Market Profile Determining Direction Through Tails Range Extensions and Skewing Trader Kingdom

Post on: 16 Май, 2015 No Comment

The Market Profile over time has become many things to many people, when at its essence it is an objective study that was developed for Exchange Members to show them where the market was, where it had been and who was behind the current trading.

The widest part of the distribution was where exchange members could work large orders. The thinner part of the distributions represented support and resistance, or opportunities for buyers and sellers. Once they knew where support, resistance and value were, they could trade or execute their client’s business efficiently as per their instructions.

We have come a long way since the Market Profile’s introduction in 1986. Because we are human, we can complicate everything that we do, and hence do just this. We add more rules, elements, more parameters until we lose the original meaning and use of the Market Profile.

We must always remember that the truth is usually easy to explain. This process of complicating the “simple” has turned many away from the profile and its original applications. If we go back to the market profile basics, we have a trading tool that is unparalleled and not just in my opinion, when you see the amount of money thrown at the market by Market Profile users.

Click on image to enlarge!

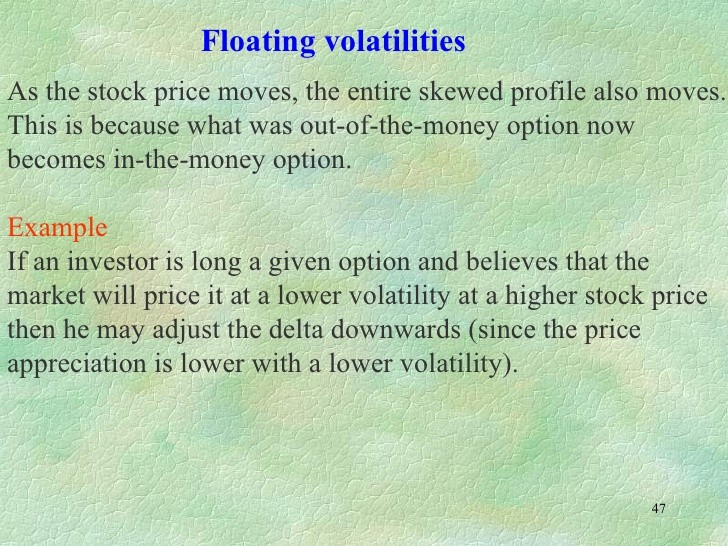

Above is a normal distribution, called a Gaussian distribution. We turn it on its side to represent how the market shows where the volume is in a distribution. The distribution becomes skewed so the large area is toward the bottom or top; it is not normal and usually has extensions from the distribution above and below it. When distributions are skewed they are referred to as Non-Gaussian Distributions and their tails are considered extensions.

Let’s step back and look at what the Market Profile really is, a non-Gaussian statistical distribution. The non-Gaussian element of the statistical distribution is what is normally called the “fat-tail”. In a standard distribution 97.5% of the volume is contained in the 1st and 2nd deviations. The remaining 2.5% of volume is in the third deviation.

In non-Gaussian distributions you can have numbers as low as 90% for the 1st and 2nd deviations, and that is quite a difference. It is this difference in volumes between the 3rd deviation in Gaussian and non-Gaussian distributions that reveals trading opportunities for the Market Profile trader. The bigger the tail, the greater the opportunity is and the more the certainty of a profitable trade.

Chart A:

Click on image to enlarge!

In Chart A above (5 Y Note) the first element that we deal with in the profile is the tail, and by definition, a tail can be as small as 2 ticks.

It is the first directional piece of information we get from the Market Profile. While a two tick tail might be a little hard to accept as a definitive indicator of direction, it is a tail and it shows that the market has rejected a price level. Tails greater than 5 ticks are, of course better and hence, more comfortable to trade, but all you need is a 2 tick tail to take a directional trade.

Chart B:

Click on image to enlarge!

In Chart B above (10Y Note) y-z forms the Initial Balance Period for the 10Y Note.

This sets up the second element piece of information that the market profile yields for determining the market’s direction. The first hour of trading in the Market Profile theory is called the initial balance period.

Range extension occurs when the first hour’s high or low is taken out. The market usually extends the session’s range by taking out one side of the initial balance period.

On 12/26/12 you had a 6 tick tail in y period, followed by range extension in z period and again in B period. The market did trade higher for the rest of the day as per market profile theory.

Chart C:

Click on image to enlarge!

In Chart C above, the ES the Initial Balance Period is the B and C period.

On 12/26/12, the Initial Balance period is from 1421 to 1425. A two tick tail was formed in the B period, followed by extension of the range lower in C period. This pointed to lower prices for the day.

This was confirmed when D period extended the range lower and the market did trade lower for the rest of the day. The information gleaned from a tail and range extension lower in both C and D period produced a profitable directional trade for Market Profile traders.

Chart D:

Click on image to enlarge!

Chart D above (30Y T-Bond Contract): As the profile develops throughout the trading session, volume will start to develop in one half of the distribution.

This movement towards one side of the market be it volume or time is called skewing. If your data feed doesn’t provide time and sales information, the profile will be based on TPO’s, or time. If your data feed includes time and sales, or actual contract volume, your distributions are based on volume. Volume at a price is better than time at a price, because of wide swings in price.

The way to compute skewing is to draw a line half way through the distribution and see which side has more volume or more letters. More volume/time in the top half of the distribution yields a “P” pattern, which favors higher prices. If you have more volume in the bottom half of the distribution, it is skewed to the lower half, or forms a “b” pattern, which favors lower prices. This skewing is the final piece of information that we need to hold or exit the current trade and will form the basis for our next trade.

Chart D listed above (30Y T-Bond Contract):

On 12/26/12, you have a “y” period high, then “z” takes out the “y” period high and “A” takes out the “z” period high. Subsequently, the market trades higher as per Market Profile theory.

The 1st indication that the market would trade higher was when “z” took out the “y” period high. The final piece of information occurred when the market extended its range in “C” on 12/26/12. The market did trade higher and closed favoring higher prices the next day.

On 12/27/12 the market retests the lows at 147-03/04, which held. This set up a triple bottom trading situation. “z” period takes out the y period high. A period takes out the z period high. And the market breaks out in B period and trades to 148-18 producing a very large gain for Market Profile traders.

The basic directional information that is revealed by the Market Profile through tails, range extension and skewing does show the market’s direction. If you get the market’s direction right, while more analysis can lead to better trade location, the majority of the profits come from getting the market’s direction right, not from picking up a few more ticks through superior trade location.

The rules associated with the Market Profile, if distilled down to the Market Profiles, are simple to learn and see. If you haven’t examined the world of Market Profile, you are short changing your development and trading skills, in my opinion.

It’s time to do yourself a favor and learn the Market Profile.

For more from Charles including daily market commentary updates, please visit Cochran Nannis Futures Trading. You can also This e-mail address is being protected from spambots. You need JavaScript enabled to view it with direct questions regarding his approach.