and commodities — high minus low — as they are for stocks.

One difference between stocks and commodity markets is that the major futures exchanges attempt to prevent extremely erratic price moves by putting a ceiling on the amount that a market can move in a single day. This is known as a lock limit. and represents the maximum change in a commodity’s price for one day. During the 1970s, as inflation reached unprecedented levels, grains, pork bellies and other commodities frequently experienced limit moves. On these days, a bull market would open limit up and no further trading would occur. The range proved to be an inadequate measure of volatility given the limit moves and the daily range indicated there was extremely low volatility in markets that were actually more volatile than they’d ever been.

Wilder was a futures trader at that time, when those markets were less orderly than they are today. Opening gaps were a common occurrence and markets moved limit up or limit down frequently. This made it difficult for him to implement some of the systems he was developing. His idea was that high volatility would follow periods of low volatility. This would form the basis of an intraday trading system. (For related reading, see Using Historical Volatility To Gauge Future Risk .)

As an example of how that could lead to profits, remember that high volatility should occur after low volatility. We can find low volatility by comparing the daily range to a 10-day moving average of the range. If today’s range is less than the 10-day average range, we can add the value of that range to the opening price and buy a breakout.

When the stock or commodity breaks out of a narrow range, it is likely to continue moving for some time in the direction of the breakout. The problem with opening gaps is that they hide volatility when looking at the daily range. If a commodity opens limit up, the range will be very small, and adding this small value to the next day’s open is likely to lead to frequent trading. Because the volatility is likely to decrease after a limit move, it is actually a time that traders might want to look for markets offering better trading opportunities.

Calculating the AverageTrueRange

The true range was developed by Wilder to address this problem by accounting for the gap and more accurately measuring the daily volatility than was possible by using the simple range calculation. True range is the largest value found by solving the following three equations: